This caused shareholders to rush to sell off HAG shares at any price. Now HAG has again become the focus of attention of many investors on the stock market after the company disclosed its interest in entering the pig breeding segment.

Move to pig breeding

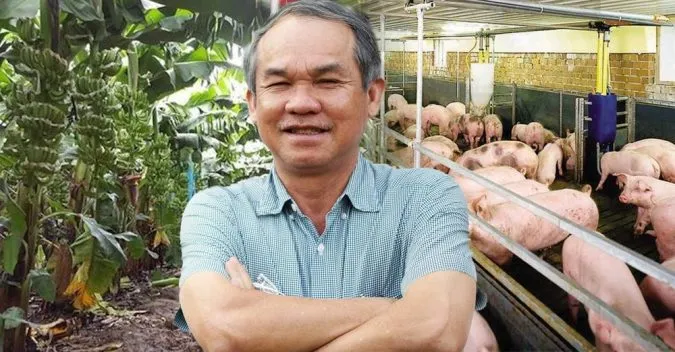

The Hoang Anh Gia Lai Group is preparing to enter the pig breeding segment and this move would include banana plantations that would support pig production in a new innovative model of growth for the company. The People’s Committee of Gia Lai Province has recently approved the investment of a project for planting 1,550 hectares of banana trees. This would serve in raising 24,000 pigs for breeding, and 560,000 pigs for meat purposes on an area of 108 hectares in the province, which would be ready for a running business by the end of the year.

The objective of the project is to grow banana trees in a sustainable way and meet Global GAP standards for domestic consumption and exports. The project would have effective irrigation for cultivation, with barns for livestock and poultry. The project has a total investment of about VND 1,852 bln, of which more than VND 538 bln of capital funding will come from Gia Lai province and HAG would support this with an added VND 1,313 bln.

At the 2022 Annual General Meeting, Mr. Đoàn Nguyên Đức, Chairman of the Board of Directors of HAG, said that the new business model aims to develop sixteen clusters of pigpens that will have a capacity of holding more than one million pigs per year and 7,000 hectares of banana plantation. At the same time, it will develop a roadmap for 5,000 stores to distribute good-quality branded pork. In an earlier report, HAG claimed to have completed nine pigpen clusters by the end of May. These clusters will sustain more than 27,000 breeding sows and 600,000 slaughter pigs per year. Therefore, if 560,000 pigs are nurtured over an area of 108 hectares in this project in Gia Lai province then HAG will complete its planned target in the livestock segment as presented to shareholders.

New business model

Mr. Đức is very confident about this new business model. At the 2022 Annual General Meeting, Mr. Đức shared that he would not let HAG fail again. According to him the previous failures of HAG could be attributed to many objective factors. For instance, in its foray into cow breeding and rubber cultivation. Mr. Đức said that this business model for feeding bananas to pigs was not entirely new, but the difference was that HAG had found a recipe to make pig feed from bananas. Pigs raised on banana feed would be more fragrant and delicious than normal pork meat.

According to Mr. Đức, there were advantages in offering a competitive price in pig meat under this model plan at cost price of VND 35,000 per kilo. On the other hand, the banana segment is also estimated to earn an additional VND 150 mln per hectare compared to the previous average profit of VND 400 mln per hectare. Mr. Đức also expects the banana selling price to enter the highest cycle in the second half of the year, and the pork price to continue to remain high with sales doubling in the first half of the year. HAG expects to soon achieve its planned target set out for the whole year and even exceed by 20% to 30%.

According to the half yearly financial report published not long ago, HAG revenue in the first half of 2022 totaled VND 1,867 bln. The main source of revenue came from the fruit industry at VND 1,094 bln, from livestock at VND 439 bln, and VND 334 bln from supporting industries. HAG suddenly reported a profit of VND 531 bln after tax in last six months. Compared to the full-year business plan of VND 4,800 bln in revenue and VND 1,120 bln in profit, HAG has completed 39% of its revenue target and 47% of its profit plan.

Investors doubtful

Although the first six months of the year saw extremely impressive business results, many shareholders are still not confident by these results. Many investors expressed doubts in their statements to Mr. Đức for stepping into a new business plan despite past failures. The lack of confidence in the new business model is also a factor that caused investors to panic and sell off HAG stocks, even though there was no negative information published in the last session on 20 July.

It was not only retail investors that expressed lack of confidence, but many experienced strategic shareholders were also not confident enough in supporting HAG in its new venture. For instance, several investors withdrew from HAG even though they themselves have full information about the upcoming direction the business was planning to take. Specifically, after the 2022 Annual General Meeting, HAG had announced a list of nine professional investors, of which seven individual investors had agreed to buy 162 million shares of HAG, at a selling price of VND 10,500 per share.

However, recently when HAG announced the list of shareholders to buy this number of newly issued shares, there are only three investors who came forward including Glory Land Company Ltd., Viet Cat Management JSC, and Mr. Nguyễn Đức Quân Tùng. This made it clear that six individual investors on the list announced in April have turned away. It is not difficult to understand the decision not to participate in the issuance of shares of HAG, because the decline in May and June dragged the share price of this company down to just around VND 7,000 per share at one point. Therefore, instead of buying at the price of VND 10,500 per share, and being restricted from transferring for one year, these investors can buy right on the floor at a discount price of up to 30%.

However, if viewed positively, the determination of these three investors to pour capital into HAG partly shows that this business has not lost the confidence of all investors. Another reason for these shareholders still having confidence in HAG is the fact that Mr. Đức's daughter, Mrs. Đoàn Hoàng Anh, constantly supports HAG every time the share price falls below par. Ms. Anh currently holds 9 million shares of HAG. Previously, a large corporation worked with HAG to discuss a plan to pour capital into the pig industry. Although this deal was not successful, this group's intention to invest in HAG shows that this new business model of HAG continues to hold the interest of many people.