Now, the issue for the director of the Macao Government Tourism Office is that it often feels like there are too many visitors.

Last year, nearly 36 million people visited Macao, already one of Asia's most densely populated cities. With 670,900 residents packed into just 32.9 sq. km, officials are pondering imposing a "tourist tax" to ease the crowding.

"Now my job is to not get so many tourists to come to Macao," she said in May, only half-joking.

But Macao is not just questioning how many tourists it can accept. The city's main attractions -- its 41 casinos -- are also facing a reckoning of their own.

A gaming expo in Macao in May: The city's six casino operators face license renewals by 2022. (Photo by Manda Yeung)

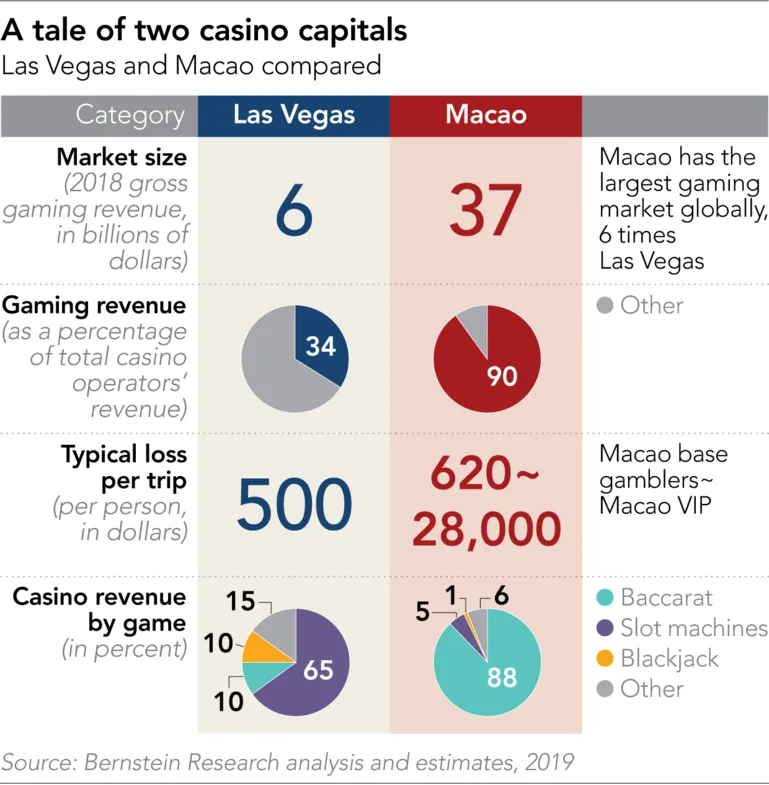

A gaming expo in Macao in May: The city's six casino operators face license renewals by 2022. (Photo by Manda Yeung) Macao is preparing to elect a new chief executive this summer who will be charged with deciding on the future of the city's gaming industry, the largest on the planet with gross winnings last year of 302.85 billion patacas ($37.5 billion). The concessions under which six companies run the city's gambling houses are set to expire in June 2022, midway through the next leader's term.

All of this has prompted a general stocktaking of what has been achieved in Macao since its casino monopoly was broken up in 2002 -- and what has not. Back then, the vision was to bring in American expertise to catalyze a Las Vegas-like transformation that would turn the city from a seedy gambling town dominated by organized crime into a gleaming convention capital featuring top-class restaurants, shops, art and performances.

On the surface, the transformation has been successful: Macao's glittering Cotai district of high-rise casino resorts bears a striking resemblance to the Las Vegas Strip. But attempts to broaden Macao's clientele have been disappointing. Cirque du Soleil, Madonna and restaurateur Wolfgang Puck have all come to Macao, but visitors are still spending most of their time and money at the gaming tables.

"Today it is clear that various efforts and attempts to diversify the economy made over the years have for the most part failed," wrote Jorge Godinho, a gaming law professor at the University of Macau in a recent academic study. "Macao is nowadays totally dependent on the gaming industry."

No unemployment, but lots of traffic

Back when the concessions were issued in 2002, ending the 40-year monopoly enjoyed by billionaire Stanley Ho Hung-sun, Macao was drawing 10 million visitors a year and generating $2 billion in gross gaming revenues. The city had returned to Chinese control just a couple years before, following four and half centuries of Portuguese colonial rule. Macao was facing an uncertain economic future, with its manufacturing base on its last legs and potential visitors still wary after a pre-handover gang war.

The new casino operators began opening their doors in 2004, and since then Macao's economy has rocketed on a wave of baccarat betting by mainland Chinese. That 15-year boom has made Macao the wealthiest place in Asia in terms of economic output per capita on a purchasing power parity basis, according to the U.S. Central Intelligence Agency's World Factbook.

The concessionaires, which originally committed to invest a combined $1.5 billion, have powered Macao's gross domestic product growth by pouring in $35.6 billion, according to equity research company Union Gaming. Even with the future of the concessions uncertain, the operators have another $17.6 billion in projects underway in the city.

As a result of this boom, unemployment has virtually vanished and permanent residents enjoy free health care and 15 years of free schooling. They also receive an annual check from the government: Last year's payment came to 10,000 patacas a person.

