While most expect the U.S. will shift its approach in dealing with China, they also say a protracted rivalry between the world’s two biggest economies is here to stay.

Here’s a look at how analysts are reacting:

Dual Circulation

With frictions likely to remain over the medium to longer-term, China will continue pursuing its policy of greater economic self-reliance, Zhongtai Securities Ltd. economists Xu Chi and Zhang Wenyu wrote in a WeChat post.

“We believe we shouldn’t make overly optimistic assumptions about mid-to-long term U.S.-China relations after Biden takes office,” they wrote. “It is still necessary to accelerate the formation of a new development pattern with the domestic market as the mainstay and international and domestic markets mutually supporting one another, in order to hedge against possible external risks and challenges in the development process.”

Rebound Expected

But China's growth during 2021-2025 to be lower than before

Source: China's National Bureau of Statistics, Bloomberg surveys

That was echoed by Bo Zhuang of research firm TS Lombard, who said China will continue to play for time, especially on the technology front.

“The U.S. and China will increasingly compete directly in multiple spheres ranging from technology to security,” he said. “The leadership in Beijing sees China as being involved in a long-term struggle with the U.S., which it has to pursue as the core of its claim to power, reducing dependence on the U.S. in favor of the ‘China Model’.”

Tariffs Time Out

It’s likely that the incoming U.S. president will look to a more multilateral approach to trade than Trump did, meaning there’s less scope for another volley of tariffs at least for the near term, said Chua Hak Bin, senior economist at Maybank Kim Eng Research Pte. in Singapore.

“A Biden administration is expected to pressure China via alliances and further liberalization, rather than via sanctions, tariffs and currency manipulation charges,” he said. “The U.S.-China trade war may cool down under Biden.”

China's Rising Surplus

After four years of Trump's policies, China's surplus has only grown

Source: China's General Administration of Customs

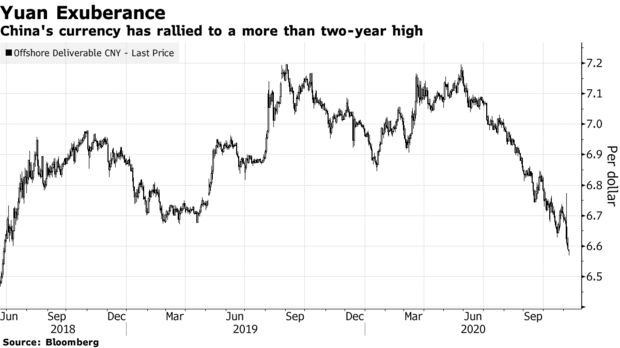

Yuan

Expectations for a somewhat less confrontational approach from Biden will offer support for the yuan, even as broader U.S.-China tensions remain, said Khoon Goh, head of research at Australia & New Zealand Banking Group Ltd. in Singapore. The offshore yuan is already Asia’s best performer this year, having gained about 6% against the dollar, on the back of the economy’s solid recovery and positive yield advantage over U.S. assets.

“The offshore yuan has strengthened past 6.60 and has the potential to rally further, especially if we see continued dollar weakness,” he said. “Yuan may rise to 6.45-6.5 by the end of the year or early next year.”

Tech Relief

While a Biden administration will continue to view China as a competitor rather than a rival, there will also be scope for cooperation between both countries, and U.S. trade policy is unlikely to be as volatile as it was under Trump, according to William Ping, managing director at Peaceful Investment Co. Ltd.

“I’m planning to add exposure to telecoms shares and other firms related to 5G, anticipating more favorable conditions for key tech sectors,” he said. “At the very least, it means Huawei lives.”

Inflection Point

A shift in approach to China will support inflows into equity markets, said Brett McGonegal, chairman and chief executive officer of Hong Kong-based Capital Link International.

“Positive U.S.-China relations will be the growing thematic pushing Hong Kong and China markets higher. The shift that will happen in U.S.-China relations will drive a sense of global connectivity and not dislocation or disconnection,” he said. “This will help open China markets and help asset allocations into China. The long-term benefit will be the bond market.”

Restraint?

Because the face-off between the U.S. and China is going to be long-term, both sides need to exercise restraint, Evergrande Research Institute economists led by Ren Zeping wrote in a Wechat post.

“China’s best response is to promote reform and opening up with greater determination and greater efforts,” they wrote. That will mean an ongoing focus on new infrastructure, urbanization and family planning policies in order to drive self sufficiency, they wrote.