In a recent interview with Saigon Investment, Mr. Prasenjit Chakravarti, Chief Strategy and Transformation Officer at Techcombank, shared insights on the bank’s digital transformation journey and its commitment to sustainable development.

JOURNALIST: - How did you come to join Techcombank, and what attracted you to this particular organization?

PRASENJIT CHAKRAVARTI: - My career has spanned several years across prominent financial institutions and consulting firms like Accenture, McKinsey, and Standard Chartered. I have always been driven by the desire to work with highly professional organizations, and Techcombank represents a unique case in Vietnam and across Asia. The bank is actively building a dynamic, ever-evolving organization. It is transforming from a traditional banking entity into something entirely new and innovative.

What makes Techcombank especially appealing is its commitment to constant reinvention. The bank has invested heavily in bringing together top-notch technology, the best platforms, and talented individuals from around the world. This commitment creates the perfect environment for me to join and contribute to this transformative journey.

- What sets Techcombank apart in terms of offering superior financial solutions?

- Our primary differentiator lies in the foundational platform we are building for the bank of the future, which is reinforced by data and digital technology. By leveraging artificial intelligence (AI) and extensive data, we can deliver personalized and comprehensive services to our customers. Techcombank’s extensive ecosystem of partners allows us to create unique value propositions that go beyond traditional banking services.

We don’t just act as a bank; we help customers in more holistic ways, such as buying homes, cars, insurance, and addressing other life needs. This is possible due to our collaborations with the best developers and partners in Vietnam. In doing so, we create a distinct value chain that not only serves our customers but also leads the market.

- Can you elaborate on the solutions Techcombank has implemented, and how the bank’s experience informs its approach?

- At the core of our transformation strategy are three pillars: data, digitization, and talent. These elements work together to allow us to deliver new, improved products and services to our customers. Individually, data, digital tools, or human resources cannot drive transformation. Only by integrating these three aspects can we create real value for our customers.

Historically, Techcombank has been known for its strong relationships with large enterprises and corporations. However, in recent years, we have expanded our focus to include small and medium-sized enterprises (SMEs). For SMEs, particularly in the context of economic challenges, digitization is a critical tool to streamline operations and reduce the daily workload. Our solutions are tailored to meet this need, helping SMEs digitize and improve operational efficiency.

- How does Techcombank support businesses, especially in areas such as sustainability?

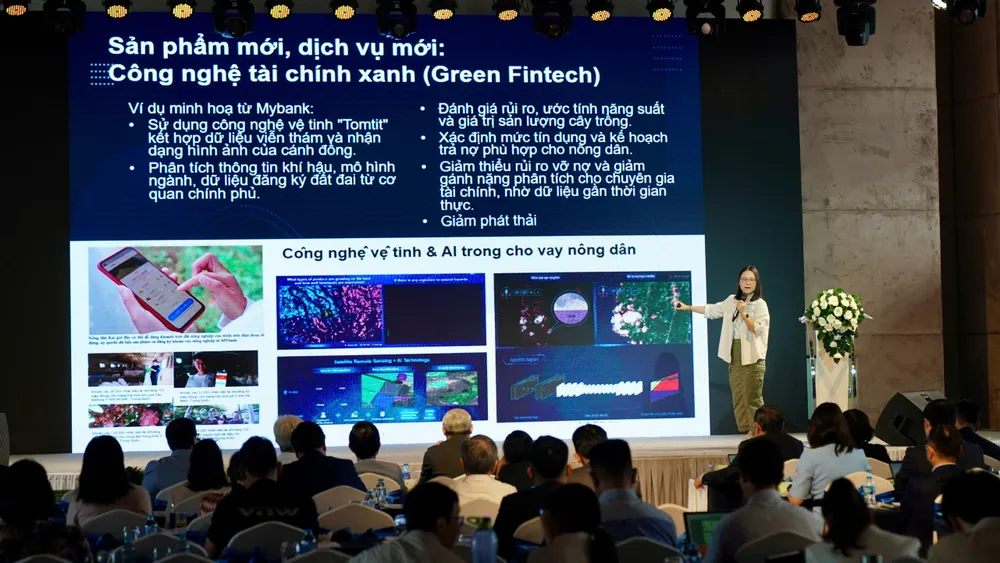

- Sustainability and green finance are essential areas of growth for the country. It is estimated that Vietnam will need approximately $1 trillion in green investments to transition to a green economy. As a leading private bank that adheres to international standards, Techcombank is committed to playing an active role in this journey. Sustainability is not only a goal but also a key component of our long-term strategic vision.

One of the most innovative products we are launching soon will allow customers to track their carbon emissions based on their spending. For instance, they will be able to see how much carbon is saved when choosing an electric taxi over a conventional one. This information will be available directly on their app, providing real-time insights on the environmental impact of their choices. This is just one example of the types of solutions we are bringing to the market, aimed at raising awareness about the importance of sustainability and helping our customers make greener choices.

- With new regulations in Europe regarding carbon emissions and greenhouse gas standards, how does Techcombank help businesses comply?

- Upcoming regulations in Europe will require businesses exporting to these markets to comply with stringent new rules regarding carbon and greenhouse gas emissions. This presents significant challenges for Vietnamese businesses. Therefore, we are working closely with our partners to explore solutions that can simplify this process for our customers.

At Techcombank, we go beyond offering financial services. We aim to provide comprehensive solutions that give businesses a competitive edge, especially when exporting to regions like Europe and the U.S. We want our customers to confidently say, “We bank with Techcombank, and they not only provide financial services but also holistic solutions that help us compete and succeed in international markets.”

- How is Techcombank incorporating environmental, social, and governance (ESG) principles into its services?

- Techcombank is actively partnering with large corporations and key stakeholders to provide businesses with solutions that meet the growing demand for green projects and ESG standards. We are tailoring these solutions to align with specific industry sectors and the unique needs of our customers. By doing so, we ensure that businesses are equipped to invest in green projects and adopt ESG-compliant practices, which in turn enhances their competitive advantage.

In addition to financial support, we aim to guide businesses towards green trends, helping them capitalize on these growing opportunities. This comprehensive approach benefits both the environment and the business, reinforcing Techcombank’s role as a leader in promoting sustainability across the Vietnamese economy.

Techcombank’s commitment to transformation and sustainability sets it apart as a leader in Vietnam’s banking industry. By focusing on digital innovation, data integration, and talent development, the bank is well-positioned to serve both large corporations and SMEs, offering solutions that go beyond traditional financial services. Moreover, Techcombank’s focus on green finance and ESG principles ensures that it will play a crucial role in Vietnam’s transition to a green economy, while also helping businesses navigate the challenges of new international regulations.

As Techcombank continues to innovate, it remains committed to providing its customers with unparalleled financial solutions, driving both economic and environmental progress in Vietnam and beyond.

- Thank you very much.