Yet many do not feel prosperous. "The cost of living has gone up and we are under a lot of pressure because of housing prices," said an elderly man chatting one evening in a park on Taipa Island. He continues working at a printing business because he has no pension and wants to save money to help his son buy an apartment. "I need to prepare well so he can afford a mortgage."

Even though the city's casinos pay out 39% of gross gaming revenues to the government, the bulk of their profits still goes to their owners, who are mostly to be found in the U.S. and Hong Kong. With ordinary citizens feeling left behind, some argue that the casinos should pay more in tax -- and do more for their local employees.

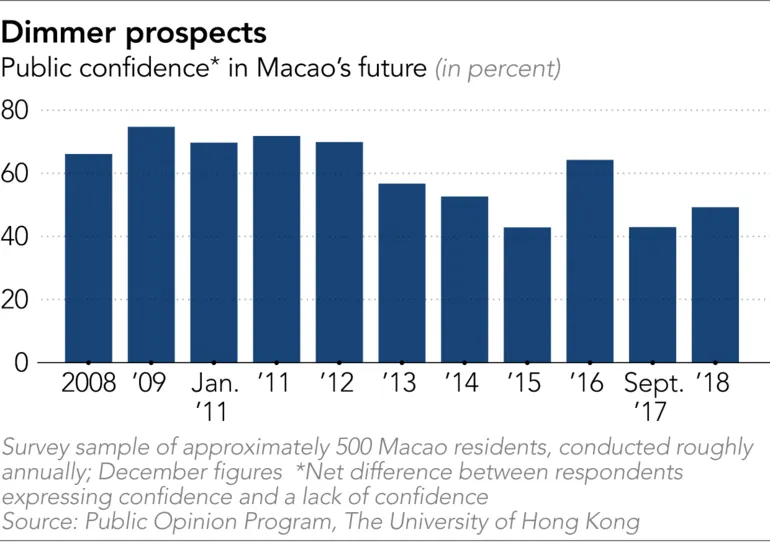

Macao's citizens have to contend with traffic congestion and pollution caused by the flood of visitors coming to the casinos, while small businesses struggle to make rent and retain staff. Less than half of respondents surveyed by the University of Hong Kong's Public Opinion Program in December on balance expressed confidence in the city's future; that compares with close to three-fourths at the time of the handover.

The economy and the government have become even more dependent on the volatile gaming sector than they were in 2002. The share of tax revenue coming from casinos hit 85.5% last year. With gaming receipts declining year on year, Macao's GDP contracted 3.2% in the first quarter, according to data released June 3.

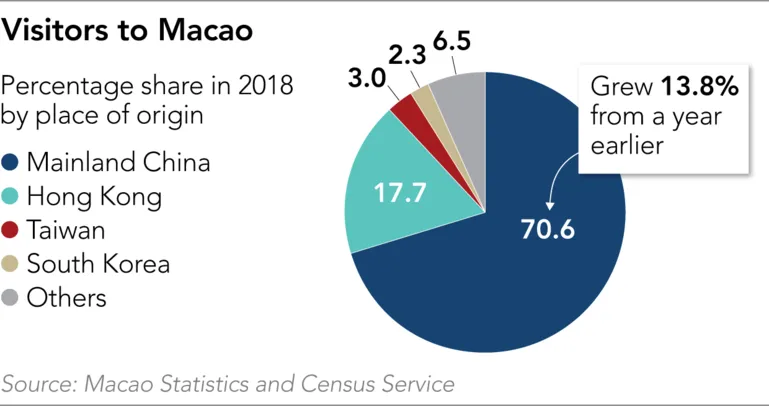

Given its tight capital controls, Beijing has never looked favorably on citizens taking money offshore to gamble in Macao. Yet the share of city visitors coming from mainland China climbed to 70.6% last year, more than double the proportion seen in 2001. Even before the trade war, there were misgivings about how much of Chinese cash was being lost to U.S. casino operators.

Macao's next government, which will take office in December on the 20th anniversary of the city's return to Chinese control, will hold a fresh tender for casino concessions. This will involve deciding whether to expand the number of concessions or shorten their duration and whether to adjust industry taxes and obligations.

So far, just one candidate, Legislative Assembly President Ho Iat-seng, has affirmed plans to run. Little is known about Ho's views and he declined an interview request.

The managing director of lighting manufacturer Hotin, Ho is seen as close to Beijing, having served as Macao's only representative on the National People's Congress Standing Committee since 2001.

Hong Kong risk consultancy Steve Vickers and Associates said in a report this year that Ho "may welcome a similar 'Sinification' of the gaming sector," noting how he dismissed two Portuguese legislative legal advisers last year. Ho also helped put through a law barring non-Chinese judges from handling cases related to national security.

Getting in on the game

The gaming sector's recent slump, a result of China's shakier economic outlook, is the first since Chinese President Xi Jinping's anti-corruption campaign put the scare into high rollers from the mainland beginning around 2014. (Growth resumed in 2016 as business confidence ticked up in China and credit controls loosened.)

