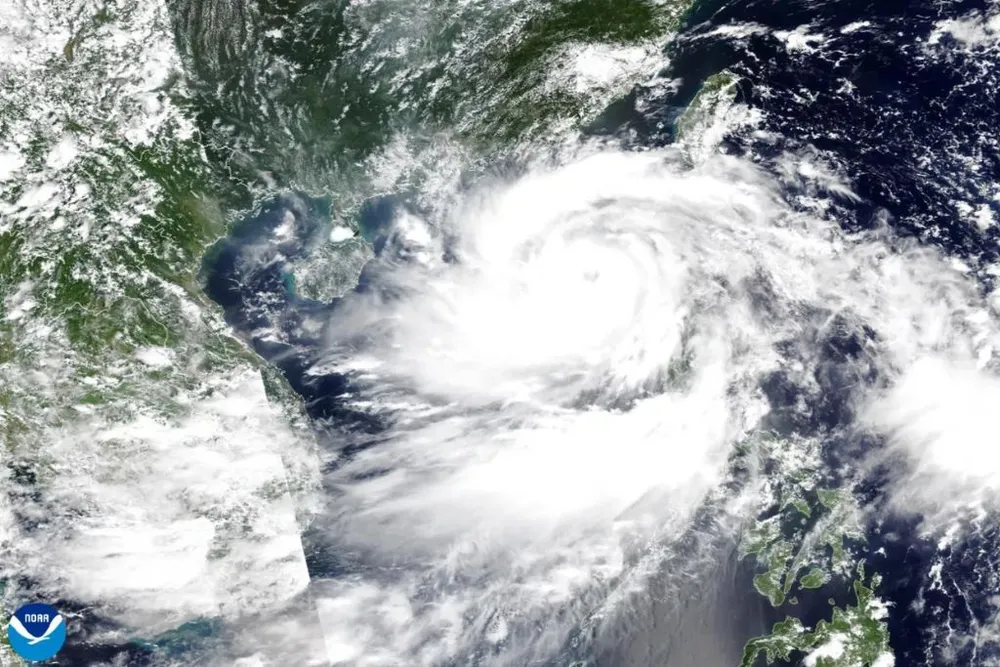

Minister of Planning and Investment, Nguyen Chi Dung, said that the typhoon had affected 26 localities, which accounted for 41% of the country’s GDP and 40% of its population.

Typhoon Yagi has resulted in 2,100 injuries across Asia with total damages estimated to exceed USD14 bn, making it one of the costliest typhoons in history.

Prior to the typhoon, Vietnam’s data up to Aug indicated strong growth momentum. Vietnam’s purchasing managers’ index (PMI) has outperformed its ASEAN neighbours since Jun 2024. Manufacturing output registered four consecutive months of double-digit y/y growth between May to Aug. Exports posted double-digit y/y gains in 7 out of 8 months this year, with trade surplus at USD18.5 bn YTD that was looking to exceed or at least match the record trade surplus of USD28.4 bn in 2023. Retail sales have maintained an average monthly growth pace of 8.8% y/y YTD, despite a high base in 2023.

Foreign direct investments (FDI) data continued to reflect foreign investors’ optimism. YTD realized FDI inflows rose 8% to USD14.2 bn, and if the momentum persists, full year inflows are likely to hit above USD20 bn for the third straight year (2023: USD23.2 bn). FDI pipeline is robust as well, with registered FDI inflows at USD20.5 bn YTD to Aug (7% higher than the USD19.2 bn recorded in the same period in 2023), with nearly 70% earmarked for the manufacturing sector. YTD, about 33% of the registered FDI came from Singapore, followed by Japan (12%).

As for the growth outlook for 2024, the setback and disruptions from Typhoon Yagi will be felt more acutely in late 3Q24 and early 4Q24 in northern regions of the country. The impact will manifest in lost output and damaged facilities from manufacturing, agricultural and various services segments. Nevertheless, aside from these temporary interruptions, long-term fundamentals remain sound.

Although Vietnam experienced a growth surge of 6.93% in 2Q24, the fastest pace in nearly 2 years, this momentum is unlikely to continue into the second half of 2024. After taking into account the disruptions from Typhoon Yagi, reconstruction efforts, and higher base in 2H23, we are lowering our growth forecasts for Vietnam. For 3Q24, we project a slower growth rate of 5.7% (down from 6.0% previously), and for 4Q24 at 5.2% (down from 5.4%). Consequently, our full year growth forecast for 2024 is lowered to 5.9% (about 0.1% pt down from previous forecast of 6%). This is still a meaningful rebound from the 5% growth in 2023. GDP growth forecast for 2025 is adjusted up by ~0.2% pt to 6.6%, to reflect an expected ramp up in output to compensate for the earlier losses.

CENTRAL BANK

SBV to keep policy rates steady through 2024

Despite the impact from typhoon and a notable rebound in VND exchange rate since Jul, we continue to expect SBV to maintain its key policy rates for the rest of 2024, with an eye on upside risks on price pressures. Overall CPI rose by 4% y/y in Aug YTD, just slightly below the 4.5% target. Upward pressures on prices may be more intense following the disruptions to agricultural output, as food accounts for 34% of CPI weight. The SBV is likely to adopt a more targeted approach to support impacted individuals and businesses in their regions, rather than implementing a broad, nationwide tool such as interest rate cuts. Consequently, we anticipate SBV maintaining its refinancing rate at the current 4.50% while focusing on facilitating loans growth and other support measures. However, the bumper 50bps interest rate cut announced by the US Federal Reserve at its Sep meeting may increase the likelihood (and pressures) on SBV to consider similar policy easing.

CURRENCY

VND rebounded from record low in 3Q24

Tracing the moves in regional peers, VND posted the largest quarterly gain on record dating back to 1993, rebounding 3.2% to 24,630 /USD. External headwind of a strong USD is starting to recede as the Fed began its much-awaited easing cycle while internal factors point to a further stabilisation of the VND. Notwithstanding the typhoon set back, Vietnam’s strong projected growth momentum, driven by both manufacturing and trade, also look set to extend into 2025.

Expectations of stable monetary policy from the SBV with focus on boosting credit growth is supportive of the VND as well. That said, further VND gains from here are unlikely to proceed at the same pace as that of 3Q24. Overall, our updated USD/VND forecasts are 24,500 in 4Q24, 24,300 in 1Q25, 24,100 in 2Q25 and 23,900 in 3Q25.