Immediately after this announcement, stocks and commodities began to tumble, while the price of the formidable US dollar skyrocketed. It will now be seen as to how investors will review their strategy after this announcement by the FED.

Success factors

Investors are always in a continuous debate as to whether to invest in growth or value stocks, which means in other words, they either choose stocks that are inclined to grow significantly above the market average or they trade at prices below the fundamentals. Among the longest adopted investment strategy tips on choosing either growth or value stocks, is the stock market version of Godzilla vs Kong, referring to the Hollywood box office hit. In Godzilla vs Kong, there is an epic showdown between two iconic rivals, with each side launching powerful blows to score points and satisfy fans.

There is a lot of suspense and heart-pounding moments in the epic, but nothing is clear in this story, as to who is the final winner, or what is the subject of the debate. Honestly speaking, the overall story is not convincing. As we see, most investors choose companies that offer strong consistent growth prospects, while for value, investors choose companies that appear to be undervalued at face value.

Whether it's a showdown with an investment in metaphor Hollywood style, or a growth investment strategy, it must be admitted that it is easy and somewhat complacent for investors to stay loyal to what they are familiar with, or what they think they know very well. Nonetheless, the argument between value investing and growth investing seems increasingly outdated. The competition between the two styles of growth and value is based on a forced dichotomy motivated by perception rather than reality.

Needless to say, there have also been times when value stocks outperformed growth stocks and vice versa, sometimes by marginal returns over the long term. However, betting on one style to be better or worse than the other, based on the magnitude or timing of results in any past time, is not a sound strategy to maximize profits.

The reason is simple. The factors leading to success are only periodic, difficult to predict, and unlikely to be repeated. Trend following investors are very vulnerable to unexpected reversal shocks. Indeed, the FED meeting on 17 June left the market dissecting whether the end of the reflation trade has been achieved, which is bringing outstanding success from time to time for growth and value investment strategy.

Identifying inflation and reflation

In understanding reflation trade, we look at two misleading terms. The first is inflation, the traditional term based on an increase in the Consumer Price Index. An investment strategy that adapts to inflation can be for investors to buy hedging government bonds, such as TIPS, which are inflation indexed bonds used when inflation rises and they adjust prices to maintain real value for investors. However, this is only half of the equation. Reflation on the other hand is based on two hypotheses simultaneously, namely, the economy and prices accelerating sharply. Reflation aims to stop deflation, which in general is a decline in prices of goods and services that occur when inflation falls below zero percent

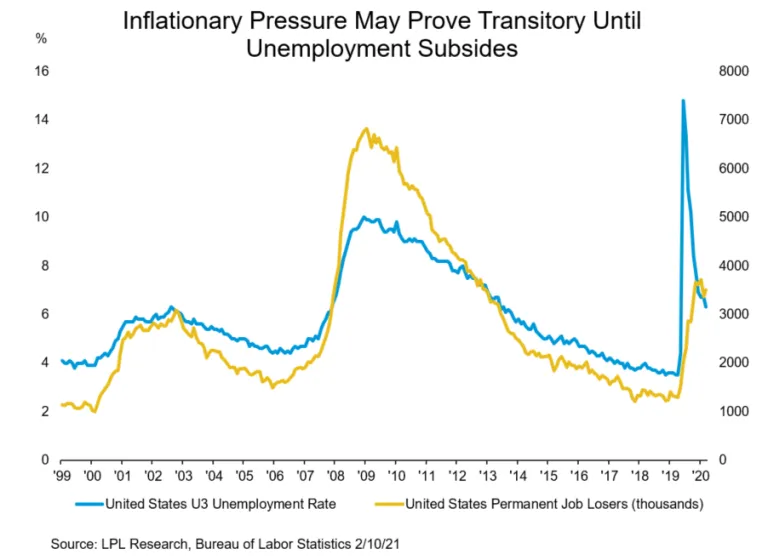

Reflation usually occurs after a period of ongoing continuous economic deflation, a situation we are now seeing since the outbreak of the Covid-19 pandemic early in 2020. In order to prevent the worst from happening, the FED implemented several unprecedented accessible fiscal policies to stave off a deep recession. At the same time, the FED also changed the whole mode of inflation from a target of 2% to an average of 2% inflation. When switching, the FED announced that it would keep interest rates near zero percent until 2024 and continue to pump money to buy USD 120 bn of government bonds every month.

The transition to average inflation targeting has combined with more certainty in the US presidential elections, by the markets. It has also brought more confidence in the global economic recovery, due to the effectiveness of vaccine studies, trials and implementation during the whole of last year. All of these unique factors inadvertently combined in early November 2020 to be exact, causing the market to begin an explosion of reflation trades.

Among the unique factors was the change in the inflation style, which after decades is the most important reason for the market to think that the FED will accept inflation higher than 2% for a longer time, long enough to keep economic growth accelerating, and making up for what has been lost. Based on this hypothesis, investors immediately implemented the aggressive strategy of selling government bonds and buying stocks. This is a tactic that anyone who understands corporate finance will see as a recreation of financial alchemy, using leverage or debt to bet on the upward potential of the stock market.

As a result, we see the US government bond yield curve starting to slightly move up at long maturities. At the same time, the stock market is also full of hopeful green colors. In essence, this is a simulation of trading and selling risk-free bonds and buying stocks, based on the assumption that inflation and economic growth both will accelerate at the same time. These are the most basic descriptions of reflation trade that are benefiting commodities and stocks, although the upper hand is more tilted towards tech stocks and cyclical sectors like energy, resources, and finance. However, the drop in markets was even more dramatic following comments from St Louis FED President James Bullard about the possibility that the FED could raise rates even sooner than currently anticipated.

Despite the FED's repeated affirmation that it's not even thinking about raising rates, the market has started to hypothesize about rising interest rates. The FED's shift in policy casts doubts on how much inflationary pressure the FED is really willing to endure. For instance, such as in the case after the Fed warned that it is likely to start discussing buying USD 120 bn worth of bond purchases a month early.

Investment perspective

Both value and growth stocks should perform well as the global economy reopens, because earnings for the rest of the quarter are likely to be strong. However, the deciding factor will not be whether a given company carries the value or growth label, but has long term investment strategies. In a recent analysis, the Financial Investment Review predicts problematic growth and investment strategies because the unique combination of factors driving stock prices is running out. This prediction seems to be gradually becoming a reality as per the analysis above. Now it is to be seen whether the strategy of choosing growth and value investments is rejected or adopted.

Instead of forcing on a particular style, investors should focus on companies with strong fundamentals that are poised to benefit from a cyclical economic recovery and strong long-term uptrend, like what people are seeing in emerging markets, small-caps, and context-adapted consumer sectors. Currently, there are also many views in favor of reflation trades that will take a long time to die out. Several economists believe that if the FED still has the ability to recognize when inflation occurs and appear at the right time to intervene, then there is no need for the market to remain worried if inflation will be too high in the long term.

A recent Barclays report makes an interesting observation, that the more concerned the FED is about inflation being too high, the less the market should care about inflation. Economist Andrew Smithers believes that the FED strategy in tightening monetary policy enough to keep inflation expectations under control would likely trigger a stock market crash, therefore the FED is hoping inflation will just go away.

The bottom line for investors is that they must understand what trends are and will be changing, such as the FED's transition from an inflation target to an average inflation target, and global market movements, and demand and the sub-sectors therein. This will greatly aid in portfolio management, instead of sticking to some run-of-the-mill and age old investment style.