Although digital banking (DB) is not entirely new, it is in the first stage of development in Vietnam.

Race in commercial banks

The first and most important opportunity that DB will provide is lower transaction costs and an increase in profit. In big financial institutions in the world, DB helps reduce transaction costs by 30-80%. However, when banks use an advanced information technology system, costs increase by 25-28%, but profits rise by 35-48%, resulting in an increase of 10-15% in net profits. DB also provides customers with an increased opportunity to access many banking services, diversified product ranges and increased competitiveness. It also enables CBs to be involved in the integrated system with a wide variety of services including finance, health, insurance and tourism.

As far as public acceptance is concerned, a study by IDG Vietnam in 2015 showed that only 21% of customers used e-banking, but IDG Vietnam’s survey in 2017 showed that upto 81% of customers had used this service, which is greatly encouraging for banks that aim to become digitalized.

According to figures released in 2018 by the Payment Department of the State Bank of Vietnam (SBV), 94% of banks in the system had studied and were making plans to turn digital, while 35% of them were developing their own strategies for digital services. Several banks have launched new creative banking services.

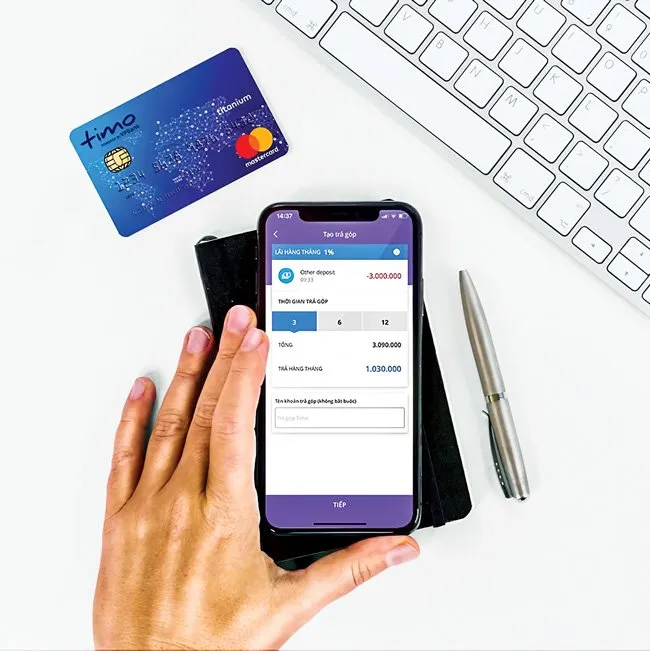

For instance, TPBank has its automated banking service called LiveBank. Vietcombank has a digital space for transactions called Digital Lab and it also has a big scale plan to go digital with advice and assistance from the international consultancy PwC. Vietinbank has Corebank of the new generation, with an integrated network of multi-services and a modern data warehouse (EDW). VPBank has its DB application called Timo while the Military Bank (MB) has its virtual assistant app called ChatBot to provide online service 24/7.

Recently, this race has been getting more and more intense as the banks have been continually introducing new special services. In early 2019, VIB introduced its new digital website with better service apps than its old version. The new one includes a service that provides contact within five minutes.

In April, OCB officially launched its OCB e-banking service called OMNI, developed with services for opening accounts, opening card accounts, taking loans via Robo-lending, buying insurance, and making investments online. MB has recently introduced its e-banking service for businesses called MB App Business & eMB new, offering a big range of transactions, multi-channels and multilingual services in Vietnamese, English, Chinese and Korean.

According to Dr. Nguyen Tri Hieu, a finance and banking expert, the trend of getting digitalized is expected to continue because e-banking is still in its first stage in Vietnam. Big and small banks have said that they would invest more in development of DB by consulting foreign advisers.

Many challenges in DB development

According to IBM experts, DB can be categorized into four forms. First, a bank establishes a new DB, using the best available resources such as infrastructure, back-office, and distribution channels of the parent bank like Frank of OCBC (Singapore) and LKXA of CaixaBank (Spain).

Second, the bank makes and publishes its products and services on an advanced interface, which is entirely different from its current services, creating a distribution channel like Simple and Moven (USA).

Third, it establishes a subsidiary as an independent bank, separate from parent bank, such as Hello Bank of BNP Paribas or First Direct of HSBC.

Fourth, it is a digital-only bank, based entirely on digital technology, without any branch. Its customers interact with the bank via digital channels. Fidor of Germany and Tangerine of Canada are good examples.

Based on these four forms, finance experts believe that Vietnamese banks can be in a rather intense race in DB development, but they are actually still in the first stage or first form.

From infrastructure to operations and distribution channels, DB still depends heavily on the traditional banking system. The new products and services are just redesigned to better meet the needs of the new trends and new segments of customers.

So far, only VPBank has turned its distribution channels into an independent branch operating on a digital foundation. Its products, services and independent sales policies have been turned into DB called Timo (the third form). Other banks are still transforming themselves or just making plans for changes.

The banks have been very cautious so far because there are still lots of challenges in DB development in Vietnam. The biggest problem is a lack of talent and qualified human resources for management of DB.

Another is the problem of limited capital and budget for digitalization, and investment and application of new solutions and technologies. Only a few banks have made significant investments in this field while most other banks are taking slow cautious steps, depending on annual distributed budget.

In the scenario of considerable differences in investments in human resources, some powerhouses have expressed their strong determination to accelerate their efforts. According to a Vietcombank representative, this bank has set its goal to be the No.1 bank in Vietnam by 2025, with a profit of USD2.5 billion. To reach this goal, the bank plans to further develop DB in 2019.

- Dr. Bùi Quang Tín, Banking University, Ho Chi Minh City

When digitalized, Vietnamese banks will have to face network security risks from fraud, deceptions, cyber-attacks and risk of leaking user information. As a result, customers are still cautious about using DB, which in turn is also slowing the development of this segment.

Therefore, in addition to plans for digitalization of financial services at banks, there are huge challenges of creating adequate management regulations, facilitating development, maintaining a good balance in promotion of creative advances and protection of consumer interest, as well as preventing risks in the financial market.