This investment is intended to enhance resilience, with approximately USD 254 billion allocated for this purpose, along with an extra USD 114 billion for the decarbonization process as per international commitments. In the pursuit of sustainable development goals intertwined with environmental preservation, establishing a carbon tax or implementing emissions trading systems becomes pivotal for Vietnam.

Gradual Establishment of the Domestic Carbon Market

As defined by the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), a green economy signifies an approach to economic growth rooted in sustainable development and environmental preservation. It underscores a high-quality, profound model of development aimed at integrating environmental protection and curbing carbon emissions within production and business processes. For Vietnam, a 2022 World Bank report underlines the urgency of climate adaptation, necessitating the implementation of policies and investments—both public and private—to lower the carbon intensity of growth.

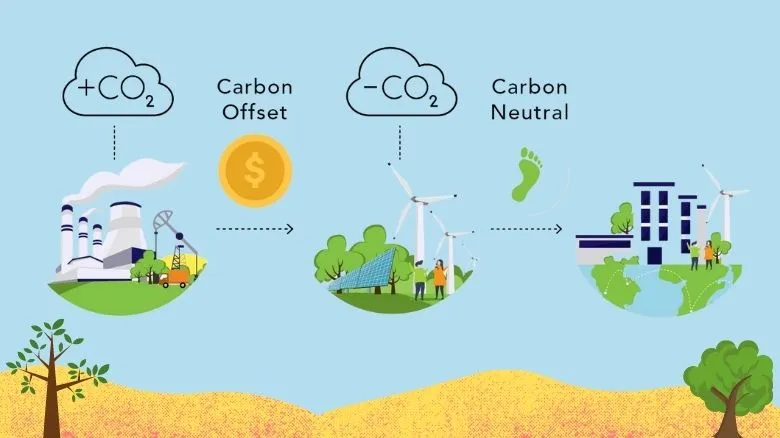

To address the scarcity of resources for green growth and climate change responses, Vietnam must enhance cooperation and receive support from the international community. Establishing a green financial market and fostering the carbon credit market are top priorities to be realized in the near future. In an unprecedented move, the 2020 Environmental Protection Law outlines regulations concerning the organization and expansion of the domestic carbon credit market, assigning the Ministry of Natural Resources and Environment the task of setting total quotas for carbon credits. The Emission Trading System (ETS) of Vietnam, determining quota allocation methods and applying carbon offset credit mechanisms, aligns with this endeavor.

In continuation, on January 7, 2022, the Government issued Decree 06/2022/ND-CP, outlining guidelines for mitigating greenhouse gas emissions, safeguarding the ozone layer, and elaborating on the carbon credit market. This decree is set to establish and test a carbon credit trading platform by 2025. This progression in Vietnam's carbon credit trading and offsetting adheres to regulations stipulated in Decision 888/QD-TTg dated July 25, 2022, endorsing the implementation of the outcomes of the 26th Conference of the United Nations Framework Convention on Climate Change.

Additionally, Decision 896/QD-TTg dated July 26, 2022, approves the National Strategy on Climate Change up to 2050, as issued by the Prime Minister. Further reinforcing this framework, on January 18, 2022, the Government issued Decision 01/2022/QD-TTg, detailing the list of fields and establishments required to undertake greenhouse gas inventories. This decision mandates 1,912 establishments to participate in the domestic carbon credit market.

With these regulatory measures, notably Decree 06/2022, it becomes evident that the domestic carbon market is progressively taking shape. This market is poised to enable Vietnam to optimize advantages from international trade agreements, such as the EU - Vietnam Free Trade Agreement. Moreover, it enhances the country's potential to attract foreign investment capital, facilitates export competitiveness—particularly in demanding markets that prioritize environmental protection, like the EU.

Key Solutions

As outlined in the Carbon Credit Market Development project proposed by the Ministry of Finance, Vietnam's carbon credit exchange is projected to officially commence operations around 2028. Nevertheless, the price of Vietnam's carbon credits, when traded on the international market, remains notably distant from the rates in the EU or the US. The current landscape necessitates that businesses actively educate themselves about regulations, risks, and strategies linked to both direct and indirect effects on reducing greenhouse gas emissions. Achieving a successful carbon credit market requires a collective approach involving the government, communities, businesses, and citizens to implement a series of essential solutions.

Firstly, concerning institutional framework, the Ministry of Finance is poised to introduce a project to officially establish a trading platform for greenhouse gas emission quotas and carbon credits. This initiative will include clear regulations governing activities connecting and exchanging domestic carbon credits with regional and global carbon markets, along with a carbon tax.

Moreover, the Ministry of Natural Resources and Environment is expected to guide the implementation of domestic and international carbon credit exchange and offset mechanisms, aligning with international treaties and regulations that Vietnam has engaged in. Ministries including Construction, Agriculture-Rural Development, Planning-Investment, and Transport will build an information and data system for the carbon credit market. This entails a management structure for greenhouse gas emission quotas and carbon credits, and the issuance of greenhouse gas emission norms for various types of production and business entities. This data system will empower businesses to formulate investment plans and potentially forecast revenues from selling carbon credits.

Secondly, formulating an operational mechanism and identifying the responsible agency to manage the carbon credit trading market becomes essential, including the establishment of trading platforms to streamline state oversight. In case a carbon tax is implemented to bolster budget revenues and support the green finance fund, it is imperative to allocate specific responsibilities for research and implementation within designated agencies.