Reasons for low credit rating

Two other credit rating firms, Fitch and Standards & Poors (S&P) have given Vietnam a BB or stable rating, which means the problems are not as serious as Moody’s cited. Relevant agencies and departments in Vietnam will have to work towards good decisions to improve the ratings and carefully analyze why Moody’s is still determined to hold on to its point of view.

Firstly, Moody’s gave a high weight to institutional strength and national administration while Vietnam got a low point for this factor. When interacting with other major and minor factors, the integrated credit point is substantially reduced. Meanwhile, S&P gave a higher weight on the factor of technocracy. That may be the reason why Vietnam’s potential rating is still at a stable level.

Secondly, Vietnam has low points in the factor of economic flexibility and fiscal strength while Moody’s put higher weight on fiscal strength for countries with low points in economic flexibility and vice versa. These two factors, together with the concerned higher weights, considerably reduced the aggregate point of Vietnam’s credit ratings.

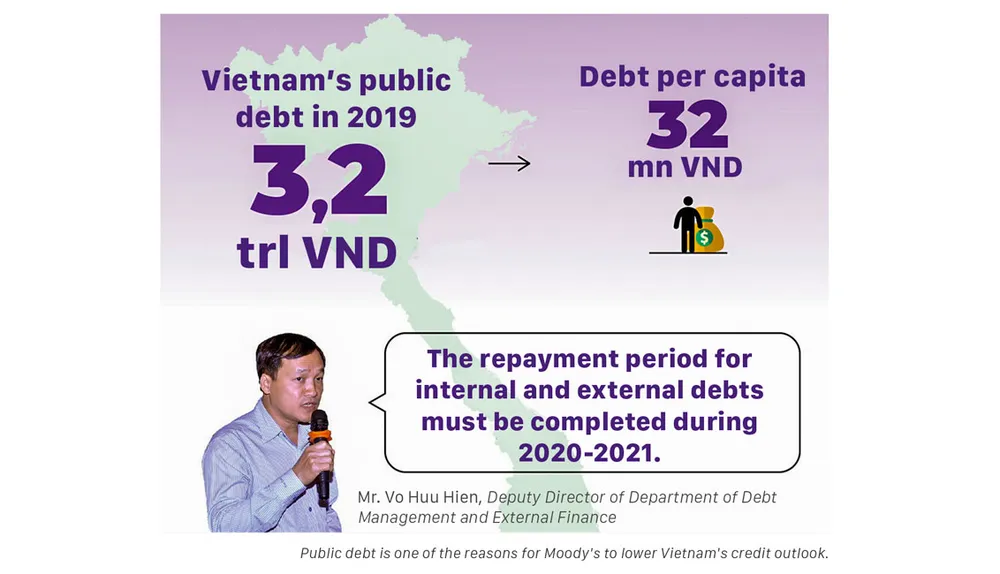

Public debt is one of the reasons for Moody's to lower Vietnam's credit outlook.

Public debt is one of the reasons for Moody's to lower Vietnam's credit outlook. Understanding approaches and requirements

After analyzing Moody’s quantitative and qualitative methodologies, we can see that the Ministry of Finance arguments are not persuasive when it complains that Moody’s did not include Vietnam’s socio-economic achievements as a factor in the ratings. Moody’s actually put all the factors into consideration. Moreover, on 16 December 2019, Moody’s had some discussion with the Ministry of Finance before it released the results and the Ministry failed to persuade Moody’s to change its point of view.

The credit ratings organizations always depend on theories of “looking forward” and “standardization” of all quantitative frameworks. “Looking forward” implies that the appropriate reactions in policies must prove to them what needs to be done instead of making arguments. And “standardization” means it is hard to change or argue against the ratings methodologies because the credit ratings organizations have set them on international standards.

If we carefully probe Moody’s suggestion, it comes as good news to us that Moody’s will raise our credit ratings to a stable level if there is “more visible” evidence in our ability to directly or indirectly fulfill public debt obligations. The fact the Prime Minister has reprimanded the concerned departments and agencies for delayed repayments of debts may be necessary “visible” evidence that came promptly enough. While waiting for positive changes, international investors are reluctant to hold government bonds if they are not offered high interest rates. Several international investment funds will automatically sell government bonds to balance the portfolio risks. Increased costs of national borrowings in the international market will make it difficult for efforts to restructure the public debts and the economy as a whole. The banking system will also be affected with their credit ratings because corporate credit ratings cannot be higher than the national ratings.

Unlike some countries that have low credit ratings due to high cumulative debts in their budgets and cannot cope with their problems in a short time, Vietnam just needs better inter-departmental collaboration before the public debt obligations can be fulfilled satisfactorily. Therefore, Moody’s is very unlikely to further lower Vietnam’s credit ratings in government bonds unless there are some adverse occurrences. Out of the 104 countries rated by Moody’s in 2018, only 19 countries had negative ratings. This percentage is not expected to see much change in 2019 even though the number of countries rated by Moody’s has risen to 140. Being rated as separate and exceptional could be a disadvantage for a strongly emerging country.

When the credit ratings organizations lower a country’s credit ratings, relevant agencies as well as most of commercial banks often find reason to complain. The fact that the three credit ratings organizations make up 95% of the global market share, shows their power and prestige. Although the ratings methodologies are never perfect, customers and bond debt issuers should learn to understand their approaches and requirements and try to adapt themselves in this ever changing world, instead of trying to making this an argument against the ratings by credible credit ratings organizations.