No access to accounts

On 10 March, the ACBS Trade system of ACB Securities Company (ACBS) was suddenly paralyzed. Investors could not log into their account with any device, either on phone or computer. Ms. Ha Thu from Ho Chi Minh City, holding 10,000 steel shares, planned to sell off to make some profit in the session on 10 March. However, because she could not access her account, she could not place a sell order. When she finally got in, the stock code she was holding was in a state of over-selling on the floor by more than two million units.

Ms. Thu felt very frustrated that she could not sell in time to make a profit, nor could she buy the many shares she wanted to during the day. When she called up the Securities Company, she only received an apology and a promise that it would be fixed in the shortest time possible, while her losses were not even mentioned or considered.

In the morning session on 4 March, the TCInvest trading system of Techcombank Securities (TCBS) also failed to make investors place buy and sell orders. Immediately after this incident, TCBS announced to give customers transaction fee revenue for three sessions, namely, 4 March to 8 March. Thus, customers trading shares on TCInvest system only had to pay 0.03% of the transaction value, which is the fee as per regulations on HoSE and HNX. However, this is not the first time TCBS has had network problems. In 2020, TCBS also had a similar problem and had a policy of not charging transaction fees for three days to compensate investors.

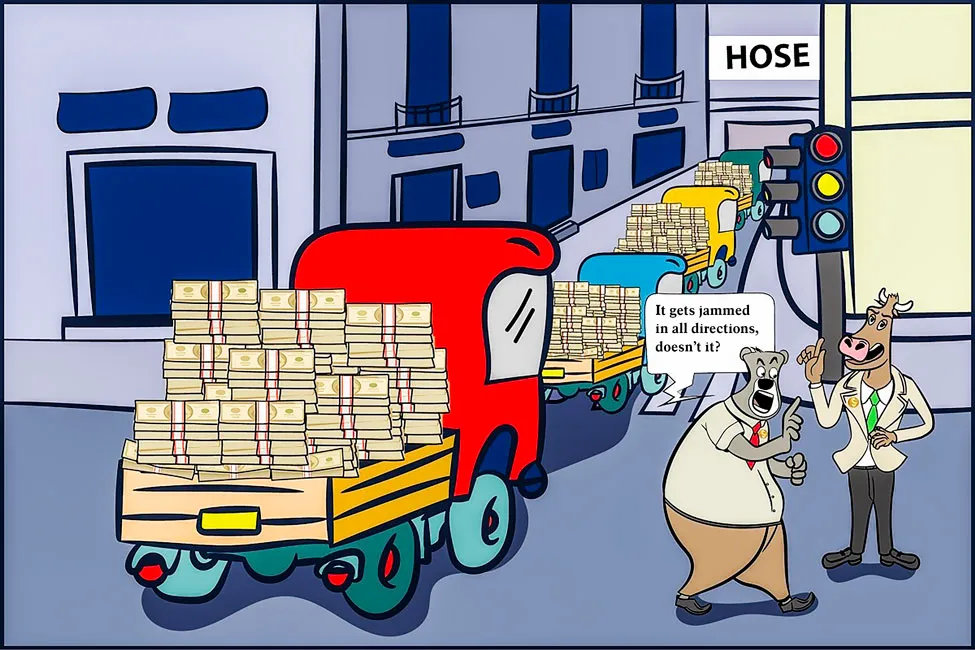

The above incidents have become increasingly common and are no longer a rare phenomenon. Previously, many securities companies had problems with similar trading systems which caused frustration for investors such as for Saigon Securities (SSI); FPT Securities (FPTS); VPBank Securities (VPS); and VNDirect Securities (VND). In the HoSE trading system, there is often overload, and many securities argue that the fault lies with HoSE, not the securities companies.

Many concerns

Mr. Dinh Tien Dung, Finance Minister, held a meeting last week with related parties and FPT Corporation (FPT) to find a solution to the network congestion problems on HoSE. At the meeting, a few solutions offered by the Minister seemed quite suitable with FPT's point of view, which now will be analysed and evaluated by related parties. Accordingly, the solution of applying a software system on the HNX to the transaction system at HoSE is completely feasible and will take three to four months to deploy and complete before it can handle the congestion in securities transactions.

Mr. Dinh Tien Dung requested related units under the Ministry of Finance and HoSE to actively coordinate with FPT to implement the above plan to resolve network congestion. In the immediate future, there is no proposal to increase the minimum trading lot to 1,000, but it is being encouraged to convert some shares from HoSE to HNX voluntarily, in order to reduce the load on HoSE, ensuring safe operation on the trading system.

The fact that the Ministry of Finance found a solution to resolve the congestion on HoSE made investors very excited. This joy was partly reflected in the stock market session on 10 March. In this session, VN Index suddenly rebounded more than 8 points and successfully re-established the level of 1,170 points. However, there are still concerns about processing time which is too long, and whether FPT will overcome the congestion when FPTS, which is a member of FPT, also continues to have this problem. On his personal page, Mr. Nguyen Duy Hung, Chairman of the Board of Directors of SSI, expressed concern about the solvency of HoSE.

Temporary solution

Recently, a former leader of SSC proposed a solution to temporarily use the HNX system while waiting to fix the HoSE system. Accordingly, HoSE only needs to set up a separate table and then calculate the index, as the amplitude of the floor is 7 percent. With the existing system, the HNX will supervise the replacement of HoSE, and also accept the listing and standards of HoSE by setting up own board or even calling the HoSE stock exchange.

Responding to the call of the Ministry of Finance and the SSC, many listed companies on HoSE are planning to switch to HNX such as BIDV Securities (BSC); VNDirect Securities (VND); and members of PAN Group. According to Mr. Do Ngoc Quynh, General Director of VNDirect Securities, joining hands with the authorities in dealing with system overload incidents is both the right and the responsibility of market members, especially as Securities Companies are organizations that provide services and do business directly on the stock market.