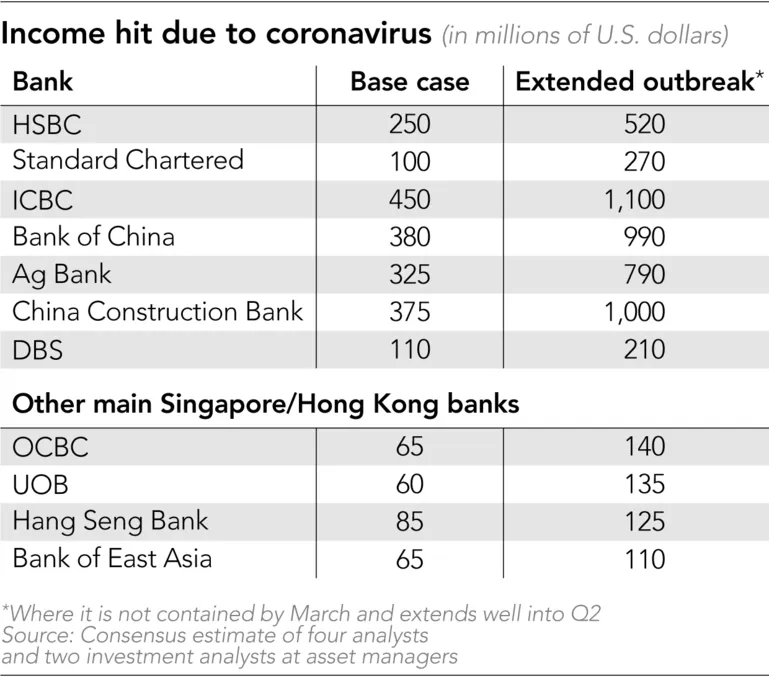

HSBC Holdings and its regional Asian rivals are staring at a hit of more than $2 billion in lost revenue and an even bigger bill in provisions for soured loans due to the coronavirus outbreak, with the impact set to double if the epidemic is not contained by March.

U.K.-based HSBC, which is planning to redeploy capital to Asia, sees $600 million in additional loan losses as clients are forced to shut operations and demand for business from their consumers dries up.

DBS Group Holdings of Singapore, Southeast Asia's largest bank by assets, estimates a drop of at least $100 in revenue, while S&P Global Ratings said the virus could add $770 billion in bad loans and triple mainland Chinese banks' gross nonperforming-loans ratio.

Analysts polled by the Nikkei Asian Review see lost revenue of more than $300 million for each of the largest mainland banks as loan growth slips and income generated from the sale of wealth-management products, insurance, trading and arranging capital slumps.

If the full group of the largest banks, including foreign banks, across Asia ex-Japan were included, the total impact could more than triple, they say. The six analysts declined to be named as they are still assessing the different scenarios that could play out and have not yet conveyed their views to their clients.

After HSBC reported earnings last week, Chief Financial Officer Ewen Stevenson told investors and analysts that the first-quarter impact on the bank could be from $200 million to $500 million. © Getty Images

After HSBC reported earnings last week, Chief Financial Officer Ewen Stevenson told investors and analysts that the first-quarter impact on the bank could be from $200 million to $500 million. © Getty Images Banks are facing the ripple effect from disruptions faced by manufacturers and services providers, with lenders already factoring loan growth to fall by several basis points in the first two quarters of the year and an uptick in credit defaults. While banks in the region are adequately capitalized to withstand any shock, analysts said the efforts to stimulate the economy may derail efforts underway to clean up China's $1.5 trillion in bad debts.

The coronavirus outbreak has shut down large swathes of the Chinese economy and crippled other Asian nations, and economists have cut their forecasts for growth in the region. China's gross domestic product growth is seen dipping to 3% in the first quarter, according to a mean estimate of economists, from 6% in the fourth quarter of 2019, with some economists even forecasting a contraction. Its economy is seen recovering in the second half.

"For now the belief is, it is the pain before the gain," said a Hong Kong-based fund manager who owns shares in HSBC, Industrial & Commercial Bank of China and Bank of China (BOC). "If the virus is contained in March, the second half can save the banks some blushes, but if it prolongs, it is going to get nasty. We are looking to protect our portfolio already."

While Chinese banks are estimated to take on most of the regional losses as a result of the outbreak, other Asian players and foreign banks will face lower fee income as clients stay away from deals, wealth management investments and insurance. They will also face the higher loan defaults from retail, tourism, small and medium-sized companies, and mortgage customers as big spenders tighten their purse strings.

More than 2,700 deaths have been attributed to the virus, which has infected tens of thousands of others. There are growing fears that authorities are failing to contain it from turning into a global pandemic. Finance ministers and central bank chiefs of the world's largest economies last weekend noted risks to global growth persisting from the uncertainty caused by the virus, and they stood ready to unleash support measures.

