Oil and gas stocks

In 2020, the market witnessed a wave of livestock stocks, and recently a wave of fertilizer stocks, steel stocks, oil and gas stocks and public investment stocks. The stocks drawing the most attention lately are all related to oil and gas. Media around the world is buzzing with stories of soaring oil prices, and an energy crisis from Europe to China. Brent oil price has increased by about 27% since the last week of August, and from the beginning of 2021 it has increased by nearly 62%. Shares of enterprises in the fields of exploitation, transportation, transmission, trade, and oil and gas have skyrocketed. In Vietnam, the oil and gas stocks have only emerged since the end of September, although the world oil price has been on an uptrend for a long time.

GAS is one stock that has received the most attention due to the high price profit of Liquefied Petroleum Gas (LPG), because GAS is involved in production and accounts for about 70% of the national LPG market share. From the beginning of September until 6 October, the price of GAS has increased by about 28.1%. Valuation of GAS in an analysis report by a large securities company on 6 October, with target till end of 2021, showed the P/E ratio of GAS is about 23 times and the price is about VND 118,500, but in just over two weeks, the price has increased sharply to around VND 113,000.

The actual gain of GAS is far behind many smaller oil and gas stocks. ASP, with a market capitalization of just over VND 612 billion, has increased by 126% since the beginning of September; PGC market capitalization is more than VND 1,850 billion, and price increased by around 53%; TDG, a gas trading company with a market capitalization of less than VND 150 billion, also increased 78%; PVG, with market capitalization less than VND 700 billion, increased price by 110%; and MTG, a very small trading company, also increased its stock price by 170%.

Speculative factors appear quite strongly in this wave of industry stocks, but they always go hand in hand with basic supporting factors. The sharp increase in oil and gas prices in the world inevitably leads to the usual inference that companies operating in this field will benefit the most. It is difficult to know exactly how the business will benefit and how the profit numbers will grow. In other words, the quantitative factor of the so-called "benefit" is not understood by all investors. However, in the context of speculative cash flow under very high risks, the only thing this cash flow will need is reason to put down the money.

Investment strategy

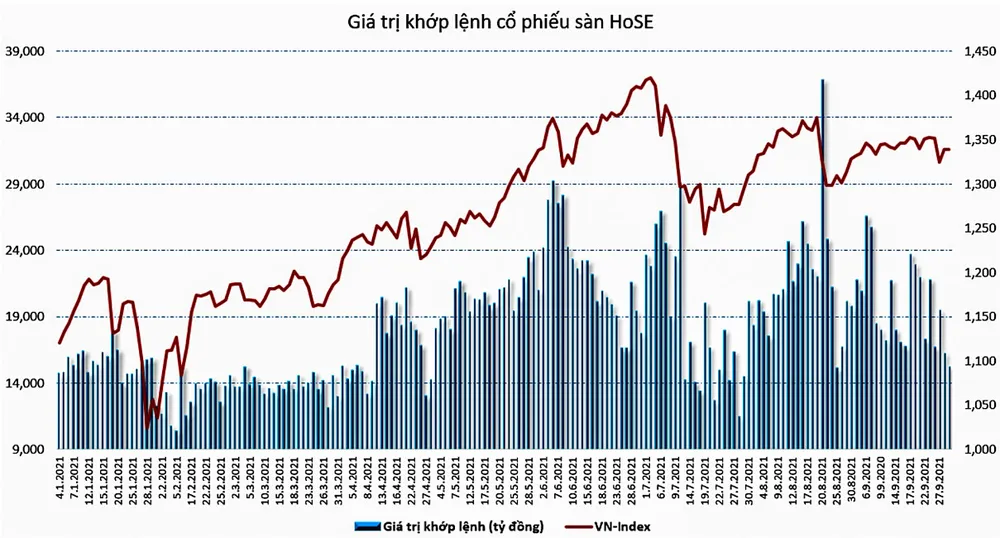

The selection of stocks by industry groups is an investment strategy that has been around for a long time, but it is not as clear and attractive as recently, partly due to the large-scale new cash flow in the market. Liquidity before 2020 was quite small, making the cash flow movement more difficult to perceive and also not creating any exciting trends. The fact that millions of new investors joined the market also means a huge increase in the size of room and groups, for discussion on social network sites. Exponentially increasing contagion creates a much more pronounced impact.

Investment trends by industry are also being encouraged during the Covid-19 pandemic when the pharmaceutical stocks boomed in a clear and recognizable way. The media also highlighted the main information circuits related to economic fields such as the high world steel price leading to a wave of speculation in steel stocks; pork causing a wave of speculation in livestock stocks; fertilizer price storm helped the group of stocks of companies producing and distributing this product to increase; the supply chain making logistics stocks flicker; and the pressure to disburse domestic public investment every time is highlighted, making construction stocks rise.

On the positive side, this movement shows more efficiency in the stock market when macro and micro information is interesting and analysed quickly by investors. This is a signal of the maturity of the market as a whole. However, the negative side is excessive rumours, which turns investment based on fundamental factors into a pure speculative movement. It is a fact that any industry wave comes from a fundamental support factor. The crowd always needs a valid reason to orient their minds, what in the language of investors is called consensus. When it goes beyond investing, however, what remains is the effect of crowd speculation.

The phenomenon of waves in the stock market, as happening now, is not an actual economic rotation investment strategy. The spurt in stock prices in the industry group based on information or trend, are still just normal speculation. When this trend is out of fashion, the information becomes redundant, and the momentum in stock price increase will also fall.