U.S. President Donald Trump said Thursday that he is currently not on speaking terms with Chinese President Xi Jinping and that Washington could go as far as severing the "whole relationship" with Beijing if trade relations do not improve.

"I have a very good relationship [with Xi] but I just -- right now I don't want to speak to him," Trump told Fox Business in a morning interview at the White House. "I don't want to speak to him."

"We could cut off the whole relationship," he said. "Now if you did, what would happen? You'd save $500 billion, if you cut off the whole relationship."

Trump did not explain what he meant by "the whole relationship," but the $500 billion figure suggests that he might have been referring to trade. He has tweeted in the past that "we lose 500 Billion Dollars" a year to China on trade. The American goods trade deficit with China peaked in 2018 at $419.5 billion, U.S. Census Bureau statistics show.

Trump's comments Thursday came as calls for retaliation against China mount in Washington, especially in his own Republican Party. The pandemic has also turned a spotlight on American reliance on Chinese supply chains for needed items, including medical equipment and drugs.

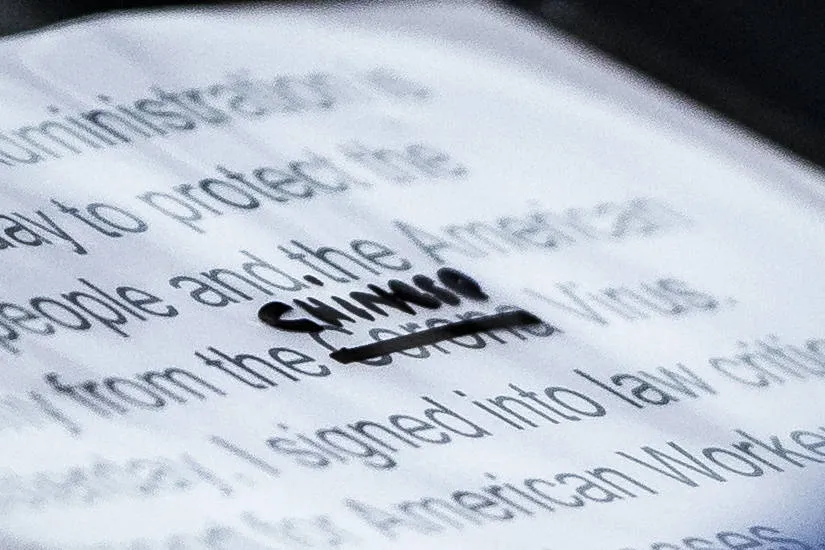

Trump said China's failure to contain COVID-19 within its own borders changed how he felt about the "phase one" trade agreement with Beijing, which he had touted as a win when it was signed in January.

"So I make a great trade deal, and now I say it just doesn't feel the same to me," he said. "The ink was barely dry, and the plague came over, and it doesn't feel the same to me."

Even as the coronavirus takes an economic toll on both countries, Trump said the U.S. will not budge on the agreement's target for Chinese purchases of American goods.

"They said, somewhere, I see they'd like to renegotiate the deal," he said. "We're not gonna renegotiate."

The agreement has China buying an additional $200 billion in American goods over a two-year period in exchange for rollbacks of U.S. tariffs.

American exports of goods to China fell about 15% on the year for the first three months of 2020, according to official U.S. data, raising concerns over Beijing's ability to hit the mark.

Their trade negotiators emerged from last week's check-in talks with different messages. Beijing accentuated goodwill on both sides, while Washington maintained that obligations must be met on time.

In Thursday's interview, Trump also said the administration is looking "very strongly" into delisting Chinese companies in New York if they fail to follow accounting rules.

But he then expressed reservations, right after calling it "pretty amazing" that Chinese companies like Alibaba Group Holding have such access to U.S. capital without having to report their earnings "the way an American company does," as the interviewer put it.

"Let's say we do that, right? So what are they gonna do? They're gonna move their listing to London or someplace else."

The idea of forcing Chinese public companies off the main American exchanges made headlines last September as an option considered by the White House, when trade tensions were at a high point, though the Treasury Department said it had no such plans.

Noise around such a move as part of a financial decoupling with China grew after a bipartisan group of American lawmakers introduced legislation last summer that would eventually delist Chinese companies out of compliance with U.S. accounting and oversight regulations.

A recent accounting scandal involved $310 million in fabricated sales at China's Starbucks challenger, Nasdaq-listed Luckin Coffee, renewed these discussions.

While an immediate delisting ultimatum is unlikely, as it would send shock waves across financial markets, the proposed legislation "could gain momentum over the summer as the Trump administration looks for ways to hold China accountable for the coronavirus outbreak," wrote Michael Hirson, practice head for China and Northeast Asia at New York-based consulting firm Eurasia Group, in a note.