A dichotomous 2022

Despite global political and economic turmoil, Vietnam has become a beacon in the APAC region and has been the beneficiary of a shift in global manufacturing supply chains, strong foreign direct investment, and proactive measures from the Vietnamese authorities. Perhaps it now warrants a closer look from investors.

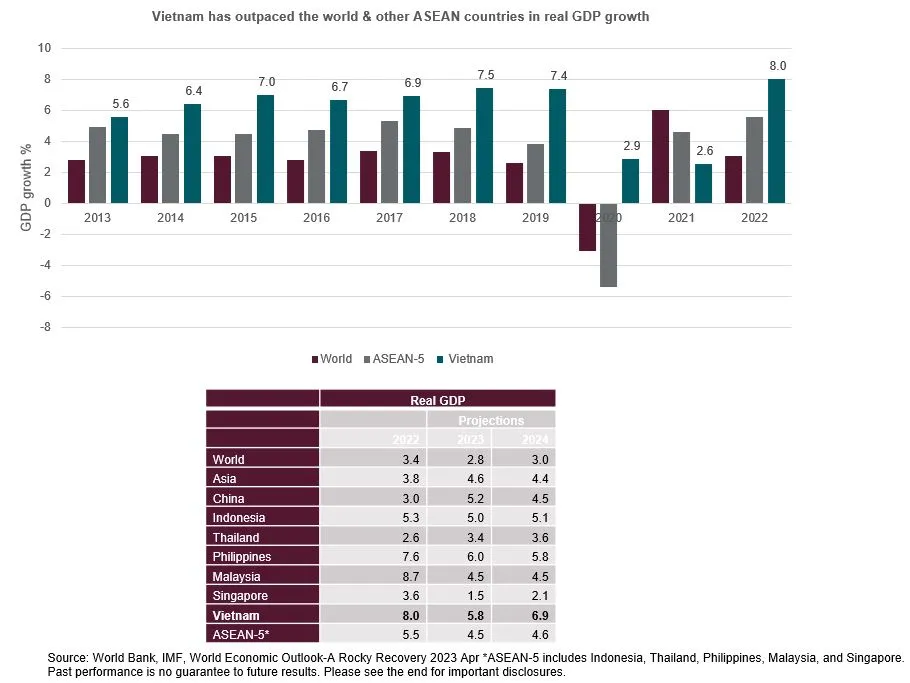

In recent years, Vietnam has taken the baton from China and benefitted from supply chain relocations, strong foreign direct investment, and political stability. Having witnessed robust growth momentum of approximately 8% since the global pandemic, the fastest annual pace since 1997. Spurred by an increase in both domestic demand and manufacturing exports. The International Monetary Fund (IMF) forecasts that Vietnam will grow its GDP by 5.8% in 2023 and by 6.9% in 2024, outperforming several other economies in the ASEAN region.

|

These positives were not reflected in Vietnam’s 2022 stock market performance. The FTSE Frontier Vietnam Index, which tracks large, mid and small caps companies listed in Vietnam, was down 47.1% in USD terms for the entire year. This dichotomy has been attributed to the fuel price crisis, caused by the prolonged Russia-Ukraine conflict, as well as tightened policy rates due to rising inflation. Additionally, Vietnam’s domestic crackdown on corruption and the arrest of some high-profile company leaders, affected investor sentiment. Higher interest rates and a debt crisis in the property market have exacerbated this negative growth.

An upward trajectory in 2023

In view of the turmoil in 2022, the Vietnamese government rolled out a series of initiatives to boost the economy including tax cuts, monetary policy easing and administrative measures in a bid to mitigate the difficult conditions in the real estate market. Vietnam’s market is on track for a comeback in 2023. According to the General Statistics Office of Vietnam, GDP in the second quarter of 2023 was 4.14%, up from the year before, it also beat the 3.28% growth of the first quarter.

