Simultaneously, American semiconductor companies transitioned to focus on chip design and outsourcing. The evolving landscape of global trade and supply chains has compelled the US to seek new partnerships in this crucial industrial sector, with Vietnam emerging as a promising ally.

Ally: Navigating the Changing Landscape of the US Semiconductor Industry

America, the birthplace of the integrated circuit, has long been at the forefront of the global semiconductor industry, with US companies consistently representing 45-50% of total worldwide sales. The United States boasts majority ownership in critical areas such as electronic design automation (EDA), IP core, integrated circuit design, and manufacturing equipment. Furthermore, the US leads the world in producing complex semiconductors, radio frequencies, and acoustic wave filters. However, despite the significant global influence of US semiconductor companies, a noteworthy 80% of their industry revenue is generated beyond the borders of the United States.

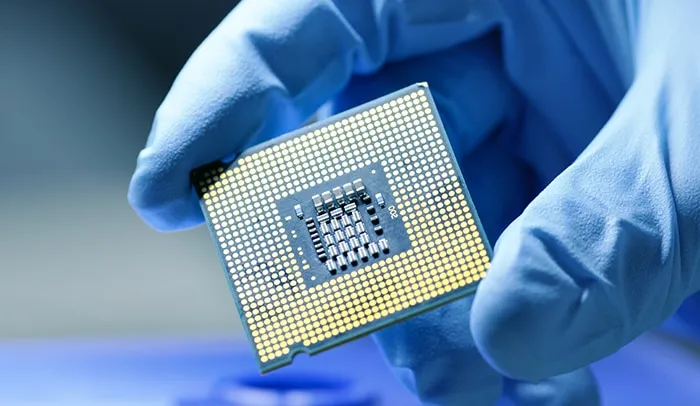

Despite maintaining its technological leadership, the US semiconductor industry is navigating a complex landscape shaped by globalization and regionalization. Semiconductor chips, a quintessential product of this industry, are not solely manufactured within the US; instead, they rely on a globally interconnected supply chain. While American companies contribute chip design software, develop chip manufacturing equipment, and engage in silicon mining and refinement, the production phase, especially the assembly of final products, is often carried out in China.

This interdependence has created challenges for US semiconductor companies, particularly concerning foreign supplies, notably from China and other Asian countries. Intense competition in semiconductor production has resulted in shortages, prompting the US to adopt measures to bolster the domestic semiconductor industry. These efforts include investments to support businesses and, simultaneously, restrictions on other countries' technology access, justified by concerns of "national security." Over the past two years, the US has actively pursued chip manufacturing alliances with various Asian countries, exemplified by the "Chip 4" alliance involving South Korea, Japan, and Taiwan. This strategic move seeks to address challenges posed by global competition and secure the resilience of the US semiconductor industry in a dynamically evolving landscape.

Vietnam's Semiconductor Potential: Navigating Challenges for a Strategic Future

Among ASEAN nations, including Vietnam, Thailand, Singapore, Malaysia, and the Philippines, there is a recognized leadership in the research, development, and design of electronic circuits. Vietnam, in particular, is acknowledged for possessing significant competitive advantages in this field, notably its large reserves of rare earth mines – around 22 million tons, ranking second globally, following China. Combined with abundant labor resources, open trade policies, and a stable political, economic, and social environment, Vietnam emerges as an attractive investment destination in the semiconductor industry.

Despite these advantages, Vietnam faces challenges in fully realizing its semiconductor potential. These challenges encompass technological barriers, the need for highly qualified human resources, and limitations in investment capital capacity. Presently, only two domestic enterprises, Viettel High-Tech Industry Corporation (VHT) and FPT Group, participate in the country's IC design process, employing approximately 200 individuals. In contrast, 30 foreign companies, with a substantial workforce of approximately 5,000 highly skilled engineers, handle various design-related tasks. Consequently, Vietnam remains heavily reliant on imported semiconductor chips.

Mr. Võ Xuân Hoài, Deputy Director of the National Innovation Center (NIC) under the Ministry of Planning and Investment, emphasizes the necessity for Vietnam to establish a clear strategy to promote the domestic semiconductor industry. This strategy should include efforts to attract and develop talent in technology, create plans for training high-quality, skilled human resources in semiconductor manufacturing, and encourage domestic enterprises to engage in the chip manufacturing market. Effective policies supporting finance, law, and administrative procedures in chip research and production activities are also essential.

To deepen participation in the chip supply chain and manufacturing market, Vietnam must negotiate with developed economies, including the US, to secure agreements on technology transfer support. This would enable the swift adoption of modern technology, moving the country towards autonomy in various stages of the semiconductor chip production process. To become a vital player in the global supply chain, Vietnamese businesses must enhance competitiveness, meet product quality criteria, and attain international standard certifications. These efforts will elevate their standing in the global semiconductor supply chain and position Vietnam as a key player in the evolving landscape of semiconductor manufacturing.