Several central banks have ventured into unusual territory in the opening weeks of this year, announcing currency sales in advance as they tread a delicate line between dulling the impact of a sliding dollar and dodging the ire of the US Treasury.

Since the start of January, central banks in Chile, Israel and Sweden have all outlined plans to sell their currencies in foreign exchange markets. Policymakers in Poland also issued a verbal warning to zloty bulls that they may intervene.

The moves underline the pressure on small currencies that are pushing higher in response to a broad slide in the dollar, holding down inflation in their domestic economies and threatening exports at a time when global trade remains fragile. But the advance warnings also suggest policymakers are keen to avoid being labelled currency manipulators — a title Switzerland and Vietnam earned from the US last year.

“We are in an interesting moment when it comes to central banks straddling the fine line between [foreign exchange] intervention and [foreign exchange] manipulation,” said Alan Ruskin, chief international strategist at Deutsche Bank in a recent note to clients.

“While each of the [central banks] has different motivations, they do appear to be deftly dancing around possible censure from the US. This is a slippery slope,” he added.

Under pressure from the Federal Reserve’s pledges to keep interest rates low potentially for years to come, the dollar has weakened almost 7 per cent over the past year against a basket of peers, sending the currencies of emerging markets and trade-sensitive economies soaring.

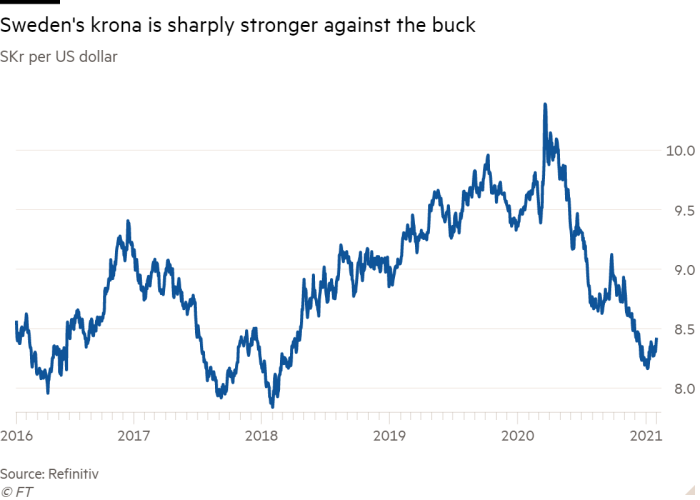

In January, Israel’s shekel hit its strongest levels since the dollar since 2008, after surging last year as the greenback lost 7 per cent against the currency. The buck also lost more than 12 per cent against the Swedish krona in 2020 and more than 5 per cent against the Chilean peso.

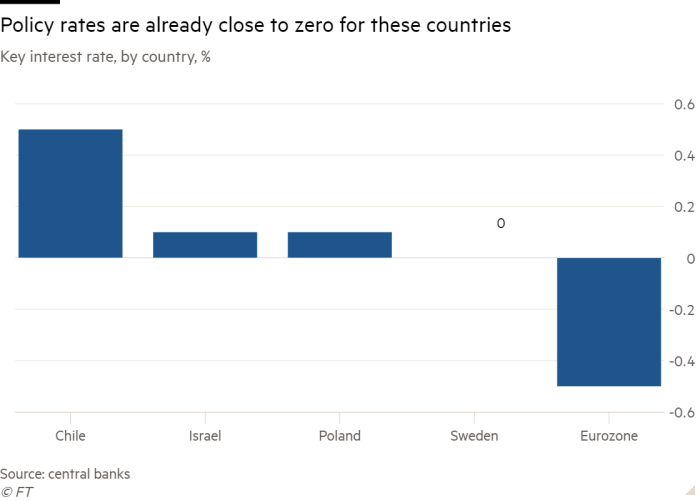

Policymakers have little room to cut interest rates further without moving below zero, with some having already slashed them in response to the coronavirus pandemic. That leaves outright currency sales as a key option, even though unilateral interventions rarely succeed in turning the direction of the dominant dollar.

Sweden’s central bank, the Riksbank, surprised analysts when it said last month it would amass foreign currency reserves over the next three years by selling SKr60bn ($7.2bn) every year until December 2023.

Swedish policymakers were at pains to emphasise that this was not a move aimed at weakening their currency — as such steps would be against the agreement of G20 countries and could attract retribution — but about eliminating the need for the Riksbank to borrow from the Swedish debt office to finance its forex reserves.

“This is not currency intervention and we have been clear that this is not intended to have a monetary policy impact,” Heidi Elmer, head of the Riksbank’s market department told the Financial Times. “Our objective is to ensure that we have appropriately financed currency reserves.”

But Robert Bergqvist, a senior economist at SEB, noted that the Riksbank had been concerned about the impact of a strong krona on inflation and the possibility of having to cut its key rate below zero again, little more than a year after it became the first country to lift its then negative rate out of the deep freeze.

“This is a bit controversial for the Riksbank to do because the currency sales will act as a headwind and make a rate cut less likely,” he said.

Chilean policymakers also decided to bolster currency reserves by purchasing $12bn over 15 months, citing anticipated political turbulence. Israel, meanwhile, highlighted risks stemming from the shekel’s rise when it said it would buy $30bn worth of foreign currencies this year. By informing markets in advance about their intentions, central bankers have created a headwind for these currencies.

“The question you have to ask yourself is: would central banks be acting this way if the exchange rate was going the other way? I think not,” Deutsche Bank’s Mr Ruskin said.

Currency interventions carry a stigma because major central banks generally agree to allow exchange rates to be market-driven. “I see an environment in which currency intervention is becoming a more important tool for macro management,” said Ed Al-Hussainy, a senior currencies and rates analyst at Columbia Threadneedle.

“That may be a polite way of saying that currency wars are more likely,” he added.

Goldman Sachs analysts also expect more intervention from emerging markets central banks if the dollar continues to decline in line with their forecasts. Deutsche Bank’s Mr Ruskin said the danger is that “surrogate” intervention from a few small central banks could spread and draw in policymakers from all parts of the world into competitive currency devaluation.

“What we are seeing is only the opening gambit of central banks responding to a weaker dollar environment,” Mr Ruskin said.