Emerging risk factors

Central Banks around the world have eased monetary policies, and are directly supporting financial markets through purchase of large-scale corporate bonds. The amount of cash that directly supports people also creates a large surplus which is much easier to flow into the stock market. However, in the Vietnam stock market, the support solutions just stop at a level concerning taxes or fee reduction.

Resources on the stock market mainly come from three main channels. The first is equity capital from investors, second is loans, and third is capital from professional investment organizations. Recently, liquidity in the market has increased sharply, and in many sessions the average trading value has been around VND 9,000 bn. The peak was VND 11,200 bn on 11 June, and about VND 23,500 bn on 15 June. The market also received additional resources from newly participating investors, reflected in the number of newly opened accounts that soared between March and May.

Securities companies also reduced their margin interest rates from an average of 14% per year to 12% per year, indicating the downward trend on interest rates in March. For example, interest on margin loans at VCSC is 0.0329% per day, at FPTS it is 0.036% per day, at SSI 0.0389% per day, and at VNDS 0.037% per day. Specialized leverage packages have lower interest rates, about 10% per year, which are not popular. Securities companies with foreign capital provide services at more competitive interest rates, usually below 10% per year such as in Yuanta at 8.8% per year, and in Mirae Asset at 9.9% per year.

The interest rate on support capital services is hard to reduce more, because the securities lending sector itself is considered high risk with a risk factor of 150%. In fact, the amount of capital is very much in the commercial banking system and the current most favorable channel is lending through securities companies.

However, the interest rate is only secondary as the market trend is the decisive factor in the use of capital of investors. For example, despite the very attractive lending rates at foreign-invested securities companies, the largest market share still belongs to domestic names such as SSI, HSC, VCSC, and VNDS. In June, when the market saw a strong upward trend, liquidity increased to a record level. After the market corrected in the last weeks of the month, liquidity immediately dropped to only half, although in this short time, lending capacity did not change.

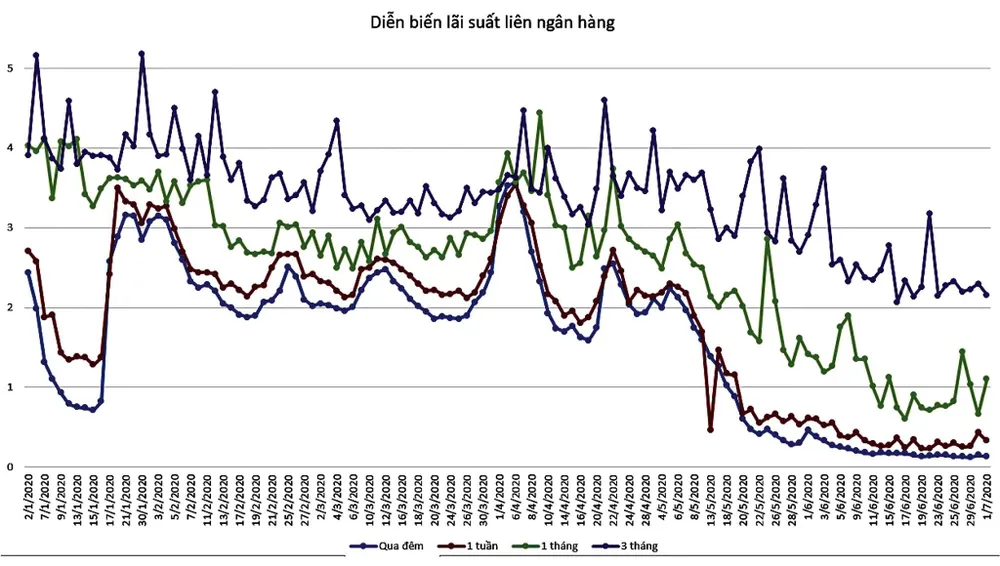

During consecutive days in late June and early July, many Commercial Banks reduced deposit rates sharply. This was an inevitable step after the State Bank of Vietnam reduced basic interest rates from the end of March and banks lent support to many businesses to overcome the impact of the Covid-19 pandemic. This move mainly reduced operational risks. Though lending rates from residents remained high, banks had to restructure debts for businesses, so profit margin decreased. Therefore, it is difficult to further reduce interest rates on both borrowing and lending. On the other hand, pressure from inflation is also emerging as a huge risk factor in the near future.

New cash flow

A decline in mobilizing interest rates could also be a factor affecting the stock market when considering which investment channels are more attractive. Currently, saving interest rates are getting worse and even at risk of becoming ineffective, with the new inflation rate of six months at 4.19%. It makes sense then that depositors will feel more secure in investing in a business. This is also the purpose for reducing interest rates so as to draw out this excess idle money back into the economy.

With a sudden increase in the number of new accounts in the past three months, the effect of low interest rates has become clear. Those who easily accept securities investment channels have now entered the market. The remaining consider saving cash as a safer haven. Although savings interest rates are low, capital mobilization of credit institutions still increased by 4.35%. Meanwhile, the mobilization rate until 15 April remained at 0.55%, which means that for nearly two months the amount of money returned to banks was quite substantial.

Return to normal economic activities will also attract back idle resources. A report of SSI Securities Company released at the end of June identified individual investors as the main driving force for the strong recovery of stock markets around the world. However, this is also a risk factor because market increase is based on capital flow of individual investors who come in quickly but also withdraw very quickly when there is sudden fluctuation. Short-term speculation of the moment is not conducive for a strong stock market in the long term.

The most noticeable effect of excess liquidity in recent years is that the market has been supplemented with new resources, and securities is likely to be empowered in investment channels. In fact, gold price in the first six months increased by 16% and is a safe investment channel in the context of lower interest rates and inflation showing signs of rapid increase. However, strong volatility of the stock market in the second quarter showed that high risks also go along with high profits. According to data from the Securities Depository Center, 34,965 domestic individual investor accounts were opened in June. In the first six months, the number of new individual investor accounts numbered 165,343, nearly that of 187,825 accounts in the whole of 2019.