Chip and display makers in virus-hit Wuhan are being given special permission to continue operating and even skirt quarantine guidelines in order to avoid major production disruptions, the Nikkei Asian Review has learned, as the government continues pushes its national tech ambitions despite the epidemic.

Flash memory maker Yangtze Memory Technologies, China's hope for creating a rival to Samsung Electronics, SK Hynix, Kioxia and Micron, received special approval from local and central governments to continue to ship products out of the city and has been receiving materials for production since the start of February, two sources with direct knowledge of the matter told the Nikkei Asian Review.

"It's the key project sponsored by Beijing so it definitely received better support," one of the sources said. "Furthermore, the project is very important to the country's effort to stay self-reliant for the future, so there is no tolerance for a huge disruption."

More than 2,000 people in Wuhan had died of the virus as of Tuesday, while confirmed infections neared 50,000. The city has been on lockdown since Jan. 23 to contain the spread of the disease.

But Wuhan is also a key part of China's ambitions to nurture a domestic high-tech industry and cut its reliance on foreign suppliers, and Beijing is apparently keen to keep operations running as close to normal as possible.

Yangtze Memory began producing China's first 64-layer 3D NAND flash memory chips -- which is about one or two generations behind the industry leaders -- at the end of last year. The state-backed company, which counts Huawei and Lenovo Group among its major customers, is able to ship products directly to Shanghai and distribute them from there, sources said.

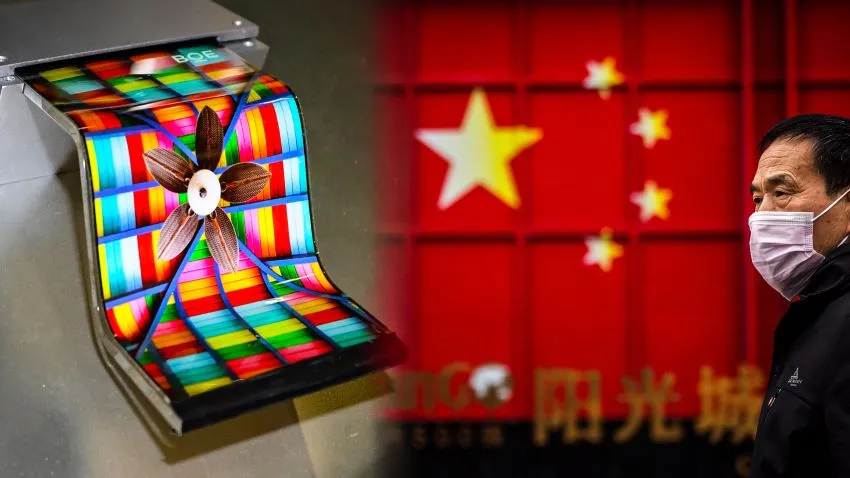

National display champion BOE Technology Group and China Star Optoelectronics Technology, the country's No. 2 display maker, have also been given special permits to deliver products from and send components to their facilities in Wuhan, Nikkei has learned.

BOE, the world's biggest TV display maker by output since 2018, just started mass production at its second 10.5-generation panel production plant in Wuhan, the most advanced display technology in the country.

China Star Optoelectronics, owned by tech conglomerate TCL, has two facilities in the city. One is the company's biggest smartphone display production site, which accounts for 17% of global output. The other is a newly built production facility for organic light-emitting diode displays, a type of advanced panel used in high-end handsets. OLED production is currently dominated by Samsung.

In addition to the delivery permits, China Star Optoelectronics has also received special treatment regarding infections among its workers, according to sources. Two employees at one of its Wuhan facilities contracted the coronavirus last month, two people familiar with the situation said, but instead of being ordered to shut down the entire production line for inspection, as is common practice in such cases, the company was only advised to enforce a 14-day quarantine for anyone who worked on the same shift as the two patients. The company counts Huawei, Oppo, Vivo and Xiaomi as its major clients.

Smaller display maker Tianma Optoelectronics has also been given the special permits from the government, sources said.

Chip and display projects like these are vital for achieving Beijing's aim of reducing the country's reliance on foreign tech and eventually challenging foreign rivals.

This push for self-reliance has only accelerated after the U.S. clamped down on Huawei Technologies, China's biggest tech company. Citing security concerns, Washington added the company to the so-called Entity List in May last year to restrict its access to American technologies. Chips and displays are the two most expensive and crucial components needed for a wide range of electronics devices, including smartphones, and are seen as a measure of a country's technological advancement.

But even though state and local governments in China have offered special assistance to strategic chip and display projects, they are still suffering delays in shipments and setbacks in development due to massive staff shortages caused by the coronavirus outbreak. Hubei Province is scheduled to end its extended Lunar New Year holidays on March 11 at the earliest. The holiday should have ended on Jan. 31 this year, according to the lunar calendar.

One of Yangtze Memory's facilities in Wuhan, a city that plays a key role in China's ambitions to nurture its own tech powerhouses (Photo courtesy of Yangtze Memory)

One of Yangtze Memory's facilities in Wuhan, a city that plays a key role in China's ambitions to nurture its own tech powerhouses (Photo courtesy of Yangtze Memory) At Yangtze Memory, only 40% to 50% of its employees remained at work during the New Year break, while most of the remainder are still struggling to return.

It is common industry practice for chip and display facilities around the world to keep production running year round, with a certain number of staff always on site to cover shifts.

"These employees who stayed at the company since the Lunar New Year are under big pressure as they have to take turns to look after production without much rest, again and again," said a source familiar with the matter. "Any employee who returns to work has to stay in the dormitory areas for a 14-days quarantine and avoid going outside before going back to the main production plaza and headquarters."

BOE also faces challenges despite the special government permit, sources said.

"BOE is among the government's priorities to keep operation normal ... But the 10.5-generation project in Wuhan is still in the early stage of mass production. It actually requires display equipment suppliers' on-site support to fine tune the production performance, which has become a big challenge after the epidemic situation worsened," said one of the people familiar with the matter.

"The on-site personnel from equipment suppliers had to leave the city and without the support from them BOE could face up to two quarters of delay to improve its production performance," the person added.

Cash is another pressing issue for companies operating in Wuhan.

BOE became one of the latest companies to take advantage of the newly sanctioned "virus bonds" to shore up its finances. The company completed a three-year 2 billion yuan ($286 million) issue of its maiden "epidemic prevention and control bonds" on Saturday, with a coupon of 3.64% per annum. All the funds raised will be used to increase capital at its subsidiaries, according to the prospectus. Wuhan BOE Optoelectronics Technology will receive an injection of about 300 million yuan.

"Since sealing off the city of Wuhan, the advance in the project was forced to slow down, limited by transportation shutdown and epidemic prevention demands," the company said. "The costs of transportation, logistics and labor have correspondingly risen, imposing relatively large influence on both upstream and downstream manufacturers in the sector which will add operational pressures to the project later on."

The virus bond is a new funding instrument created by five central government institutions, including the People's Bank of China, the Finance Ministry, and securities and banking regulators, to assist companies' urgent funding needs to cope with the epidemic.

"The labor constraints are still a headache for display makers, as module assembly requires more workers. On top of that, they also face shortages of trivial supplies such as tape, cartons and packaging materials, as those are not among the top priorities for returning operations to normal," Eric Chiou, a display analyst at research company WitsView, told Nikkei. "Any kinks in the supply chain will still affect the product shipment," he added.

Yangtze Memory told Nikkei that the company's production and operations are running smoothly and orderly but declined to give further details.

China Star Optoelectronics and BOE did not respond to request for comments as of publication time.