Tedious procedures

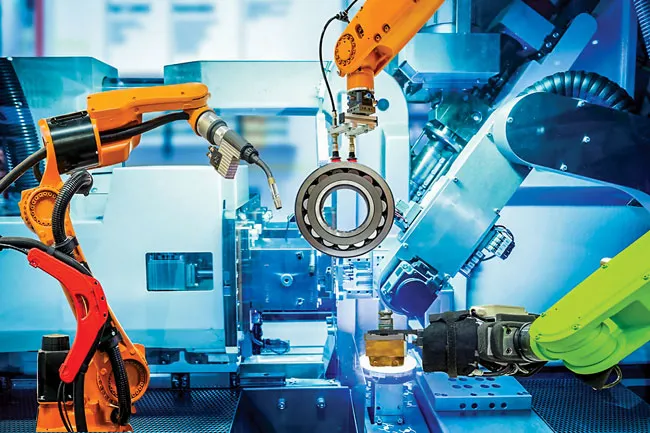

At the preliminary meeting in mid-March of the working group on investment and information gathering for plans to improve the investment environment in Ho Chi Minh City, Mr. Do Phuoc Tong, Chairman of the Ho Chi Minh City Association of Mechanical Electrical Enterprises, said that in the past, the mechanical industry was always considered very weak, but now many businesses are trying to transform, and more many more are determined to invest because otherwise there will be no standard products to meet the needs of the international commodity buyers.

However, investment by enterprises is facing several difficulties. In the past, banks have always played a major role in investment for businesses. However, the mechanical industry was always considered to be inefficient, so banks are hesitant to review loan applications, and hence this industry struggles to borrow capital, or faces multiple tedious procedures and endless red tape. The evidence lies in the investment in the Hi-Tech Park of Ho Chi Minh City, where a group of eight enterprises in the mechanical and electrical industries were issued licenses to invest at the end of 2017 and at the beginning of 2018. However, until now, only two of these businesses have been able to start their construction. Mr. Tong gave another example of the the mold mechanical industry which is classified as a heavy industry or light industry, where the process for obtaining a building permit can vary. As these procedures are still not clear, it makes it difficult for enterprises and for officials of departments and agencies to coordinate.

Faced with the problems mentioned above, if businesses do not invest, they will not have a product to meet the standards of the buyers. Therefore, Vietnamese businesses will continue to be burdened under barriers for acquiring sufficient capital and licenses to make suitable products for customers. Their entry into the supply chain of multinational corporations is not simple or easy. At present, the Ministry of Industry and Trade, and the Department of Industry and Trade of provinces and cities are trying to connect buyers with Vietnamese support enterprises so that businesses continue to meet. However, at a conference at the end of 2020, on connecting automobile-electronics-mechanical enterprises, Mr. Chu Trong Thanh, Sales Director of Giai Phong Rubber Co., Ltd., said they were having difficulty in gathering information on FDI enterprises or buyers wishing to buy components.

If the competitors are the multinational corporations, then small Vietnamese enterprises that are making standard products will not find it easy to enter the supply chain. Firstly, the cost of Vietnamese products is often higher than that of foreign products. Secondly, multinational corporations entering Vietnam already have their own subsidiary groups of enterprises, with whom they have a mutual trust and agreement, so it will be extremely difficult to enter this chain.

The question remains if one should focus first on the investment or the customer. This is similar to asking whether the chicken came first or the egg. In order to participate in the global production chain, Vietnam still faces plenty of limitations. Up until now, Vietnam has only around 300 enterprises participating in the production chain linked with multinational corporations. Although FDI enterprises contribute a great deal towards Vietnam's exports, they are also the major importers, and so there lies in this situation a huge paradox.

Policies in practice

Many experts say that what they want is for enterprises as well as support industries in Vietnam to strengthen via indepth investment and strong linkages. The majority of Vietnamese support industries are small enterprises with low supply capacity and low ability to control production costs. The enterprise owners know this, and they crave to form industrial clusters for textiles, garments, footwears, mechanical equipment, plastic, and rubber. So far, it has only been the Ho Chi Minh City Association of Mechanical Electrical Enterprises that has persisted for the last five years in their proposal to construct a concentrated industrial park.

The formation of an industrial cluster will not only bring in adequate infrastructure but also reduce logistic costs, increase specialization of each enterprise, so that businesses will not need to invest too much in machinery or manufacture too many products. This is also a strong premise for businesses to participate in the global supply chain. Enterprises expect that some localities also have policies to reserve land for industrial clusters like for instance in Ho Chi Minh City. However, upto now, industrial clusters for support industries have not materialized for many reasons. Enterprises nowadays are like single entities and unable to enter the common playing field, but the supply chain needs the right push from the support policies of the state. Countries such as China, South Korea, Japan, and Thailand, all have strong policies for their support enterprises to develop.

There are many policies for support industries, but according to enterprises, these policies are difficult to put into practice. More recently, the Government issued Resolution 115/NQ-CP on solutions to promote the development of support industries. The contents of the Resolution favor enterprises, such as preferential interest rates and policies for processing and manufacturing in which the State will compensate differences in interest rate with upto 5% per year. Besides this, it will also enhance the capacity of small enterprises through construction of technical centers to support regional industrial development from central and local investment, specifically, with five centers, that include three centers in mechanical fields, and two centers in textile, garment, and footwear sectors. The domestic value chain will be developed to promote links between Vietnamese and multinational enterprises, and build concentrated support industrial parks to create industry links, and also build pilot projects of dedicated industrial parks.

Despite the introduction of a new Decree, businesses continue to wonder if this time will be any different to previous times and if the new policies will be easier to implement. If ministries do not realize the effectiveness of a policy, the opportunity to participate in the value chain for enterprises will be lost. The support industry in Vietnam is still at a primary stage and unable to grow on its own. We will all only benefit from a shift in investment flow, especially from the tech-eagles. More importantly, the goals set for the support industry in Vietnam under Decree 115 are still difficult to realize, and therefore need maximum state support.