Even before the pandemic, India’s banks were struggling. With among the highest ratios of bad loans in the world, at least five lenders have had to be rescued from collapse since late 2018. Several more were in a precarious state. Already creaking under the strain, the sector now faces one of its biggest tests: emerging intact from the crisis.

A strict lockdown in place for several months from March was devastating for the businesses of borrowers big and small. This in turn prompted a historic economic contraction — forecast by the IMF at 10.3 per cent for the year ending in March — that was worsened by the spiralling Covid-19 caseload. But while emergency government relief measures for borrowers helped soften the immediate blow to banks, this support is now being phased out.

“This is like being in the middle of a storm,” said Uday Kotak, chief executive of Kotak Mahindra Bank, one of India’s largest private banks, which like most banks took advantage of the support. “One hopes that most of the boats reach the other side of the shore, but you can’t take it for granted.”

Mr Kotak, who is one of the richest bankers in the world with a net worth of more than $16bn, added that with lockdowns now lifted and case numbers on a downward trend: “For the financial sector players who are able to get on to the other side, there will also be significant opportunity.”

Swords hanging over the system

Pandemic-hit borrowers had until the end of 2020 to apply to restructure debts with banks through a one-off scheme designed to prevent a sharp rise in defaults.

Other measures — including a moratorium on loan repayments in place from March to August, followed by a Supreme Court order instructing banks not to classify loans as defaults — mean the extent of problems will only become apparent in the months to come.

The Reserve Bank of India, the country’s central bank, acknowledged that the relief measures may have masked the extent of the damage, saying in a report last month that “the asset quality of the banking system may deteriorate sharply, going forward”.

By any measure, the ratio of non-performing banking assets is expected to shoot up. The RBI is forecasting an increase from 7.5 per cent in September 2020 to between 13.5 per cent and 14.8 per cent in September 2021. Fitch said last year that India’s banks will need anywhere from $15bn to $58bn in recapitalisation by 2022.

“There are still quite a few swords hanging over the banking system,” said Ajay Mahajan, chief executive of rating agency Care and a former executive at several Indian and foreign banks. “We’ll have to see the outcomes to pass a judgment as to how the system has reacted to the entire pandemic.”

Chronic bad debt problems

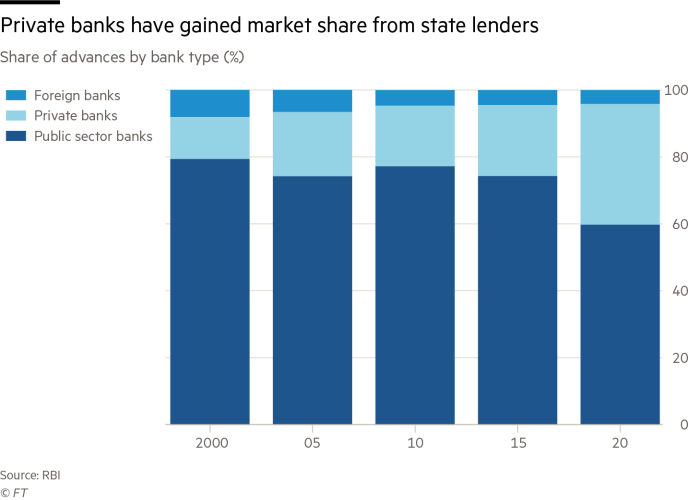

The country’s banking system is dominated by a dozen state-owned banks that control about two-thirds of assets, the legacy of a 1969 socialist-era bank nationalisation. But private competitors like Kotak Mahindra and HDFC Bank have gained share since the 1990s and 2000s as the economy has liberalised.

Foreign names like Citibank, HSBC and Deutsche Bank have also built up local operations focused on niche markets like retail banking for the wealthy and distressed debt.

The sector’s chronic bad-debt problems have prompted several near-misses. In early March last year, the central bank had to intervene to rescue scandal-hit Yes Bank, one of the country’s largest private lenders, from collapse.

In November it stepped in once again to oversee a takeover by Singapore’s DBS Bank of Lakshmi Vilas Bank, a regional lender whose decline predates the pandemic and had rattled markets.

Some worry that the sector, already weak before the crisis, will burden the financial system for years to come.

Capital Economics, a consultancy, warned in a note that the need to address rising non-performing loans will drain profitability and restrict lending and, ultimately, growth in what had been one of the world’s fastest-expanding economies.

Others hope the pandemic will force a shake-up of a moribund, scandal-prone sector that has been held back for years by the cosy nexus between tycoons, bank executives and politicians that results in the misdirection of capital into expensive vanity projects that often fail.

Analysts said the best-run banks, mostly private but some state-owned, are well placed to gain market share. A recent rally in India equities, which pushed the benchmark Nifty 50 index to an all-time high this month, has helped the likes of State Bank of India and Kotak Mahindra to recapitalise swiftly, raising billions in capital to bolster their balance sheets and increase their cover against non-performing loans.

An opportunity for overseas money

Following the takeover of Lakshmi Vilas by DBS, other overseas banks sense an opportunity to expand if regulators have become more open to foreign capital after years of reticence.

“This whole Lakshmi Vilas Bank, the way the [central bank] has handled it does show some indication of things to come . . . of the fact that there’s a need” for foreign money, said Kaushik Shaparia, Deutsche Bank’s India chief executive. “The [public-sector] banks’ ability to absorb all this is limited.”

Deutsche has invested some $1bn in India since late 2018, Mr Shaparia said.

Foreign investors have also circled other distressed financial-sector assets. Oaktree Capital Group, the LA-based fund, is one of the final bidders for the books of Dewan Housing Finance, a shadow bank that collapsed into bankruptcy in 2019 and is the first financial company to restructure using the country’s four-year-old insolvency code, which aims to speed up the process.

Some hope greater foreign participation in the financial system will address a chronic shortage in domestic capital willing to take risky bets and help speed up the often tortuous process of turning around ailing lenders.

But executives and analysts said it is hard to say how much the ownership make-up of India’s banks will change and, with the impact of the pandemic still unclear, the investment case remains to be seen.

The later months of 2020 saw improvements in corporate earnings, demand indicators and the daily Covid-19 caseload has fallen to below 20,000 from nearly 100,000 in September. But it is unclear how many borrowers will have viable businesses once the last of the relief measures runs out and they continue repaying their debts.

“One has to look at the ground level reality in terms of return of the small businesses and employment to see what will be the quality of the balance sheets,” said Sanjay Nayar, chairman of KKR India. “The jury is out until at least March if not June to see what’s the quality of the books.”