Increase volume of projects

By 20 December 2019, realized FDI had reached USD 20.38 bn, up by 6.7% compared to 2018. Total newly registered, adjusted and contributed capital of foreign investor shares were at USD 38.02 bn, up by 17.2% over the same period in 2018. Foreign investors invested in 19 economic sectors, including processing and manufacturing, with capital of USD 24.56 bn, accounting for 64.6% of registered capital, while real estate was at USD 3.88 bn, accounting for 10.2% of registered capital. This was followed by retail and wholesale trade and science and technology.

The distribution of FDI capital in economic sectors continued to hold the same proportion as previous years, with some positive shifts in the real estate sector. The country has strong potential and is offering a very conducive business environment, and hence, a number of foreign investors have set up joint ventures and partnerships to transfer new technologies and business methods to domestic enterprises.

Mergers and acquisitions (M&A) have been active in recent years, accounting for an increased proportion of total registered capital. In 2017 it accounted for 17.02%, in 2018 it accounted for 27.78% and in 2019 it accounted for 56.4%. This good indicator is due to two main reasons. The size of domestic enterprises has grown, creating abundant supply for M&A, and opening the stock market under the policy of loosening room for foreign investors. M&A has advantages compared to new investments, because investors look to businesses that can bring in profits for them on the basis of monitoring and researching financial statements of enterprises selling shares, which cuts project execution time because of simpler and speedier procedures.

Lack of large scale projects

The quality and efficiency of FDI in 2019 did not meet the country's requirements in the transition towards better innovation, science and technology and higher quality of human resource. Building a modern digital economy and joining the industrial revolution 4.0 is now a non-negotiable option for the future. The average size of each FDI project is far too small, with 3,833 projects granted investment certificates with a total registered capital of USD 16.75 bn. So on an average, each project is only about USD 4.3 million. Some localities also attract projects of upto USD one to two million, or even less than USD 1 million.

Of course, the project scale varies in each field. Some service sectors do not require large scale, but in production and processing, project scale needs to be considered. When small and medium enterprises are operating competently, it is necessary that the government facilitates them in carrying out such projects.

Besides, there were also not enough large-scale projects. In 2018, there were some projects such as Smart City in Dong Anh in Hanoi, a joint venture with Japan of USD 4.14 bn; and a Polypropylene factory and a Korean liquefied petroleum storage depot worth USD 1.2 bn in Ba Ria-Vung Tau. But in 2019, the largest project was worth USD 420 mn. The manufacturing and processing industry has not attracted future technology projects such as with AI, blockchain, Fintech, and R&D centers. Two major economic centers in Hanoi and Ho Chi Minh City have potential for science and technology, and a highly skilled work force.

Change and innovative thinking

When the US government imposed a 25% import tax on goods imported from China, it forced Chinese businesses to look at other markets of consumer goods, and at the same time increase offshore investments to cope with toughened US measures. Vietnam is a neighbor country that offers great potential for China, so Chinese businesses will be looking for opportunities to expand the scale of their two-way trade, and also rapidly increase direct investment projects. Therefore, Vietnam needs to study and identify new challenges and opportunities, and appropriate policies for Chinese enterprises in terms of selection, screening, and guaranteeing national interests in trade and investment cooperation between Vietnam and China.

Along with that, the proportion of enterprises using advanced technology, modern management techniques, sustainable environmental methods, and high technology are forecast to increase by 50% in 2025 and 100% in 2030; the localization rate will increase from 20-25% at present to 30% in 2025 and by 40% in 2030. The proportion of trained labor will increase from 56% in 2017 to 70% in 2025 and 80% in 2030.

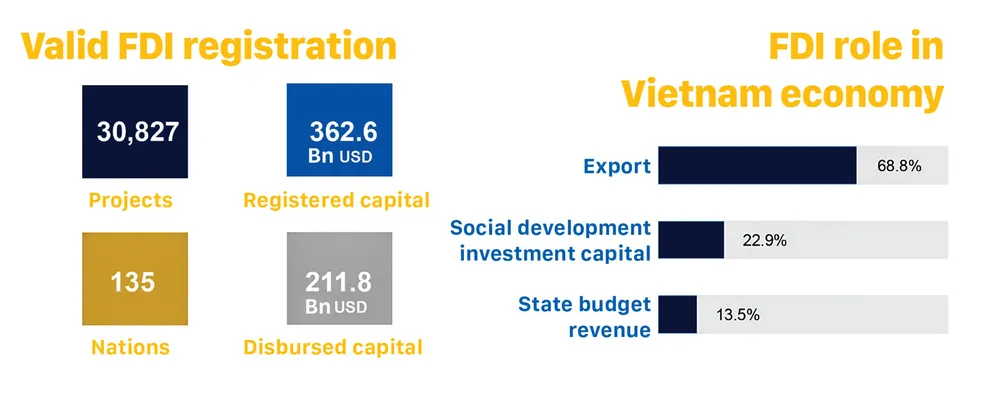

In fact, until the end of 2019, the registered FDI capital was over USD 360 bn, and the realized FDI capital was USD 210 bn. In particular, only USD 50-60 bn can disburse, more than USD 100 bn cannot be implemented, become "virtual capital" needs to be excluded from the statistics on FDI so as not to create the illusion that there is too much FDI capital. Therefore, the new orientation for medium and long-term FDI must take quality as top priority. It must be placed in the context that our country is pursuing a growth strategy at high speed to move towards a green and sustainable economy.

In 2020, in addition to the ongoing tasks such as perfecting the legal system, and reforming administrative procedures, Vietnam needs to create an attractive and proactive investment environment in selecting long term projects and viable investors. The World Economic Forum's Global Competitiveness Index 2019 report states that Vietnam is a country with the strongest rise in competitiveness in the world. However, in Southeast Asia, we are much behind Singapore (No. 1), Malaysia (27), Thailand (40), Brunei (56) and Philippines (64).

Therefore, it is necessary to find a new approach to reforming the national administration, bring about a new generation of e-governance and digitalize official systems to achieve goals and targets set by the Politburo Resolution No. 50, which is focused on, "creating a competent business environment in ASEAN 4 before 2021, and in ASEAN 3 before 2030”.