Unexplained capital flow

Apart from the outbreak of the Covid-19 pandemic early last year, there is no specific reason why foreign investors have been net selling on Vietnam's stock market throughout 2020, because in January 2020, capital flow was still very strong in net buying. By 2021, this reason can no longer stand because Vietnam has successfully controlled the Covid-19 pandemic, and has set an example for the world. However, the new reason appears to be a strong upturn momentum of developed stock markets due to the expectation that the economy will recover strongly with huge stimulus packages. The developed stock markets have strongly been attracting capital flows into stock funds.

According to a report on international investment capital flows compiled by SSI Securities, stock funds have recorded the sixth consecutive month increase since September 2020. Particularly in February 2021, the amount of capital invested in these funds reached USD 141 bn, up 70% compared to January, and the month with the strongest net inflow since the beginning of 2018. Capital inflows to ETFs in February 2021 were USD 104 bn, focusing mostly on the US market and multinational investment funds.

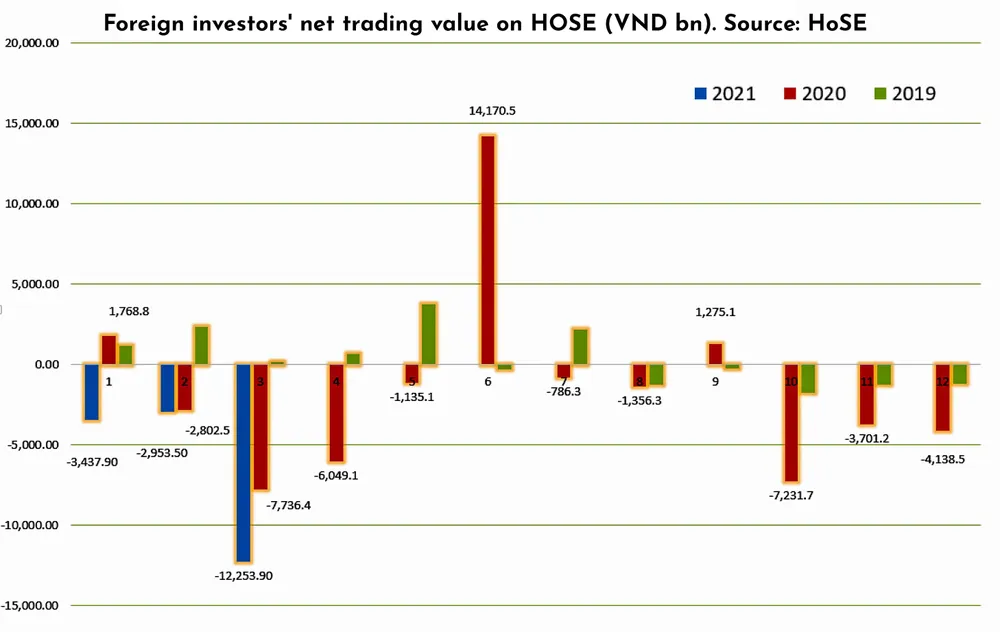

Along with this, Vietnam's stock market recorded a very large scale of net selling in the first three months of 2021. By the end of March, the total value of net sales on HOSE was VND 14,095 bn. However, stocks net sold worth VND 18,645 bn, while ETFs invested in stocks only net bought VND 4,481 bn. Thus, the amount of capital transferred from direct stock investment to indirect investment through open funds is negligible. The question then lies as to where does the large amount of capital earned from selling stocks actually go.

According to SSI data, the stock markets of Malaysia, Philippines and Thailand are also having a very strong net withdrawal. The positive movement of capital inflow into developed and emerging markets has put pressure on small-scale and frontier markets. Currently, the trend of capital movement to developed markets is quite strong due to the attraction of the US economy recovery. The effect is of course reducing the attractiveness of lesser markets, like Vietnam.

Frontier markets like Vietnam are attractive in that they are primitive, with high volatility, and in other words, more speculative. However, in the first three months of 2021, Vietnamese stocks were not really more attractive than developed markets from a growth perspective. For example, the US Dow 30 Index grew 8.1% in the first three months of the year, while the VN Index grew by only 7.9%. In international investment capital flows, not all funds choose a particular market, but only seek the best opportunity.

The above situation shows that, while assessments and statements of foreign fund representatives in the Vietnamese market often reveal their excitement or expectation, many active and trust funds do not show their viewpoint to the public. Therefore, assessments are difficult to represent. Even the VanEck Vectors Vietnam ETF fund, in January net withdrew about USD 9.08 mn, in February about USD 6.2 mn and in March there was no money. For the whole of 2020, the market had a net withdrawal of USD 12.48 mn.

The movement of capital flows between markets has been mentioned for a long time, especially when the Covid-19 pandemic created a huge risk. The most noticeable fluctuation in the first three months of this year is the appreciation of the USD against all other currencies in the world. After a long decline from the end of March 2020, the time when US stocks reacted to Covid-19 pandemic break out, by the end of 2020, the dollar has risen sharply again for the last three months. The USD Index has increased by nearly 4.4% for the last three months. In the country, the USD on free market has also risen very quickly, exceeding VND 24,000 for one USD.

Obviously, the exchange rate risk is affecting the decision of foreign investors. At a conference last week, the Korean KIM fund was cited as a case for this risk, when the Korean currency depreciated 4%, the fund withdrew from Vietnam upto USD 60 mn in the first three months of the year.

Diverse markets

Of course foreign investment flowing into the Vietnamese market is very diverse and foreigners do not need to net-sell continuously as is happening now, which means that capital is flowing out of borders. The USD appreciation is also due to the general increase in global exchange rates. There will still be other capital flows into the Vietnamese market. The latest evidence is of Taiwan's Fubon FTSE Vietnam ETF fund. On 24 March, it conducted a capital call with an expected size of about VND 8,100 bn. This fund invests according to the FTSE Vietnam 30 Index, which is specialized for Vietnam's stock market.

Longtime investment funds in Vietnam or specializing in the Vietnamese market still buy and sell everyday. This is a normal portfolio structure. For example, every week statistics show that a series of large-scale foreign exchange funds, such as Asia Reach Investments, and First Burn Investments, sell more than 100 million ACB shares. Other fund groups of Dragon Capital sold DXG and KBC in the penultimate week of March, or Penm fund sold HPG. It would not be reasonable to say that these funds sell and withdraw capital from Vietnam market. Although the statistics showed that foreign capital flow was net sold or withdrawn from stocks, but that does not mean withdrawing from the market is implication of terminating investment.

According to Finn Group's aggregate data, as of 1 April, the percentage of foreign ownership in general in the market is only about 18.24%, down from 21% in January 2020. The other data announced in the seminar last week is that the amount of foreign cash on the account is currently about USD 2.7 bn, while the figure at the end of 2020 was USD 1.2 bn. These numbers show that foreign investors are still maintaining a large amount of cash in the market, because they have not found the opportunity or time to disburse it elsewhere.