During the first half of the year, despite fluctuations in global financial markets, the exchange rate in Vietnam remained stable thanks to abundant foreign exchange reserves, a surplus trade balance, disbursed Foreign Direct Investment (FDI) inflows, a recovery in the tourism industry and a weakening of the US dollar.

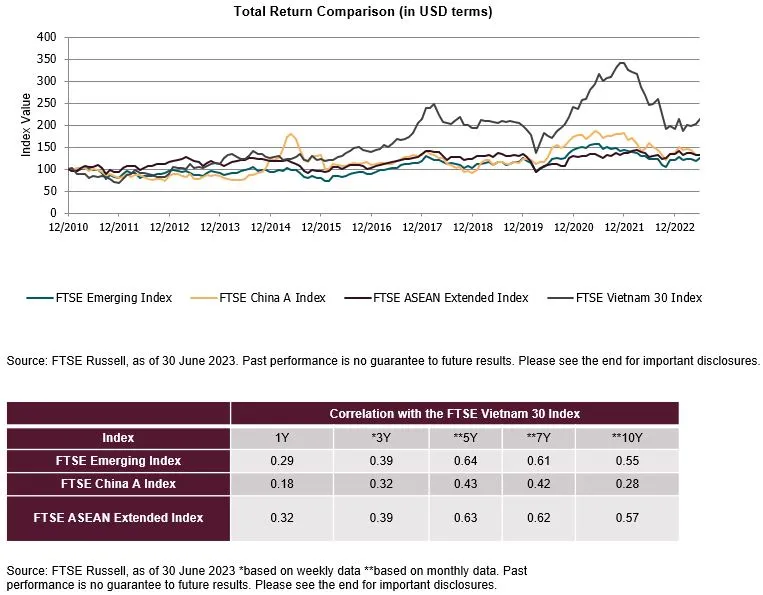

Year-to-date, The FTSE Vietnam 30 Index—which captures the largest 30 companies listed on the Ho Chi Minh Stock Exchange (HOSE)—recorded a positive return of 12% in USD terms, this was a strong bounce-back when compared to the FTSE APAC (3.3%), FTSE Emerging (3.9%), FTSE China A (-3.5%), and FTSE ASEAN Extended (-1.1%) indices.

Vietnam is also garnering more attention from the global investor base. When compared with its frontier and emerging market peers, it has delivered strong, long-term, relative risk / returns against other emerging and frontier market equities, as well as global equities more broadly. Vietnamese stocks have recorded a 10-year cumulative total return in USD terms of 107.8%, while other emerging markets such as the China A share market and the ASEAN Extended market, have delivered more modest returns of 43.7%, 70.9% and 12.6% respectively. Throughout this period of growth, Vietnam’s market has also displayed a low correlation to these markets, making it a compelling diversifier.

|

The FTSE Vietnam 30 Index, similarly to the broader Vietnamese market, is also more exposed to the Real Estate, Financials, Consumer Staples and Industrials, with an aggregated weighting of 86.4%, as of 30 Jun 2023. Financials and Industrials were the largest contributors to the FTSE Vietnam 30 Index’s positive first half of 2023, with a weighted average total return of 7.3% and 6.3% in USD terms respectively, while Consumer Staples dragged on the index with a negative weighted total average return of 2.5%, caused by a short-term downturn in exports.

