View from United Kingdom

The Bank of England estimated in early May that GDP was on course to shrink by 2.9% in 2020 quarter 1, then 25% in quarter 2. With a fall 14% in 2020, this is twice the size of the collapse during the financial crisis. With the figures in for April the UK economy shrank 20.4%, the largest monthly contraction on record. For the 3 months to April the decline was 10.4%.

By June, 8.7 million workers had been furloughed since the start of the coronavirus crisis so that the government’s support scheme cost £19.6billion. The unemployment rate stopped being a measure of joblessness. For the 3 months to April it remained at 3.9%. The number of hours worked per week dropped to 959.9 million from 1.041 billion in the three months to March, the biggest amount on record. In effect, the government’s job retention scheme to kept employees on firms’ books. Although government confirmed that furloughed workers would continue to get 80% of their pay until the end of October, but then a fifth of their salary will have to be met by employers. Another 200,000 self-employed had taken up government grants worth £2.5 million and a further £31 billion in government-backed loans to help survive the crisis had been disbursed.

Organisation for Economic Co-operation and Development suggested that the UK is likely to be the hardest-hit by Covid-19 among major economies. Britain’s economy is likely to contract by 11.5% in 2020, outstripping falls in other developed economics of Germany, France, Spain and Italy. Furthermore, if the raising of lockdown caused a second peak in the pandemic, the UK economy could contract by 14%. This is, in part, because the UK is particularly exposed to the trade in tourism, and hospitality sectors, which have been disproportionally affected by lockdown restrictions.

Although difficult to measure, the inflation rate as proxied by the consumer prices index for May was 0% as it was for quarter two. All sectors apart from food and non-alcoholic drinks saw a drop in price. Particularly affected were Health, Transport, Recreation and culture, and Restaurants and hotels. This rate flirts with deflation. One would anticipate that there will be many fire sales driving prices down as shops collapse just after they are allowed to reopen. The Bank of England on 18th announced an increase its Quantitative Easing Programme, rising the capacity to bond purchase from £645 to £745 billion. Since January, the Bank has cut interest rates to record lows (0.1%) and injected an additional £200 billion in new money into the banking system. This should favour asset holders and the stock exchange.

A wound that remains uncauterized is BREXIT and the threat of a ‘no-deal.’ The outgoing Chair of the Confederation of Business claimed business could not cope with both a no agreement scenario and the corona virus. A concern here is that faith in the Conservative administration over issues related to the managing of the crisis could spill over to upset support for any trading arrangement with Europe. Concurrent negotiations are taking place with Australia and New Zealand as well as the United States, the European Union and Japan. On the 17th of June it announced that it was interested in joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a free trade agreement that links Australia, Japan, New Zealand, and Vietnam.

Vietnam economy

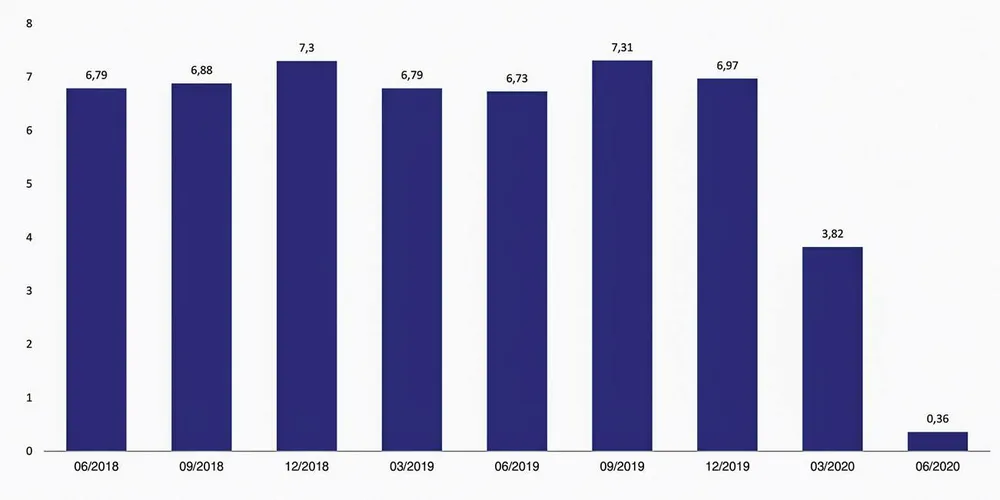

The effect of the pandemic has now been seen in the GDP growth which was 0.36% for the 2nd Quarter and 1.81% for the first 6 months year on year, the record low in the last 10 years. Given that the World Bank had earlier forecasted a decline of 5.2% for the global economy in 2020, it is however notable that Vietnam is amongst a few countries that saw positive economic growth.

Although economic growth has declined sharply, there are two points to note. Firstly, the signs of recovery which were seen in May have now been seen again in June. For example, the industrial production index in June increased 7% year on year after two consecutive months of declining. The manufacturing sector, the key driver for economic growth, increased by 10.3% - a level that is similar to that in the same period in 2019. The retail sales index surged 5.3% year on year after declining in three previous months.

Secondly, with Vietnam practically imposing lockdown restrictions for only two weeks, the declined economic growth reflects its exposure to foreign markets. The pandemic, which is still far from being controlled globally, triggered by the threat of the second outbreak, is still the main and immediate threat to Vietnam economy. The target of 6.8% in GDP growth set for 2020 is therefore an impossible mission.

While economic growth is not impressive, the consumer prices index increased. The CPI for June surged 3.17% year on year, resulting in the increase of 4.2% for the first six months, much higher than that for 2019 which was at 2.65%. The consumer prices index normally tends to be higher in the last 6 months comparing to the initial half of the year and therefore the target of controlling it below 4.0% for 2020 is very unlikely practical. Jointly, the economic slowdown and higher consumer prices index imply the quality of life would be declining.

That being said, it is worth noting that Vietnam has not only done well in controlling the spread of the virus, but also in maintaining positive economic growth. With the main economic indicators showing signs of recovery, the most difficult times might have been past. The reopening of the global economy would stimulate more growth for Vietnam in the time to come.

In last month’s publication, we predicted a sideway trading mode, or even a decline for the Vietnam stock markets in June, and we now continue to hold this view for July. Our opinion is based upon the facts while the emotional trading has stopped, the economy has returned to normality. The monetary regulators will be more cautious about their cheap money policies and credit regulations. Credit growth in the first 6 months increased by 2.45%, the lowest level in the last 5 years, comparing to 6.22% same period last year. With relative valuation proxied by price to earnings at 14, price to book value at 1.9 and price to sales at 1.3, Vietnam is fairly valued among other competitive markets in the Asian region in the global asset allocation strategy.