Startups in Southeast Asia, especially those in health care and deliveries, have managed to raise millions of dollars to accelerate their expansion, showing investors' appetite to find promising openings in the region despite the economic turmoil stemming from the coronavirus pandemic.

Among the health care startups that seem to have been boosted during the pandemic is Singapore-based telehealth app Doctor Anywhere, which raised $27 million in late March in a series B funding round from a group of investors including Malaysian hospital operator IHH Healthcare.

"Since the start of the outbreak, we've had more people reaching out to us in the past weeks expressing interest and setting up conversations [for potential investments]," Doctor Anywhere's founder and CEO Lim Wai Mun told the Nikkei Asian Review.

The Doctor Anywhere app allows more than 1 million users to consult a local doctor via video call -- at 20 Singapore dollars ($14) per consultation in Singapore -- and get medication delivered to the user's location within hours. It also has an online health products marketplace. Some 1,300 general practitioners and health care specialists in Singapore, Thailand and Vietnam are registered on the platform.

As the coronavirus started to spread, the telehealth platform gained more attention. It was deployed at Singapore's ferry terminal customs checkpoints to help with on-the-spot checks of the health of passengers with symptoms of COVID-19 via a teleconsultation. It also provides medical services for home-quarantined individuals in the city-state.

Startup fundraising in Southeast Asia slowed late last year after the debacle surrounding the failed U.S. IPO of shared workspace company WeWork cooled investors' sentiment. The coronavirus pandemic and economic effects of social distancing measures to contain it have added to that trend, with some investors turning away from risky new funding and keeping their money to support their existing portfolio companies.

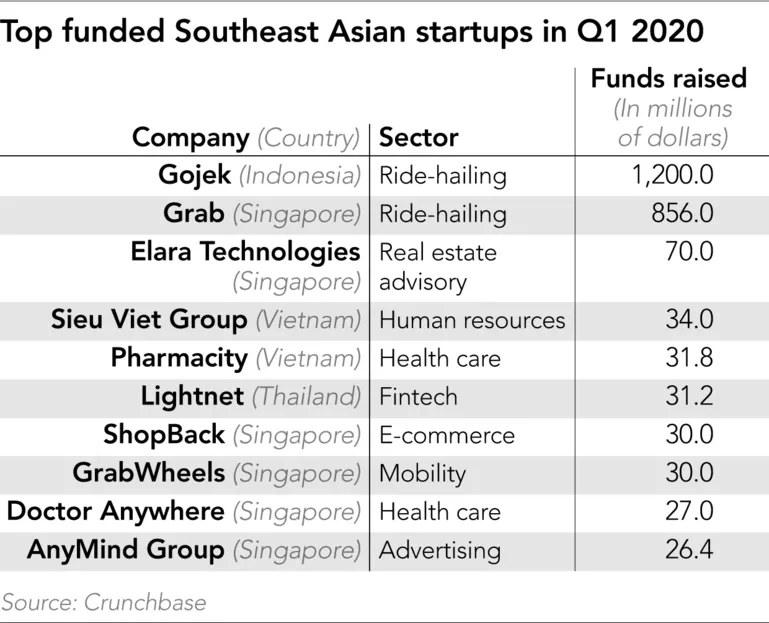

Reflecting that trend, the total funds raised by Southeast Asian startups in the first quarter of 2020 was $26.5 billion, down 10% from the same period last year ($29.3 billion), according to U.S. startup database Crunchbase. The number of deals announced in the period, ranging from pre-seed stage to late-stage rounds, declined by 40% to 144.

The health care sector has been one of the few bright spots.

Doctor Anywhere's business has experienced "a two- to three-fold increase" since the COVID-19 crisis started, Lim said. "The COVID-19 situation, while unfortunate, has brought to light the need for telehealth as a useful tool and additional means to address workforce issues, care for at-risk populations, and deliver health care more efficiently."

The company will use the $27 million to reinforce its existing business in Singapore, Thailand and Vietnam, and to facilitate expansion into new markets such as Malaysia and the Philippines this year, he said.

During the first three months of 2020, Vietnamese drugstore chain Pharmacity also raised $31.8 million, while Malaysian food delivery startup Dahmakan raised $18 million, according to Crunchbase.

Food delivery is another business that is booming in the region as more people work and study at home due to lockdowns. Total funds raised by logistics-related startups during the January-March period tripled on the year to some $56 million, according to the database.

Over the past two to three years, telehealth apps have been seen as a promising sector in Southeast Asia due to a scarcity of doctors and a burgeoning middle-class population who are more conscious about their health. Similarly, logistics startups have also been expected to grow due to rising e-commerce demand and traditionally weak last-mile delivery systems. The pandemic has only served to underline these shifts.

About 80% of the new funds raised in the first quarter of 2020 went to Indonesia's Gojek and Singapore's Grab, Southeast Asia's super app rivals that offer services from ride-hailing to food delivery to e-payments. Gojek and Grab raised $1.2 billion and $856 million respectively, showing that these unicorns continue to be an attractive investment target despite global uncertainties from the pandemic.

While their core ride-hailing services have been severely affected by the outbreak, both Gojek and Grab have seen rising demand for food delivery.

The trend of aggressive fundraising by health care and delivery startups is still in evidence in April, as the disease's infection tally has risen and more curfews and travel restrictions have been put in place by the governments.

A Ninja Van employee unloads his delivery van at their office in Singapore. The logistics startup raised $124 million earlier in April. © Reuters

A Ninja Van employee unloads his delivery van at their office in Singapore. The logistics startup raised $124 million earlier in April. © Reuters Indonesian logistics startup Kargo Technologies raised $31 million, while Singaporean logistics startup Ninja Van raised $124 million this month. Vietnamese telehealth operator eDoctor also raised an undisclosed amount of money this month.

Having said that, overall fundraising activities will likely slow down further in the second quarter due to fewer meetings and event opportunities between investors and startups.

"The impact will come in Q2 with a global restriction in travel and deals less likely to be funded without a physical meeting. Venture investors are also reserving [cash] to help their existing portfolio companies," Martin Tang, co-founder and partner of Genesis Alternative Ventures in Singapore, told the Nikkei Asian Review.

Many startups have started cutting labor and marketing costs to survive the pandemic. Even big startups are feeling the pinch. Grab CEO Anthony Tan said in a recent statement, "There will be tough decisions and trade-offs to make." He said the company would "right-size our costs, manage our capital efficiently and make the necessary operational adjustments in order to weather the storm and carve out a path to profitability."

"Investors are hunting for good value investments especially in the sectors which are COVID-resistant, like telehealth [and] remote working software," Tang of Genesis Alternative Ventures said. "The outlook for the rest of the year will depend on how long the travel restrictions remain in place. And even when travel restrictions are lifted, investors are likely to travel cautiously, which will slow down the pace of investing."