|

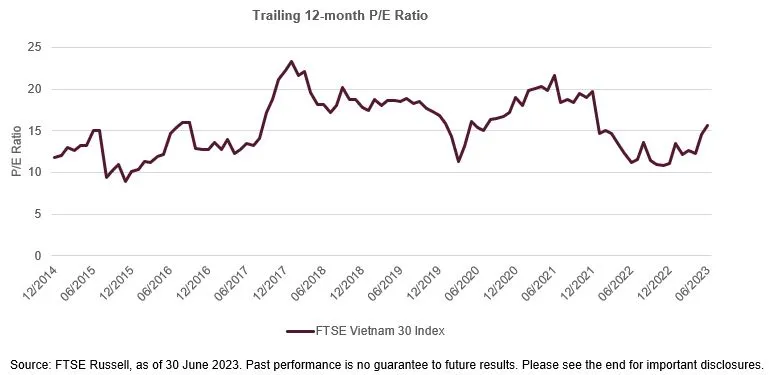

The average trailing 12-month PE ratio of the FTSE Vietnam 30 Index has remained at 15x over the last 10 years, which is appealing to investors, especially long-term investors who are looking for enterprises with strong profit growth. Foreign investors remain optimistic about Vietnam’s stock market. The HOSE statistics show that 2022 recorded the greatest foreign investor net inflows since the beginning of the pandemic, reaching VND 23 trillion.

Upgrading Vietnam’s stock market

Vietnam government is speeding up putting the KRX trading system into operation to facilitate the deployment of new products and solutions to the Vietnamese stock market and ensure the smooth operation of the market continuously and effectively. The HOSE recently announced a trial for this connection with a functional trial set to take place from June to August. The move aims to tackle system overloads, something that has troubled investors recently. The system will officially be put into operation at the end of 2023 following its six-month trial run.

The shortening of settlement time for securities with the T+2 settlement cycle since 29th August 2022 is helping boost investment efficiency and enhance market liquidity, gradually bringing Vietnam’s stock market more in line with international standards.

Vietnam is currently classified as a Frontier market and was added to FTSE Russell’s watch list in September 2018, for a possible reclassification to Secondary Emerging market status. FTSE Russell continues to regularly review and monitor Vietnam’s development for a possible classification upgrade.

An ecosystem built around Vietnam’s indices

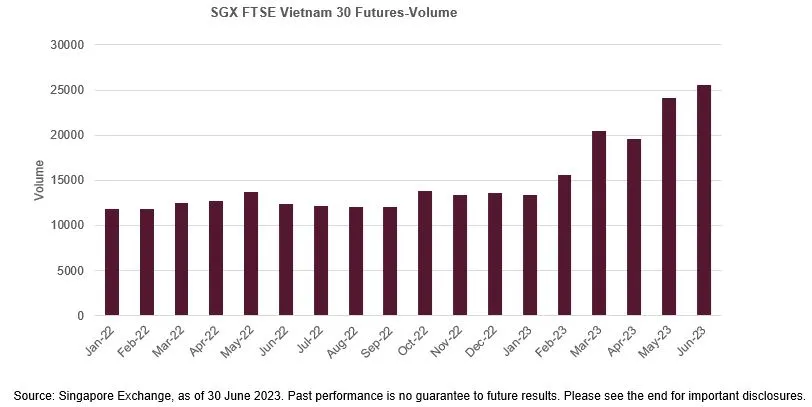

The partnership between FTSE Russell and the Singapore Exchange (SGX), to develop a comprehensive Asia and emerging markets focused, multi-asset derivatives offering began in 2020. Two Vietnamese equity index futures based on the FTSE Russell indices were launched on the SGX in 2021, making it easier for investors to manage the risk associated with Vietnamese equities. Together with the two FTSE Vietnam 30 ETFs (totaling an AUM of USD867 million as of 30 Jun 2023), an ecosystem has gradually evolved to offer international investors effective access to, and hedges on, the Vietnamese market. YoY, the SGX FTSE Vietnam 30 Futures have seen a 59% increase in volumes traded, with higher volumes and open indications of interest being reached over several months through 2023.

|

The shift in global manufacturing supply chains will be the ASEAN region, with Vietnam expected to be one of the main winners. Benefitting from its relatively cheaper manufacturing costs and its large labour force. In the first half of 2023, some big names have announced plans to increase their presence in Vietnam, such as the Chinese display manufacturer BOE, the US semiconductor producer Marvell Technology, and the global tech giant, Apple.

A large number of positive growth drivers are creating favourable tailwinds and will continue to underpin the rapid growth of Vietnam's economy.