China is already taking steps. Loan defaults arising from the coronavirus will not be included in nonperforming loans for a "grace" period, the China Banking and Insurance Regulatory Commission said this month. Beijing has also cut a key lending rate, injected liquidity into the financial system, and introduced preferential loans and tax breaks for industries worst hit by the virus. South Korea, which has hundreds of confirmed cases, also has rolled out loans for industries.

"The push to extend more loans could further stretch the Chinese financial system reeling under bad debts," said Andrew Sullivan, a director at Hong Kong-based investment and brokerage firm Pearl Bridge Partners. "The virus will increase defaults, and numbers will no doubt be poor for the first half of the year. But the stimulus means the risk of default only heightens."

China's $41 trillion banking system, the world's largest, is also home to the largest bad-debt pile, which the country is trying to clean up.

After factoring in the regulatory relaxation on defaults, S&P estimates Chinese banks' "questionable" loans ratio will peak at 10.5% to 11% in the aftermath of the outbreak from about 7.5% currently. If the virus peaks in March, S&P estimates a 5.4 trillion yuan ($767.9 billion) increase in nonperforming loans before government support and write-offs that would triple the gross nonperforming loans ratio to 6%.

If the banks "fully provision for those new nonperforming loans in the same accounting period, the increase in bad loans could shave about 350 basis points off the sector's core capital adequacy ratio," S&P said in a report this month.

However, it expects authorities to offer assistance, such as an extended repayment schedule, to businesses and people to alleviate the pressure aftershocks. That would allow banks to amortize the questionable loans -- those not yet classified as bad debts -- over a longer period of time.

Chinese banks have not commented on the impact of the virus on their operations. The largest lenders, including the top four -- ICBC, Bank of China, Agricultural Bank of China (ABC) and China Construction Bank -- will report full-year earnings in March.

After HSBC reported earnings last week, Chief Financial Officer Ewen Stevenson told investors and analysts that the first-quarter impact on the bank could be from $200 million to $500 million. The worst-case scenario was for loan losses of $600 million, he said. While he did not disclose the impact on revenue, he said it would become "progressively more acute if the coronavirus was to continue beyond the next month to six weeks."

DBS expects the bank to suffer in the first quarter, estimating that a loss in revenue could be roughly $100 million to $150 million, representing 1% of total income. That figure could double if the outbreak lasts longer. © AP

DBS expects the bank to suffer in the first quarter, estimating that a loss in revenue could be roughly $100 million to $150 million, representing 1% of total income. That figure could double if the outbreak lasts longer. © AP DBS Chief Executive Piyush Gupta expects the bank to suffer in the first quarter, and he estimates the virus to be controlled by then. He estimates that a loss in revenue could be roughly $100 million to $150 million, representing 1% of total income. That figure could double if the outbreak lasts longer, he said in a conference call after results earlier this month.

DBS expects wealth-management fees to fall as sentiment weakens, and it is seeing some signs of a slowdown in retail sales, which will affect its credit card business, Gupta said. The bank also is seeing an impact on U.S. Treasury sales, particularly from smaller firms. Credit costs would increase by as much as $50 million, which is adequately covered, he said.

Hong Kong-based Bank of East Asia has cut its loan growth forecast from mid- to high single digits to single digits and has lowered expectations for fee income from double digits to single digits. It also expects a deterioration of 10 to 20 basis points in credit costs in Hong Kong because of the outbreak.

"The impact of the coronavirus outbreak is yet to be reflected on the Asian banking system, but it seems the macroeconomic impact is greater than the market expected," Vincent Tsui, Asia analyst at Gavekal Research, said.

The impact depends on the "duration of the outbreak and government's policy response like credit guarantees," he said, adding that while bad debts could rise, there is "enough buffer in the banking system to absorb the economic shock."

Asian banks are among the most capitalized in the world, with the common equity tier 1 capital ratio, a measure of banks' ability to absorb future losses, well above 11% of assets across the region.

HSBC, Standard Chartered and Singapore banks top the list with over 14%, while the largest Chinese lenders hold 12% or more, according to the banks' latest financial statements. The global minimum as prescribed by regulators is 7%, though countries can mandate a higher ratio, which Asian jurisdictions typically impose.

For Asian banks, "if the situation is stabilized, then we should have a recovery in the second half, though we believe full-year profit will be under pressure with loan growth in the low single digits," Michael Wu, a Hong Kong-based analyst at Morningstar, said.

"However, the medium- to long-term fundamentals are still intact with the rising middle class expected to fuel demand for banking products and income growth in the coming years."