In context of the current Covid-19 epidemic that has caused fear among people and reduced consumer spending, a call for a stimulus package to ease monetary policies needs reviewing.

People afraid of risks

During the global recession of 2008, people were afraid of taking any risks and controlled their spending habits. This further affected demand and led to a continued recession. Stimulus packages are normally launched by governments at such times to increase demand and encourage people to consume and spend more.

In some countries, the government even gives money to its people to spend more freely. The current atmosphere generated by the Covid-19 epidemic has hit people like a shock, and calls for a stimulus for monetary easing need to be reviewed.

The economic impact of the Covid-19 epidemic can be summarized in one word "fear". This fear is not fear of losing money but a fear of catching the infectious disease. Time seems to have stopped and all trading activities are on hold. Even without a clue about economics, it is easy to see that there is no fiscal stimulus package or currency to treat fear or make time stop.

The Covid-19 epidemic has simultaneously impacted decline in both supply and demand, and it is impossible to use fiscal and monetary policies to counter the cycle. With each passing moment, people are seeing that any citizen in any country can get infected, and this fear is growing.

Most people hope and pray that the Covid-19 epidemic will eventually pass and end. No matter how great the fear is, the corona virus will never be an intrinsic structural cause of an economic recession in countries. If it does, it will only accelerate the recession process, so the governments will have to launch stimulus packages. Internal motives of each country are relative and if China, Thailand, Singapore and the Philippines have launched economic stimulus packages, Vietnam must not necessarily follow.

Even in the worst case scenario of the Covid-19 epidemic spreading globally, some international organizations forecast that global GDP will only decline once in 2020. China is the largest and most vulnerable trading partner and is taking measures to withstand all negative impacts. In a recent statement to Congress, the US Federal Reserve (Fed) confirmed that the coronavirus, even though it is the biggest risk, is not strong enough to impact the US economy. Vietnam too is not outside this logic. A current stimulus package could be harmful.

Fear will not diminish but only generate more fear, such as fear of accelerating inflation, and fear of rising public debt, all of which will lead to macro-economic instability. Even without monetary easing, because it is too risky, fiscal measures such as tax reduction, increased public expenditure, are likely to have disproportionate consequences on the economy. The latency of integrated public expenditure packages is likely to become a sufficiently large source of energy, causing the economy to heat up and inflation to accelerate.

The most significant fiscal package at this time is to urgently solve the bottlenecks in disbursing public investment. It is also possible to devote a certain amount of fiscal budget to improve infrastructure or help regions in combating climate change, as climate change will eventually have a very severe impact on Vietnam, in all aspects of the economy in the long term, even after the threat of Covid-19 dies down.

Shared responsibility

Only in a financial crisis is the government forced to launch stimulus packages with loosened fiscal or monetary policies. As for specific risks or diverse risks, there is no economic formula or pressure on the state to rescue enterprises that face these risks. For example, in the tourism business, if the business does not accept diverse customers from many different countries but only focuses on Chinese customers, it means they have accepted a risk. They should have a contingency plan in place to compensate for such a big risk. They cannot rely on taxpayer money to rescue them from this situation.

The possible solution now is to create stable packages instead of stimulating the economy. First of all, everyone in society has a shared responsibility to tackle the current pandemic. It means supporting each other, not relying on the state.

The government can only participate in the rescue process to a certain extent, for example, reducing tax. In addition, there should be a communication strategy and role model to support the community in times of need. There are many philanthropic people who would be willing to contribute in these difficult times.

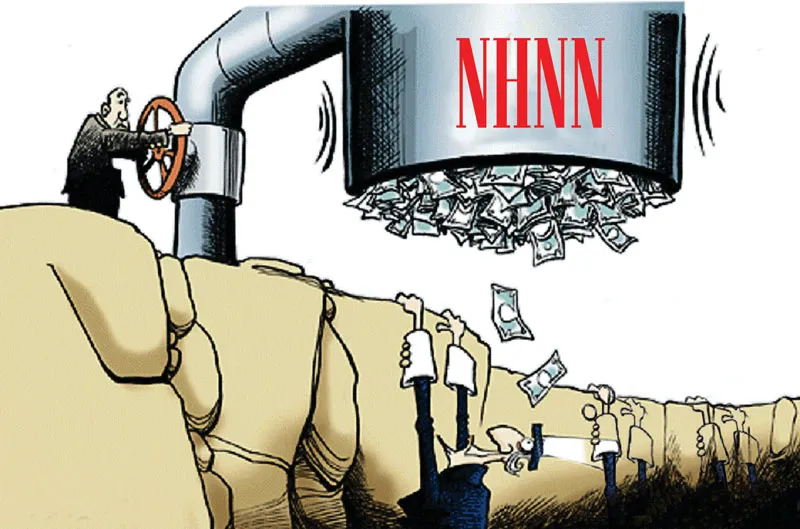

Meanwhile, it is still possible to create economic stability packages that use the least budget. For example, the State Bank can provide liquidity support to banks that dare to share risks with businesses affected by Covid-19.

Accordingly, if banks with bad debt increase and liquidity is scarce, the State Bank can pump liquidity into the whole system by buying government bonds from commercial banks, with the commitment that commercial banks will then buy back within a certain period of time, the purpose being to neutralize the money to avoid inflation.

At the same time, in many other ministries, it is possible to synchronously implement many solutions such as delayed payment of social insurance, taxes, exemption and reduction of fees for businesses directly affected by the Covid-19 epidemic, especially small and medium-sized businesses.

It's like a football team which has a few players with fever and the coach still gives the whole team medicine to reduce fever, showing the absurdity of a rescue proposal on a large scale. Instead, there is a need for policies to encourage healthy people to make more efforts to compensate players in weak health. Unfortunately, the easiest solutions will usually be the preferred option that defy consequences afterwards.

Institutional stimulus, not money

The decline in growth in businesses due to the Covid-19 epidemic can be partially offset by other businesses that are continuing to run somewhat unaffected. For example, the decline in demand in the tourism sector can be offset by new demand in growth in the health sector. So why don't we think about creating more favorable conditions for the health sector, such as in the textile industry to increase production of medical equipment, medicines and masks to serve the domestic market and export to countries that are seriously affected by the epidemic and are facing a shortage of medical supplies.

The government can also use this opportunity to carry out a comprehensive plan to attract foreign investment and target more FDI inflow from countries reeling under the epidemic to view Vietnam as an investment opportunity. Creating a new resource to compensate for losses is a radical and sustainable solution, rather than sticking to the immediate growth target with a short-term economic stimulus package.

Hypothetically speaking, there is another virus called "fear of responsibility". This virus does not allow us to even dare to declare a time when this epidemic will come to an end. Hence, if we can effectively handle the fear of responsibility, without the need for fiscal, monetary packages, the growth target will not only take off this year but stay for many years.