Some of the factors are already in place for a more optimistic outlook in 2H21, which include favourable base effect, strong trade and manufacturing performances, continued FDI inflows, and a benign inflation environment. As such, we are keeping our forecast for Vietnam’s GDP growth in 2021 at 6.7% versus the official forecast range of 6-6.5%. The COVID-19 pandemic remains the biggest downside risk factor in this outlook.

A benign inflation environment will afford more flexibility for the State Bank of Vietnam (SBV) to manage its policy and maintain the refinancing rate at 4.0% for now. On the currency front, depreciation pressures on the VND would be limited for now and we maintain our end-2021 USD/VND forecast at 23,000.

Vietnam’s 2Q21 GDP boosted by low base and manufacturing

Vietnam’s economic growth rose 6.61% y/y in 2Q21, extending from an upwardly revised gain of 4.65% y/y in 1Q21 (previous estimate: 4.45%), according to data released by the General Statistics Office (GSO) on Tuesday (29 Jun). While the outcome fell slightly short of our projection of 7% and Bloomberg’s survey of 7.2%, it nonetheless reaffirmed the upward trend from the depths of COVID-19 pandemic in 2020.

The acceleration in 2Q21 was partly boosted by an extremely low base in the same period last year, which barely expanded at 0.39% y/y in 2Q20 as the nation went into a lockdown as a result of the global COVID-19 pandemic. Meanwhile, strong external demand has lifted much of the manufacturing sector, in a pattern similar to many export-driven economies in the region. The manufacturing and processing industry grew 11.42% y/y during the quarter. Within the services sector, wholesale and retail output rose by 5.63% y/y while financial, banking and insurance services saw a rise of 9.27%, and lodging and catering services output declined 5.02% y/y, according to GSO.

For the first half of 2021, Vietnam’s GDP expanded 5.64% y/y, more than 3 times the 1.82% pace in 1H20. The gains were led by industry and construction sector which grew 8.36% y/y, while agricultural sector’s output increased 3.82% y/y and services output was up 3.96% y/y. In terms of broad sectoral shares in 1H21, agricultural sector made up 12.15%, followed by industry and construction (37.61%), services (41.13%), and others (9.1%).

Exports surged in 1H21 while FDI inflows lay foundation ahead

Vietnam’s economic performance has so far followed the pattern of other regional economies where external oriented sectors (such as trade and manufacturing) outperformed domestic oriented ones (e.g. tourism related trade) through the pandemic and in the current post-pandemic recovery.

Vietnam’s exports in 1H21 jumped 28.4%y/y to US$157.63 billion, while imports surged 36.1%y/y to US$159.1 billion, resulting in a trade deficit of US$1.47 billion for the period. This is the country’s first semiannual trade deficit since 1H17. The relatively weaker export performance in 1H21 was likely to be due to shipment disruptions from the fourth wave of COVID-19 infections which forced some factories to suspend operations temporarily during parts of 2Q21.

In the first half of 2021, the US was the largest destination which took US$44.9 billion or 28.5% share of Vietnam’s exports. This is followed by China and the EU, which purchased US$24.4 billion (15% share) and US$19.3 billion (12.2% share), respectively. Other major destinations in 1H21 were ASEAN, South Korea and Japan, at US$13.8 billion, US$10.5 billion and US$9.9 billion respectively.

In terms of key exports commodities, Vietnam continued to thrive in the electronics manufacturing space as exports of mobile phones and parts, computers and electronics parts, and machinery/equipment dominated the top three categories in 1H21, at US$25.2 billion (+14.7% y/y; 16% share), US$23.5 billion (+20.9% y/y; 15% share), and US$17.2 billion (+65.3% y/y; 11% share), respectively.

China was the largest source of imports in 1H21 at US$53.4 billion (33.5% share of imports), followed by South Korea at US$25.2 billion and ASEAN at US$20.9 billion. Other key sources of imports to Vietnam included Japan (US$10.6 billion), EU (US$8.1 billion) and the US (US$7.7 billion).

Closely related to the strong external trade sector is the manufacturing sector, as manufacturing output rose 11.6% y/y YTD to Jun, 2.5 times faster than the pace of 4.6% in the same period in 2020. This is led by the outperformances in output of basic metals, automobiles, furniture, and electronics.

The draw of Vietnam as a production base continued to attract investment inflows to the country. Foreign direct investment (FDI) inflows in 1H21 amounted to US$15.27 billion, or 97.4% of the US$15.7 billion achieved in the same period last year. This will be a key catalyst to pave the way for further economic activities ahead.

During 1H21, 804 new FDI projects were licensed with a total registered capital of nearly US$9.55 billion, an increase of 13.2% y/y. In addition, new pledges of US$4.12 billion were made to 460 existing projects, an increase of 10.6% y/y. Foreign investors’ capital contributions and share purchases in 1H21 were down 54.3% y/y to US$1.61 billion.

The processing and manufacturing sector continued to take the lead with US$6.98 billion of inflows, accounting for 45.7% of the total registered capital in 1H21. This is slightly lower compared to the 51% share achieved in 1H20, as larger inflows were seen in the electricity production and distribution, real estate, and science & technology sectors.

So far this year, 80 countries and territories have invested in Vietnam, led by Singapore with US$5.64 billion (36.9% share of the total) which represented a 3.6% y/y increase. Inflows from Japan and South Korea gained strongly in 1H21 to rank second and third with shares of 16% and 13.4%, respectively. Of note is that inflows from China and Taiwan shrank significantly during the period, while FDI from the US surged by 145%, likely to be part of the narrative of ongoing shifts in supply chain in the post-pandemic era and heightened US-China trade tensions.

