Psychological burden for investors

After a sharp increase in stock prices in mid-October, the VN Index reached 1,024 points in the trading session on 6 October, and the market suddenly declined dramatically to 950 points. The fact that the VN Index failed to hold its juncture of 1,000 points as analysts had judged at the beginning of 2019, along with net selling by foreign investors, aroused many investors bearish sentiment towards the stock market. According to statistics, from the beginning of December till now, foreign investors have net sold VND 520 bn, of which, two blue-chip stocks with the strongest net selling were Masan (MSN) and Vinamilk (VNM).

In fact, figures are showing many disadvantages for the market. For example, many investment funds cannot call for extra of new capital sources to make sure that foreign investment capital is stable in the market. Along with that, foreign investment capital is withdrawn quite progressively from emerging markets, including Vietnam.

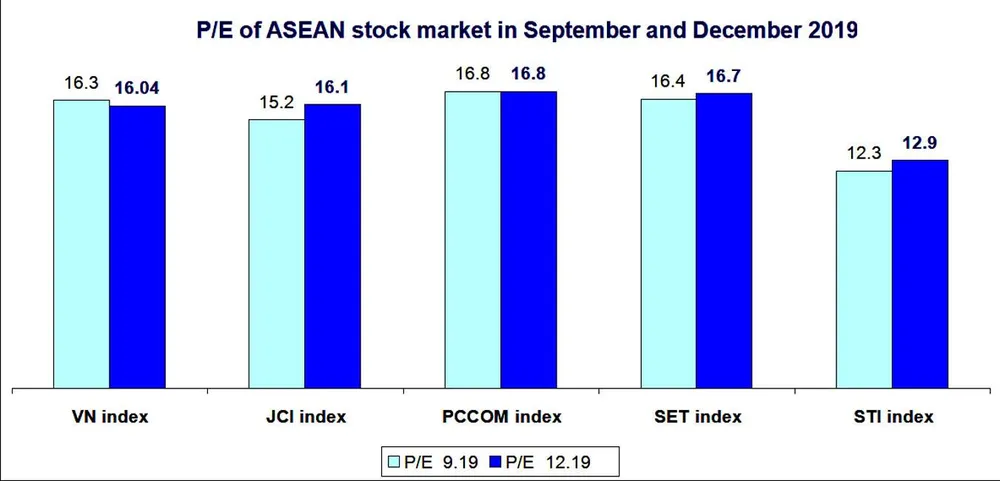

P/E ratio of Vietnam’s stock market decreased slightly due to a downward trend in the market. However, it still is at a relatively high level compared to other countries in the region, but currently reduces the attraction of foreign investors into such a market. These factors have dramatically affected the decline of capital sources in the stock market. The statistics also show that the market average liquidity is now reaching USD 176 mn/day, a decrease of 27% compared to the average level in 2018.

No signs of reversing

Recently, the stock market has not shown any signs of increase in the context of investors bearish sentiments towards the market downturn. However, it is noticeable that other investment channels are not attractive enough for investors to withdraw cash flow from the stock market.

Meanwhile, money market and bond investment channel is not a good place for investment capital from stock market to flow into. Bank interest rates are considered an example for most investors. Interest rates are expected to remain at current level in coming time due to abundant liquidity in the banking system. Large banks have interest rates of 6.5-7%, while other small banks have interest rates upto 8%/year, but it is difficult to attract large capital in reality.

Another factor is that interest rates of government bonds have decreased in the past three months and may continuously decline in coming time, causing difficulties for investment funds to transfer money to this channel, whereas the stock market is going down. Bond interest rates in both short-term and long-term periods will be difficult to increase in coming time.

Short-term bond interest rates are expected to fluctuate around the current level in the near future, due to abundant liquidity in the banking system. In developed markets, government bond yields in developed countries have increased again since late August to early September. This is a sign that cash flow for safe-haven bonds has significantly cooled down. In other words, investors high expectations for safe-haven bonds with the aim of avoiding a recession risk have gradually lowered.

Chance for investors

Most investors, called surfers, often like following investment strategy of William O’Neil, which is, "Buy stocks when stock prices rise, but don’t purchase when the prices go down”. Thus, this period is still an observation phase because they believe the market hasn’t had an opportunity to increase yet. However, in view of the stock price in a month, the decline of large-cap stocks is easily recognized, such as Vingroup (VIC), Vietcombank (VCB), FPT, and Mobile World (MWG), leading to a decrease of many mid-cap stocks. It is noteworthy that lots of stocks pulled down haven’t increased yet since the market was bullish in October.

Therefore, the stock prices with an average market capitalization became attractive, with P/E ratio of 7-12x compared to current market average level of 15.5x. As a result, the recent downturn of the stock market is a chance for investors to restructure the portfolio that can be planned and implemented quarterly.

With the current price of several stocks, individual investors can make a profit of 20-30% based on the prediction of increasing prices after Tet. The leading stocks are still of the consumer service industry along with some banking shares. In view of the real estate sector, although the low price is quite attractive compared to profits, this sector is still underestimated by the market, and that is why the possibility of increasing prices is questioned in such sectors.