However, we are now witnessing many founding shareholders trying to leave their companies. Does this mean they do not believe in loyalty?

Capitalizing on property

In the past, “loyalty” of founding shareholders changed the way of holding shares. Instead of directly holding shares of individuals or groups of individuals in a company, these shareholders established companies under different names. By establishing these companies, founding shareholders set different goals, but it usually meant “capitalizing on property” for them.

This trend may have come into existence as a result of the introduction of the personal income tax law, applicable to individual dividends as stipulated in Clause 3, Article 2, Circular No.111/2013/TT-BTC. In response to this Circular, a few major shareholders in companies listed in the securities market established companies that received transfer of personal property. Founding shareholders who were holding a majority of shares of such listed companies gave up their “loyalty” and transferred their shares to these newly-established companies.

Founding shareholder Le Phuoc Vu, Chairman of Hoa Sen Company (HSG), established Tam Hy Co. Ltd. and Tam Thien Tam Co. Ltd. in order to transfer most of his personal shares to these two companies. These shares were then transferred to two other companies. Now, the two companies established by Le Phuoc Vu, Hoa Sen Group and Hoa Sen Tourism & Investment Co. Ltd., are the biggest shareholders with their shares making up 24.33% and 20.26% of HSG shares, respectively. He himself is holding 11.74% at HSG.

Not only owners of production and business companies, but also business people in the financial sector are doing this. Holders with a major part of SSI Securities Corporation have also established private companies to transfer their personal property to other companies. Instead of directly holding the property, SSI Chairman Nguyen Duy Hung and his two brothers established NDH Investment Co. Ltd., Dan Linh Real Property Co. Ltd., and Nguyen Saigon Co. Ltd., to directly hold shares in SSI. The founding shareholders at HSG or SSI have changed the forms from personal to corporate ownership. The money received from the transfer of these shares is put in new companies.

Founding shareholders capitalize on assets

Capitalizing the personal property in a company is done in different ways, together with the development of financial assets. First, we should remember the case of Chairman of Duoc Vien Dong Company (DVD) when the founding shareholders listed DVD in the banks or securities companies to take loans. Some used the loans to continue to get more shares while others used them for other purposes. When share prices went down for some reason, lots of mortgaged shares were released regardless of the market. This still happens often in the securities market, most recently in the case of Duc Quan Investment & Development Corp. (FTM), causing ten securities companies to suffer an estimated loss of VND 200 bn in total.

It was a bit more sophisticated in the case of Nguyen Duc Kien, a founding shareholder of Asia Commercial Bank (ACB), who established a financial investment company and then used the investments as mortgage to take loans from other banks. The investments became the bank assets. Then, the amounts were used as mortgage on loans from other banks again. They used the representative rights of major shareholders at the banks to put pressure on lending at those very banks.

This sort of dealing is not new in the international financial market. In 2005, Professor William K. Black published a book titled “The Best Way to Rob a Bank is to Own One.” This book also mentioned the basic tricks to “rob” a bank. Seeing the dangerous impact of this way of funding and tricking the financial system, the State Bank of Vietnam (SBV) issued a set of regulations to limit securities loans at banks.

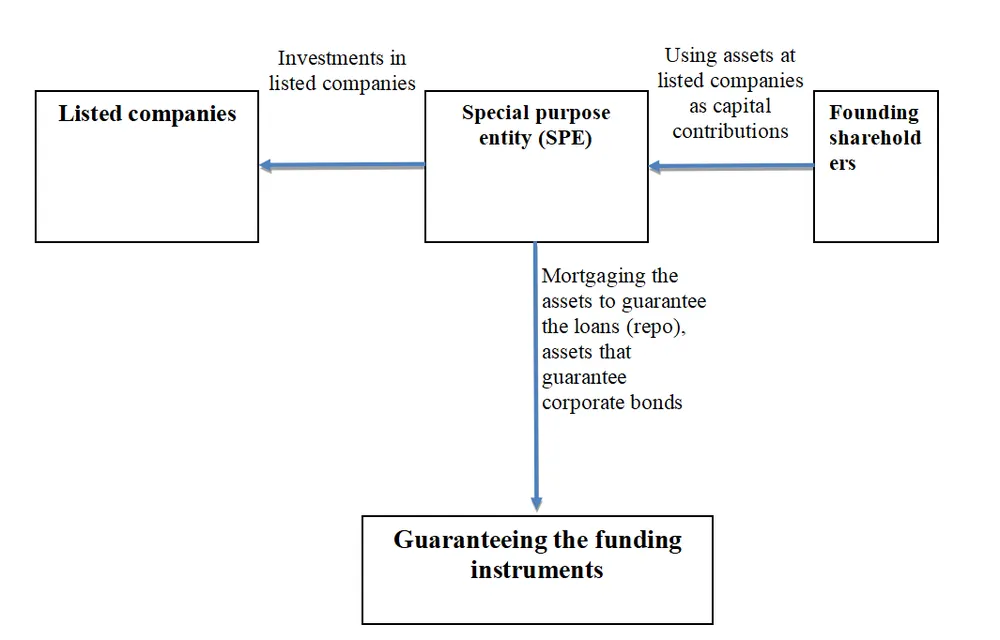

Generally, these are ways that founding shareholders use to capitalize on their assets, using the direct or indirect owned assets through investments to guarantee loans or mortgages, or even issuing corporate bonds (fig.). This funding helps founding shareholders to increase their assets, and also increase their loans. When risks arise out of loans, for example, share prices do not rise 20% per year as some analysts say, but the founding shareholders are very likely to lose all of their assets.

If such ways are extremely risky then why do founding shareholders head for these risks rather than choosing a safer path? Instead of putting all their investments in a listed company, the founding shareholders just make a little contribution and use the rest as loans to the company so that they are in a position as creditors of their company. For instance, instead of using VND 1,400 bn as capital in their company, and the founding shareholders buy shares, they use just VND 5 bn and use the remaining VND 1,395 bn as loan to the company. So do they deliberately sell the assets to “pay for their own debts”, and run away when some calamity happens?