New buying psychology

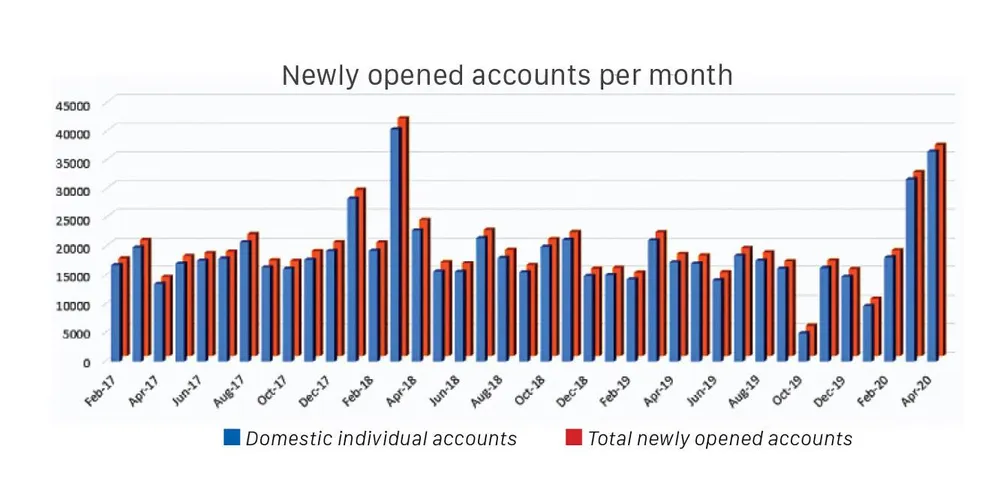

A quick look at a number of securities companies with a large market share on the HSX, showed many new customers in the first four months of the year, with the sharpest increase being in March 2020. A broker at a securities company in Hanoi, who has the highest number of new accounts that opened in the first quarter, said that not only new accounts but also old accounts have been re-activated. Nearly 15,000 accounts opened in April, while the total number of newly opened accounts in the whole market this month were 36,867.

According to the Vietnam Securities Depository, the month of April 2020 was a record-breaking month for the number of new accounts that opened in the last 26 months. March 2020 also recorded 32,140 new accounts. The number of individual investors accounted for around 99% of the total newly opened accounts in the last two months.

Explaining the phenomena of a sudden rise in newly opened accounts, brokers at securities companies believe there are two main reasons. Firstly, for investors who have not joined the market or left the market for a period of time, the market decline means an opportunity to buy cheap stocks. When the market increased in April, the psychology of buying during the right wave strongly stimulated the greed of new and old investors. The newly opened accounts continued to increase very high in April 2020 when the market increased by nearly 21%. This is also similar to the period of March 2018 when VN-Index increased by 20% and the number of newly opened accounts in the next month were nearly 41,500.

Secondly, social distancing regulations during the Covid-19 pandemic allowed for a considerable amount of free personal time. The opening of securities accounts can easily be done online, so participation in the stock market increased. At first, this may sound an assumption, but it is the reality in many countries. Bloomberg survey of AAA Southeast Equities in the Philippines show newly opened accounts of customers have doubled since the lockdown on main island Luzon in mid-March. Trading volume on the Philippines Stock Exchange has also increased 47% compared to the average of the whole of last year, higher than the 32% increase of the MSCI Asia-Pacific index.

The participation of new cash flow in the stock market has "blown new wind" into transactions. Two distinctive characteristics of this cash flow involve new accounts and old re-activated accounts. Moreover, the psychology of new investors is always stronger, and the level of expectation is higher, much more than the old investors. Therefore, new investors often do not cut losses but wait for stock prices to recover.

New cash variable

With the number of newly opened accounts setting records in March and April of this year, the market will have an additional flow of capital. However, it is difficult to quantify the total amount of new capital entering the market through these new accounts, but the daily liquidity in the market shows that the strength of domestic capital flow is increasing.

The market has two groups of domestic and foreign investors. With the increasing number of newly opened accounts by domestic investors, it is expected that daily liquidity will increase. It can be seen in the chart that the market share of foreign investors is clearly declining, which means an increase of domestic investors with daily liquidity reaching a record high since the beginning of 2019.

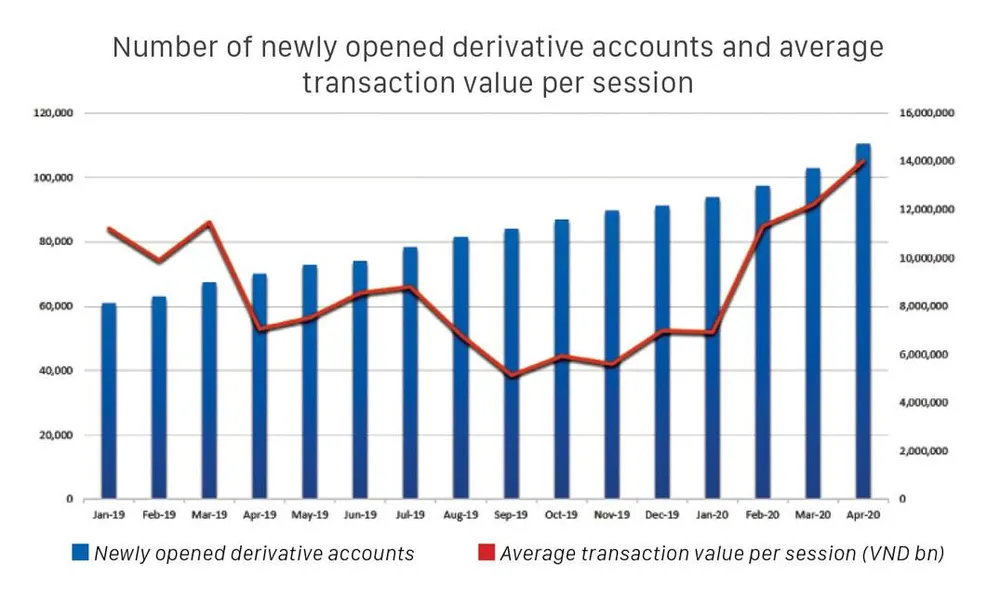

For the derivative market, the liquidity and the number of new accounts also increased sharply. Statistics show that the nominal trading value of this market is reaching a historical peak since the opening of the market with an average of two weeks in May with around VND 17,000 bn per day, while average of April 2020 reached around VND14,000 bn. The peak was on 13 May with the nominal value of VND 21,163 bn. The number of derivative accounts at end of April 2020 reached 110,458 accounts, 1.8 times that in January 2019.

Thus, the overall transactions on both the base market and the derivative market have increased sharply, confirming the new cash flow entering the market on a large scale. Notably, the statistic of leverage lending from securities companies until the end of the first quarter of 2020 at the end of March was approximately VND 50,000 bn, down 15% compared to the end of 2019. Loans decreased but liquidity still rose very high in March, confirming new amounts of money.

Similarly, the net selling value of foreign investors on the HSX reached nearly VND 14,000 bn in March and April. In order to withdraw this huge amount of money, the selling transactions of foreign investors must be matched with the amount of money purchased by domestic investors, in order to maintain the common liquidity and push up the stock price higher in April 2020.

The reduction of interest rates by the State Bank of Vietnam, and by banks seeking to increase lending by lowering deposit rates to very low levels, is making idle money more abundant. Securities companies will be able to channel this cheap capital. In other words, this is the "new cash variable" that will make the market movement strong and directly affect supply and demand in daily transactions.