More foreign investors

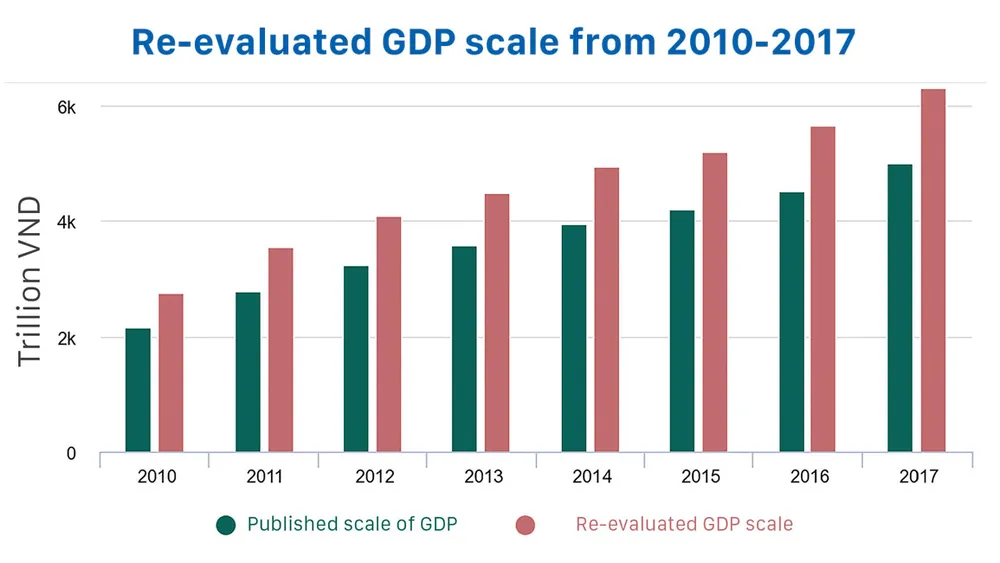

The General Statistics Office of Vietnam (GSO) recently reviewed the Gross Domestic Product (GDP) for the 2010-2017 period and presented a very detailed analysis data of eighty-eight second-level economic sectors, twenty-one first-level sectors, and three economic regions.

The results showed that the average GDP during this period increased by 25.4% year by year compared to previous figures, which is an increase of VND 935,000 bn per year. The figures show the highest increase of 27.3% in 2011 and the lowest rise of 23.8% in 2015. The economy also rose to USD 275 bn from previous released statement of USD 220 bn.

Taking into account the growth figures of 2018 and the first half of 2019, Vietnam’s economy exceeded USD 300 bn, and GDP per capita went up to USD 3,000 bn from previous figure of USD 2,590 bn.

With regards to the economic sectors, the size of the industrial, construction and service sectors increased greatly. Particularly, the increased value of the agricultural, forestry and aquatic sectors in the review of the 2010-2017 period, showed an increase by VND 25,000 to VND 46,000 bn per year, equivalent to 5.4% to 6.2%, higher than previous figures. The review of these sectors for 2017 reached VND 814,000 bn, from previous figure of VND 768,000 bn.

With regards to the industrial and construction sectors, the review showed an increase of VND 211,000 to VND 555,000 bn per year, equivalent to 27.6% to 36.6% higher than previous figures had shown. The review of the industrial and construction sectors for 2017 showed an increase of over VND 2.2 trn from previous figure of VND 1.6 trn. Meanwhile, the increased value in the services sector rose VND 316,000 to VND 615,000 bn per year. The increased value in this sector after the review reached more than VND 2.6 trn from around VND 2 trn.

That is to say, the recent GDP review showed positive macro-economic figures which are likely to attract foreign investors. Direct and indirect investments from foreigners are expected to soar in 2020 and the years to come, gathering fresh momentum for the growth of the domestic economy.

Possible negative effects

However, what is most important is the effect of the GDP figure of 25.4% and how the relevant authorities will deal with this figure in their planning of socio-economic development strategies in coming times, without feeling excessively smug, which could possibly lead to negative effect on the current growth of the economy. The authorities need to make proper plans and adopt appropriate policies for the socio-economic development in coming years, because an increased GDP will result in changes in the balance of other macro-economic figures such as inflation rate, state budget deficit and trade balance deficit.

What is special is that the rate of GDP payment to the state budget in 2018 of 25.7% GDP, with tax revenues making up 21.1% GDP, fell to 20.5% and 16.8%; and the rate of GDP payment to the state budget in 2019 of 24.4% GDP and 21% GDP from tax revenues went down to 19.46% and 16.8%, respectively. The rate of overspending of the state budget which was 3.46% GDP and 3.54% GDP in 2018 and 2019, became 2.76% and 2.82% GDP, respectively. These figures show that the macro-economic indices in the economy in the past few years were much better than before. Obviously, the rate of GDP gains and tax revenue for the state budget are relatively low, compared with figures in the region and around the world.

However, when the figures of public, government and foreign debts become low, they may lead state debt management officials to become too smug and they may decide to take more loans to meet various expenses and thereby increase debts, scatter investments, indulge in poor management and corruption. Lower CPI and basic inflation rates are likely to cause lax management of prices, finances, and currency in the market. These, together with fluctuation in foreign exchange rates and rise in prices of certain essential goods in the regional and international markets, could increase the inflation rate again and reduce the country’s socio-economic achievements.

Also, the rate of GDP gains and tax revenue for the state budget, which are relatively low compared with figures in the region and around the world, require rigorous reform policies for appropriate taxes and other revenue, for the country to have more comprehensive global integration.

An increased GDP will certainly change the strength of economic sectors and raise the nominal GDP per capita. Companies will have to take into account an individual’s expense while calculating production rate and making business plans. This could be an opportunity for an increase in capital in the private sector in the economy.