The last document concerning credit limits for the securities market was Circular No. 36/2014/TT-NHNN introduced in November 2014 and which was set to go into effect in February 2015. The document was meant to allow SBV to control credit flow to the securities market by imposing limitations and safety guarantees for credit institutions (CI).

As a rule, financial institutions (FI) must meet the requirements of operational safety, and bad debts must be kept under 3%, before they are allowed to give loans for investments. Article 14 in Circular No. 36 stipulates the scope for investment in shares to be 5% or less of the charter capital of a CI. This considerably limits the cash flow, because loans for investment in shares were 20% before Circular No. 36 was brought out.

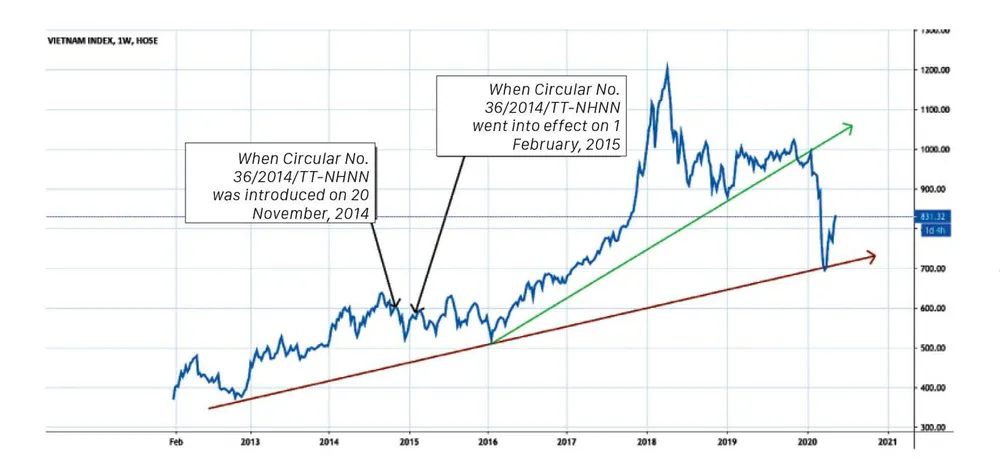

The removal of 15% of credit limit for the securities market left a negative impact at that time. The VN Index figures from the issuance date of Circular No. 36 till the date it was to take effect showed a sharp decline in a short space of time. About a year after Circular No. 36 came into effect, the VN Index actually began to surge, and soon doubled, rising from 500-600 points to 1,100-1,200 points.

Foreign investors net sell

One basis for analyzing prospective growth of markets is by monitoring the flow of cash. At present, some banks have used up their credit limit of 5% allowed under Circular No. 36, therefore SSC has proposed increasing the credit limit. For cash flow to increase, Vietnam pins its hopes on foreign investments, but this year foreign investors have continuously been net selling. Since 1 April 2020, the date when Prime Minister Nguyen Xuan Phuc declared a state of emergency due to the Covid-19 pandemic, foreign investors have net sold almost VND 9,000 bn and since 25 January, foreign investors have net sold approximately VND 20,000 bn.

Foreign investors are net selling for two reasons. Firstly, because the interest rates have fallen over the last few months. Secondly, because the forex rates have risen considerably. By the end of the first quarter of 2020, transactions were mostly in the upper margins of VND-USD exchange rates, and had even reached VND 23,660 to the US dollar.

These two reasons had negative effects on returns on foreign direct investments (FDI), and easily explain the withdrawal of net capital from the Vietnamese market. The loss of value of the local currency may happen in any country, but the interest rate decrease has been the primary reason that reflects on the monetary policies of both developed and developing countries amid the Covid-19 pandemic.

In addition to macro reasons, another more practical reason for foreign investors net selling may have come from the fact that the VN Index has broken its medium trend increase (see green line trend). Although the long-term trend increase remains (see red line trend), the broken medium-term trend indicates that the growth momentum in the Vietnamese securities market has come to an end.

Previously, several foreign investment funds had predicted that the VN Index would reach around 1,500 points, but the breaking of this trend has brought this scenario to an end, and the situation is unlikely to look bright again for at least one or two years. After all, the market supply and demand tells the actual truth and expectations of the market.

More concerns about bad debts

The SSC proposal may be a strategy for using domestic demand to satisfy foreign supply. This is very much like what the National Assembly expected from the Vietnamese economy at the beginning of 2020. By the end of 2019, Vietnam’s exports rose beyond expectations, especially in the third quarter of 2019, with a surge in exports to the US market.

In 2020, however, the domestic demand for goods and services, together with the rise of the middle class, are expected to promote macro growth in Vietnam. If the securities market is a test of the economy, it is possible to expect a similar strategy for both the goods and services market and the capital market.

As far as domestic economic prosperity is concerned, it will still be seen as sustainable growth in the long run if the VN Index remains between long-term trend and medium-term, which is between the blue and red lines. Therefore, if SBV accepts the proposal from the Ministry of Finance, it will surely create positive effects on the entire market and will reverse the effects of Circular No. 36. Shares of banks and securities will be the first to benefit from such positive effects, stimulating the growth of the VN Index again.

Regarding the credit dependent growth of goods and services, experts are most concerned about bad debts as they are serious setbacks for any financial institutions and economies. Thus, relaxing the 5% credit limit will certainly enable new capital flow to promote the securities market. Margin calls or wrong decisions on investments will first hit individual investors, followed by bad debts. However, if securities companies strictly manage guarantee deposits, the relaxed credit limit will not create effects in the short term.

The GDP growth, management of general prices, promotion of comprehensive demand, and support for supply, have always needed some time to reach a new place of balance, especially after an economic shock such as that felt with the Covid-19 pandemic. According to a World Bank report, Vietnam will see strong growth in domestic demand for goods and services in 2020. When the securities market plummets, it will have macro effects on the general demand for goods.

Individual investors’ property is important for domestic demand while the growth of companies listed on the securities market is significant for suppliers of goods and services, growth in employment, as well as unemployment for households. How much the credit limit should be eased to ensure a new balance and also promote economic growth is actually a science and a skill in policy management.