This is quite worrisome, even from the perspective of state management, especially as the economy has continuously been taking a severe hit because of the ongoing and relentless Covid-19 pandemic.

Paradox in pricing

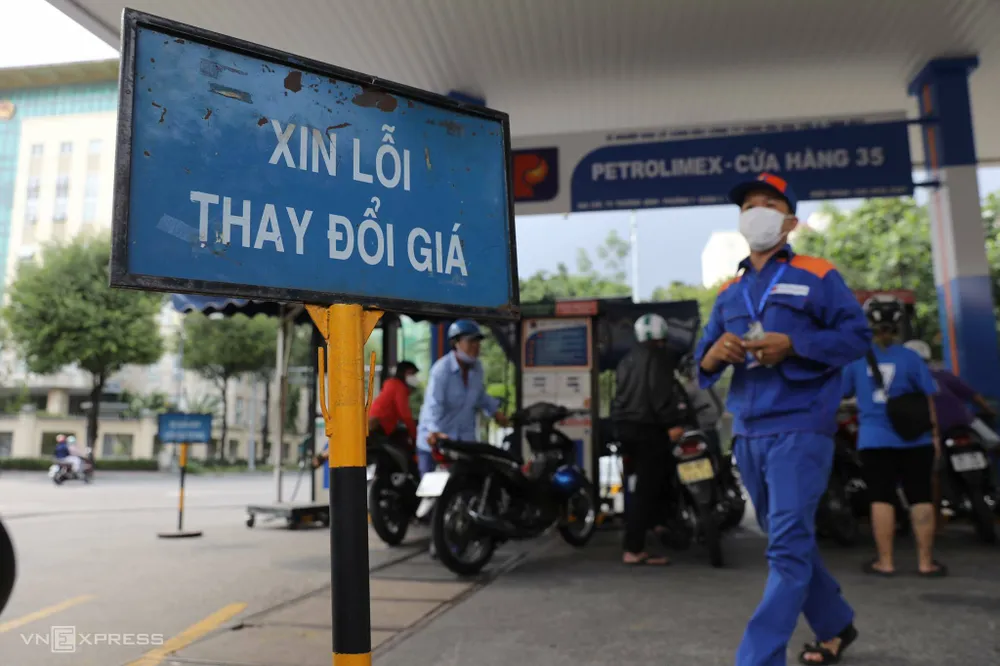

After price adjustment on 21 February, domestic gasoline price increased to VND 26,280 per liter for RON95 gasoline, surpassing the peak level in July 2014 of VND 26,140 per liter. Currently, the retail price for consumers includes taxes and fees, along with the CIF price, which is the price delivered at the port of discharge with costs, insurance, and freight. A representative of the Ministry of Industry, Trade, and Finance explained that the domestic gasoline price adjusted due to the increase in oil prices on the world market in the last ten days following tensions between Russia and Ukraine and the shortage of domestic supply. However, this does not seem to be the realistic situation at all.

In the current retail price structure of gasoline, each liter of gasoline and oil is subject to taxes such as special consumption tax as in RON 95 gasoline at 10% and E5 RON 92 at 8%, along with 8% import tax, and 10% value-added tax (VAT). Added to this is Environmental Protection Tax from VND 3,800 to VND 4,000 for gasoline and VND 2,000 for oil. The retail price also has a standard profit of VND 300 per liter of petrol and standard costs of VND 1,050 to VND 1,250 per liter of gasoline, while it is VND 600 to VND 950 per liter on oil, depending on the type.

Therefore, it is estimated that in the price structure of petroleum products, taxes and fees account for about 42% to 43% for gasoline products and about 30% for oil products. When the price of gasoline increased, the paradox was even more evident as enterprises were burdened with extremely high production input costs, and the state budget appeared to get richer through collection of fuel tax. This paradox is ironic in that the Government has been offering many solutions to reduce taxes and fees for many other industries in order to revive the economy due to the disastrous impact of the ongoing Covid-19 pandemic.

The current increase in gasoline prices has come as a blow to domestic enterprises. After being ravaged by the current Covid-19 pandemic, a huge number of domestic enterprises have suffered very heavy losses and some have even exhausted their last resources during this time. Although the Government support packages have been approved by the National Assembly, it is not known when they will reach businesses. Seeing from previous times, capital disbursement to support businesses is very slow in coming and the amount is also too small, which does not really help businesses to recover.

Currently, taxes on petroleum products are very high, and the immediate need is to reduce them. Among the taxes and fees, Environmental Protection Tax is considered the heaviest tax on petroleum products. This tax is being mechanically calculated in absolute terms, rather than as a percentage of many other taxes. For instance, with the price of RON95 gasoline at VND 26,280 per liter and E5RON 92 gasoline at VND 24,570 per liter, the Environmental Protection Tax rate is VND 3,800 to VND 4000 per liter, accounting for about 6.5% of the retail price of gasoline. Therefore, whether gasoline prices fall or increase sharply, the cost of the Environmental Protection Tax per liter of gasoline will remain unchanged.

The management of petroleum is the task of the Ministry of Industry and Trade, but the policy of reducing taxes and fees is calculated by the Ministry of Finance. The Ministry of Industry and Trade has proposed to reduce taxes and fees on 1 liter of gasoline for last many years, but the Ministry of Finance has not yet agreed to it because the revenue from gasoline tax makes a large contribution towards the state budget. Hence, the higher the price of gasoline, the more the Ministry of Finance can collect, and the more burden businesses have to shoulder. When businesses lose a lot, the manufacturing industry loses a lot too, therefore it is not possible to recover the economy back to normal. Reducing taxes and fees is a way to help the economy recover, and also help the Government to obtain a more stable and long-term budget.

Many inadequacies

The Minister of Industry and Trade has proposed to reduce the price correction cycle to three to five days instead of the current eight to eleven days. When the price correction cycle is short, the price follows the market price more closely. However, in essence, it is still very difficult to overcome many inadequacies. We currently manage petroleum products in a half-hearted way as the State neither regulates closely nor does it let the market decide. This ambiguity of the management not only brings fatigue to businesses and people whenever the world gasoline price fluctuates but also causes trouble for the petroleum business itself.

The non-market factor in domestic petroleum products is also reflected in the application of a series of additional taxes and fees. According to the roadmap, by 2024, petroleum import tax from the ASEAN market will be 0%. However, since a few years ago, petroleum products have increased on two types of taxes such as Environmental Protection Tax and VAT. Therefore, the domestic petrol price does not follow closely with the petrol price in the world market.

The state agencies do not explain what the tax collection is for. If the petrol tax is increased to protect the environment, it must clearly demonstrate how that tax money is being used to protect the environment, and how the environment is improving after the tax increase. If the tax should be increased to benefit the budget, it must be made clear to the people how much of the tax money is being used for environmental protection and how much is left to make up for other revenue shortfalls in the economy.