Macao has always faced competition around the region for Chinese bettors, but some analysts see this intensifying with higher-quality properties opening up in other markets. Macao's major junket agencies, which funnel high rollers into the city's casinos, are themselves becoming investors overseas, giving them incentive to redirect traffic to where they can take a higher cut of the profits.

Suncity Group, Macao's largest junket agency by far, recently became the top shareholder of a Hong Kong-listed company running a casino in Vladivostok, Russia. It is also leading the development of a $4 billion casino resort in Hoi An, Vietnam, and pursuing a project in Busan, South Korea.

Other billion-dollar casino resorts are going up in Cambodia and the Philippines. Las Vegas Sands in April committed to invest a further 4.5 billion Singapore dollars ($3.26 billion) in its showcase resort in Singapore that was featured in "Crazy Rich Asians." Sands and other operators are suggesting they would invest $10 billion or more if they win the race to open Japan's first casino resorts.

97-year-old casino mogul Stanley Ho Hung-sun, pictured here in 2001. Ho enjoyed a monopoly until the Macao government's decision to award licenses to outside operators in 2002. © AP

97-year-old casino mogul Stanley Ho Hung-sun, pictured here in 2001. Ho enjoyed a monopoly until the Macao government's decision to award licenses to outside operators in 2002. © AP "Regional competition is putting real pressure on Macao," wrote Grant Govertsen, Asia research head at Union Gaming, in a recent report. He argues that Macao should introduce a lower tax rate for VIP gambling, as Singapore has, to fend off competition from casinos opening in low-tax locations, like those of Suncity. "If tax rates remain static, we expect continued [market] share loss to higher-quality regional properties," he said.

Rather than adjust base rates, Carlos Lobo, a local lawyer who has worked on gaming policy with the Macao government and for Las Vegas Sands, suggests the authorities could allow operators to write off uncollectable debts from high rollers. Steve Wynn, founder of Wynn Resorts, once threatened not to open any properties in Macao if the government did not legalize such write-offs.

Other observers, questioning the impact of regional competitors, see room for the authorities to raise taxes to address grumbling about the outflow of profits offshore.

"One cannot blame overseas leakage for the recent Macao VIP revenue growth slowdown," said Praveen Choudhary, head of Asian gaming research at Morgan Stanley, in a recent report. "Although [Macao's] gaming tax of 39% is one of the highest in the world, it could easily be increased by 3% or so."

Sources familiar with the Macao government's deliberations say operators investing heavily in Singapore and Japan will lose some goodwill with the authorities. Yet most expect the same six companies to remain in business after the official tender, given the government's intense aversion to risk.

"The key principle in re-tendering will be 'stability,'" said Glenn McCartney, who teaches gaming management at the University of Macau and acts as a consultant to the government and casino operators, in an address at the Global Gaming Expo Asia, known as G2E, last month.

If new operators were allowed, most bet that they would be controlled by local investors rather than another foreign company. Suncity, which has built up goodwill by sponsoring key local events like the Macau Grand Prix race, has already expressed interest.

But Macao's shortage of available land and labor makes it hard to accommodate another operator. Migrant workers, mostly employed in construction or at hotels and hailing from China, the Philippines and Vietnam, already represent 28.2% of the city's population.

Some expect the operators to be asked to do more for local staff. MGM and SJM Holdings, the successor company to Macao's old gaming monopoly, were required to join a new government-led employee retirement savings program as a condition of having their concessions, which were to expire next year, extended until 2022 to align with those of the other operators.

SJM is in the midst of its own transition. Founder Stanley Ho, 97, completed his retirement by stepping down from the chairmanship of SJM's parent company in April, but his 17 children and their mothers have been jostling for control of his business empire. SJM, the only operator missing from the Cotai casino cluster, is to finally open a resort there by next year, which might help arrest its sliding market share.

Many expect city authorities to come up with new demands for the operators to help diversify Macao's appeal beyond gaming as Las Vegas has successfully done. Even the International Monetary Fund, in making policy recommendations to Macao in February, said the authorities "should craft new regulations with stronger incentives for operators to expand non-VIP tourism."

"Gaming is 90% of the total revenue pool in Macao and 34% in Vegas," Vitaly Umansky and Kelsey Zhu of Bernstein Research wrote in a recent report. They noted that visitors to Macao spend almost twice as much time each day gambling than in Las Vegas while also losing much more each trip.

The operators are keen to play up how their latest investments involve more than casino capacity. "Basically, we will be focusing on nongaming aspects," said Galaxy Entertainment Group Deputy Chairman Francis Lui in February in describing plans to expand the company's flagship Galaxy Resort.

The resort's new phases, to cost at least $5.7 billion, will include a 16,000-seat multipurpose arena and 400,000 sq. feet of meeting space.

Some suggest Macao's next government should give all the operators a short extension. With three more years, officials could set a clearer plan for long-term renewals -- and give the operators incentive to stay in their good graces. Notably, the other four operators have followed SJM and MGM in joining the government retirement savings program in recent days.

"Now everybody is behaving so well," remarked Alidad Tash, a gaming consultant previously with Sands and Melco Resorts & Entertainment, at the G2E conference.