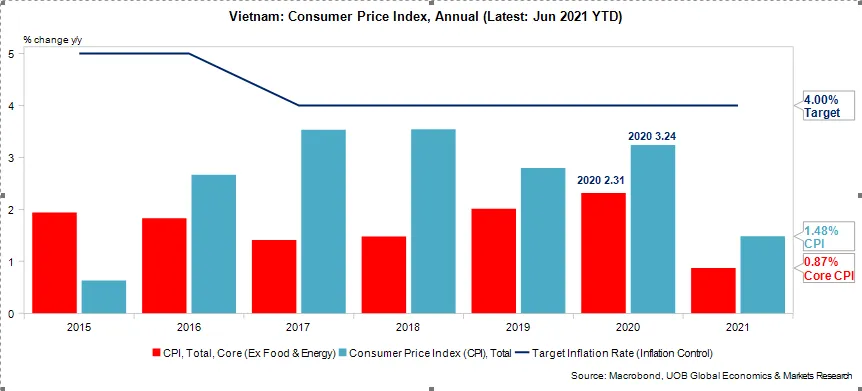

In other economic data released by the GSO, the overall consumer price index (CPI) averaged 1.48% y/y in 1H21 (2.4% y/y in Jun 2021), the slowest pace since 2016, while core inflation (ex food & energy) came in at just 0.9% y/y (1.1% y/y in Jun 2021), both of which are below the central bank’s inflation target of 4%.

Looking into the components, the key drivers for inflation were due to a pick up in transport costs (weightage in CPI basket: 9.7%) in Jun, as restrictive measures were gradually eased as COVID-19 cases came under control. Other CPI components such as clothing, housing, medical care, were relatively well behaved, leading to a somewhat benign inflation environment, allowing more flexibility for State Bank of Vietnam (SBV) in its policy measures.

Forecasts for 2021 intact but with downside risks

While Vietnam’s 2Q21 economic growth came in somewhat short of expectation at 6.61% y/y, it nonetheless reaffirmed the ongoing upswing from the depths of the COVID-19 pandemic in 2020, and also the re-establishment of its historic trend seen during 2013 to 2019. In those pre-COVID-19 years, GDP growth tended to be slowest in 1Q, then gradually moved higher through the remainder of the year as production and exports activities picked up. On average, GDP growth in the second half was about 0.8-0.9% point higher than the first half during those years of strong growth.

With 1H21 having recorded 5.64% y/y, and a favourable low base in 2H20 (average: 3.6% y/y), we are keeping our full year forecast for Vietnam’s GDP growth at 6.7% versus the official forecast range of 6-6.5%. This assumes an average growth rate of around 7.7% in 2H21, about twice that of the average growth rate in 2H20 and should be achievable as long as activities continue to normalize and are not being disrupted significantly.

Some of the factors are already in place for a more positive outlook in 2H21. FDI inflows already matched that of the first half in 2020 amidst the ongoing shifts in supply chain, which will lay the groundwork for activities ahead. Manufacturing sector continued to show its resilience and perform well in 2Q21, despite various setbacks from the resurgence of COVID-19 infections across parts of the country and neighboring countries.

A benign inflation environment will mean that the central bank has a lot more flexibility to manage its policy to ensure a supportive environment ahead. As such, we continue to expect the SBV to stay on hold for now, and keep its policy stance steady with the refinancing rate at 4.0% and rediscounting rate at 2.5%.

For the Vietnamese dong (VND), while the FX manipulator label of Vietnam was dropped in April, the US Treasury will continue enhanced engagements with Vietnam on FX practices. Furthermore, the SBV has also reduced the frequency of its FX intervention (to keep the VND from rising) to once a week instead of daily from February. All these mean that while the upcoming US Federal Reserve “taper” may weigh on the VND, depreciation pressures on the VND would be limited as it invites scrutiny from US authorities. Our forecasts for USD/VND are 23,000 in 3Q21 and 4Q21, followed by 23,100 in 1Q22 and 23,200 in 2Q22.

However, the key downside risks to the outlook will be challenges from the current fourth wave of COVID-19 outbreaks that began late April. The rapid increases of infections in the country are further compounded by slow pace towards herd immunity via mass vaccination, which is considered one of the few tools available to fight against the COVID-19 virus.

As of 29 Jun, data from World Health Organization (WHO) shows Vietnam’s cumulative COVID-19 infection cases at 16,136, relatively low compared to cumulative cases of 254,515 in Thailand and 739,266 in Malaysia. However, it should be noted infections multiplied rapidly since end-Apr when the cumulative caseload then was only 2,914, underscoring the ferocity of the spread of disease in the current fourth wave.

At present, vaccination rate in Vietnam has been lagging well behind more developed economies in the region, a common predicament faced by less developed markets globally due to limited supplies of the COVID-19 vaccines. The proportion of population having 2 doses of vaccination in Vietnam is estimated at 0.2%, well below that of Thailand (3.9%), Malaysia (6.6%) and Indonesia (4.8%). The Vietnamese government has set a target to administer 150 million doses to 70% of the population to reach herd immunity although supply availability is the main uncertainty, the same constraint faced by many governments worldwide. Going by the Vietnamese government’s track record of successful handling of the pandemic over the past year, there is a good likelihood that the current wave would be put under control.